Gold and Global Reserve Currencies

News

|

Posted 17/04/2018

|

8242

The prospect of a new global reserve currency is often raised, along with questions of whether it would be feasible. It could be, with gold backstopping it just as it backed the US dollar until the gold standard was abandoned by President Nixon in 1971. The question being asked right now is whether the US dollar will remain the world's reserve, considering emerging threats to its dominance?

The answer, for now, appears to be “yes”, as the reality is that there is simply no other currency that would be able to replace it, at least in the short to medium term. We recently reported here that there is potential in the form of China's “petro-yuan”, symbolized by the March launch of an oil futures contract denominated in yuan, or renminbi, and convertible into gold. Establishing this as a viable USD reserve replacement is not going to happen quickly however.

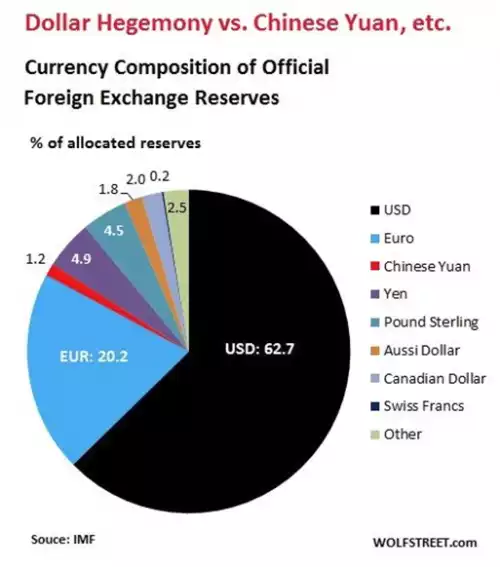

According to the IMF, dollar-denominated assets among foreign exchange reserves were at $6.28 trillion in Q4 2017, a 14% increase from the fourth quarter of 2016 and 42% higher than in Q4 2014. Out of total official exchange reserves held by central banks, two-thirds are US dollars. Euros were second at 20% and the yuan represented a measly 1.2%, as can be seen in the chart below. However Q4 2017 saw the fourth consecutive quarter fall in the USD’s share of reserves, down to a 4 year low.

If the yuan were to gain more international standing, you also need to take into consideration that the US has plenty of ways to knock it down. For example, if China chooses to resist any of Trump’s demands for concessions on trade, the US could prohibit the renminbi’s use in invoicing or settlements by US businesses transacting with Chinese partners. It could discourage, or establish new barriers to, investments in renminbi-denominated assets. Or it could offer swap agreements on favourable terms to any central bank that is prepared to abandon its agreement with China. The list of possible punitive actions is long.

We’ve reported before on the IMF’s own SDR (Special Drawing Rights) currency, a basket of the majors that included the Yuan in 2015. As a possible hint to the future, a seat at the SDR table requires minimum gold reserves. Indeed Jim Rickard’s thesis is the SDR will become the new world reserve currency coinciding with a sharp revaluation of gold. You can read a little more here.

Part of the problem for the Yuan/Renmimbi is it’s ability to truly freely trade internationally. From the South China Morning Post:

“The IMF took the decision to include the yuan in the SDR basket in 2015, giving it equal status with the US dollar, the euro, British pound and Japanese yen. The move came into effect in October 2016 and was hailed by Beijing as a nod to its efforts at financial liberalisation.

However, the Chinese government’s imposition of draconian curbs on outbound investment and capital outflows since the stock market rout in the summer of 2015, has fanned allegations that it has been back-pedalling with regards to creating a freely usable yuan.

Yi Gang, the newly appointed governor of the People’s Bank of China, said in Boao on Wednesday that Beijing was committed to making the yuan a fully convertible currency, but wanted to do so on a gradual basis.” The big unknown is what China’s definition of ‘gradual’ is, which in itself is up to them and how aggressive they choose to be.

Whether the US continues to be responsible for the world's reserve currency and is therefore obligated to run a deficit, or another “global” currency comes along to replace it, both scenarios are good for gold. In the first scenario gold benefits because a deficit means a lower dollar and therefore higher gold prices. In the second scenario, a world currency would almost certainly be backed by gold, especially if the SDR is adopted. Given the resounding failure of the current monetary system, based on fiat currencies, to avoid global trade imbalances (which are one of the major reasons for financial crises), gold backing is the logical choice.