Global USD Reset or Fed Reverse – Your call Mr Powell

News

|

Posted 13/07/2022

|

8322

“When will the US Fed pause or reverse and ease rates?” is quite simply the biggest and most important question in global finance right now. This question is not simply one of US interest rate impacts, US inflation or US financial markets plunging off the back of all that liquidity being removed. Its also about the USD and its globally pervasive hegemonic impacts.

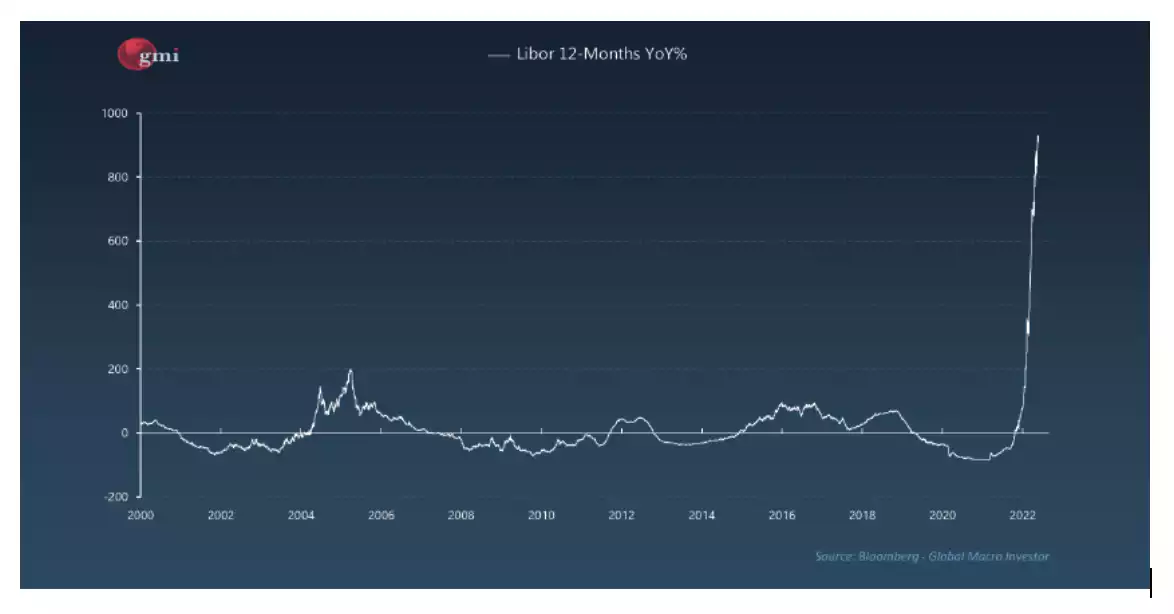

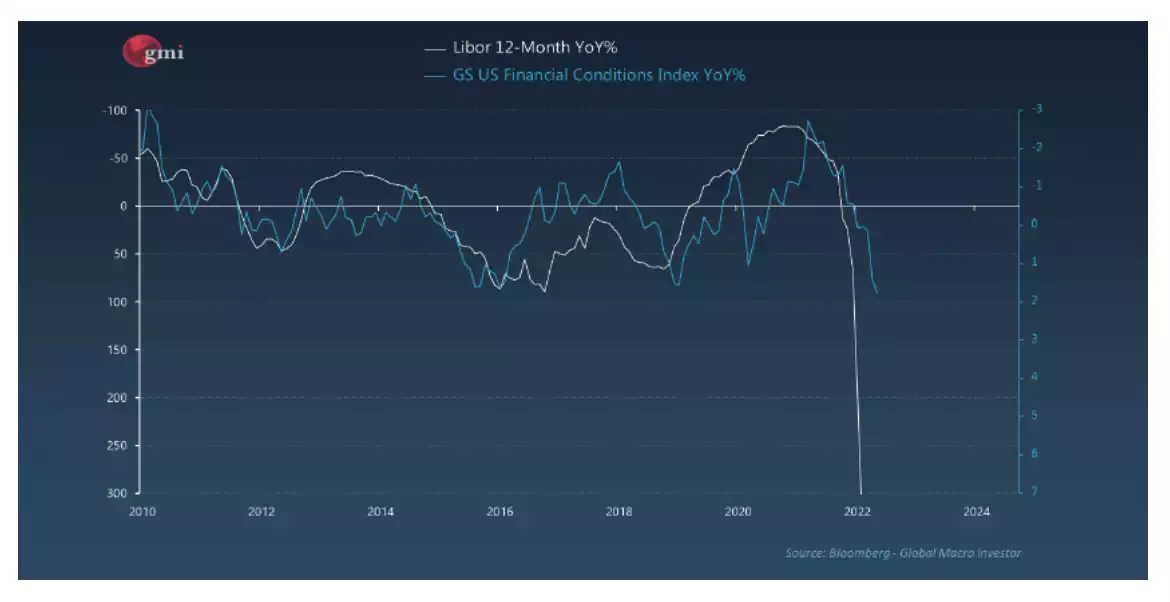

First we must remember just how unprecedented this tightening cycle is and that it is happening into economic weakness. US Treasury yields have never risen so fast in history. If you want to look more broadly, Libor is the global benchmark interest rate by which global banks lend to one another. The charts below put what is happening now into perspective and how much further financial conditions are set to deteriorate.

That we are even talking about ‘many more’ hikes from the Fed in the face of this alone should be cause for alarm. Today we wont talk about how on earth the world’s biggest debt pile can handle higher rates, or how prepared the Fed are to take the market into recession before pausing in order to rub out a largely supply lead inflation, or how much further pain can be realised on sharemarkets with the ‘juice’ that has driven them being removed. Lets today just talk about the US dollar.

As the Fed and the bond market raise rates, so too the US dollar rises. Most of the unprecedented global debt is denominated in USD and that needs to be serviced with USD. That of course further adds to demand and perversely further increases the cost and need for more USD. As the war increases the cost of goods, particularly oil, which again is largely traded in USD, so too goes up demand for USD. In effect the Fed has exported inflation globally. This week we saw the EUR fall to parity with the USD for the first time in 20 years. The Japanese Yen too has fallen off a cliff to a 24 year low against the USD. In other words the 2nd and 3rd biggest western economies are hurting badly at the hands of the US. Riots in Sri Lanka have seen the leaders resign, and we reported last week about protests in Europe as well as everyday people are rebelling about inflation. This puts serious pressures on governing officials.

The question then is, what does the ‘world’ do about that?

We’ve already reported on the BRICS nations, 5 of the world’s largest economies, actively moving away from the USD. Most people discount that being more broadly adopted as there appears to be no viable alternative to the USD because it is essentially the basis of nearly all global currency exchange. Without it inter country trade freezes. What few realise is that central banks around the world have been actively working on their own CBDC’s – Central Bank Digital Currencies. What crypto and particularly DeFi has taught us, and the central banks clearly taking note of, is the frictionless trade between different blockchain based currencies in deep liquidity pools. And so whilst there appears no alternative to USD for global trade, there clearly is and who do you think was the first to develop and deploy a CBDC?... China. Australia is working on theirs too as we speak.

But let’s get ‘real’ and remember if we are spotting the opportunity you can bet the ‘experts’ at the Fed have too. In 1965 then Charles de Gaulle's finance minister Valery Giscard d'Estaing referred to the USD reserve status as an “exorbitant privilege” as it can print more and more at essentially no cost whilst the rest of the world has to stump up real goods to ‘buy’ it. Nixon arrogantly even said “the dollar is our currency, but your problem”. Just 6 years later the gold standard was removed and the “exorbitant privilege” went full fiat, the ultimate abuse of said privilege. The point is they will not let it happen easily. So how to fix this?

Notwithstanding the aforementioned issue of servicing even their domestic debt, a domestic recession and a crashing of their domestic sharemarket, the Fed MUST revert to easy monetary policy to reopen the USD liquidity floodgates and appease all its global users. Past instances of high USD pain have been largely contained to developing economies for which the US likely has little real regard. This time they are materially hurting there biggest trading partners in the EU and Japan, and already the BRICS nations are clearly pre-emptively moving as a combined more materially important global force to force their hand.

Matters of global currency and trade are never simple and this is but one thesis for how this plays out. But the ‘there is no alternative’ premise is now dead with the advent of CBDC’s. Whether they are deployed or not is ultimately up to Mr Powell and his Fed colleagues. Again this is also only one of the many mounting pressures on pausing and then reversing this unprecedented tightening regime. When, not if, that happens, we could see the kind of explosion in gold and crypto we’ve seen time and time before as the liquidity gates reopen but yet again all based on debt funded money printing.

There are only so many times you can do that before the whole house of cards comes tumbling down and the kind of ‘reset’ history is littered with is the inevitable result. Only one form of money has survived and prospered in each event. Gold.