Global Financial Bloodbath – 2 Black Swans Collide

News

|

Posted 10/03/2020

|

15817

Last night Wall Street dropped over 7.5%, the biggest daily dropped since the GFC and at one point down 8%, the biggest since Black Monday in 1987. The US’s Russell 2000 (stripping out those big blue chips and FAANGS in the Dow and S&P500 entered a bear market, down 23%. Both Europe and most of Asia are now in a bear market having dropped over 20% since the recent highs. The flight to safety saw gold up and US Treasury yields crash the most since the GFC and at its lowest intra day, the 30yr bond had its biggest crash in all of history. Silver was dragged down with all commodities for now. It’s dual hat of monetary metal and industrial metal can see that happen but that has taken the GSR out to an incredible 99. We remind you of our last article on this here.

Being Monday, it was the first time Wall Street had been open since the confluence of a worsening of the Coronavirus and the shock 30% drop in oil (biggest drop since the Gulf War in 1991) as a new oil war starts. Effectively we had 2 black swans collide. As Bloomberg summarises on the new oil shock:

“First Russia tossed a hand grenade into global oil markets. Then Saudi Arabia dropped a bomb. After the dramatic collapse of an alliance between the OPEC oil cartel and Russia, a one-day plunge of more than 30% in oil prices sent shockwaves through global financial markets already reeling from the fallout of the coronavirus epidemic. The blow-up of Russia’s deal with the 13-member club of oil exporters -- an alliance that has underpinned world oil prices for three years -- triggered a sudden price war.”

Russia is likely being opportunistic to punish the US. Also from Bloomberg:

“Institute of World Economy and International Relations president Alexander Dynkin as saying, "The Kremlin has decided to sacrifice OPEC+ to stop U.S. shale producers and punish the U.S. for messing with Nord Stream 2."”

(Nord Stream 2 is the pipeline linking Siberia’s gas fields with Germany which Trump’s sanctions stopped the completion of.)

Russia has a low price breakeven point and can ride this out longer than most. The Saudi’s response of slashing production as well may be an attempt to force Russia back to the table but as the quote above implies Russia may have stronger strategic reasons to ride this out. US Shale oil has an enormous amount of debt via bonds on issue and has a higher breakeven cost. To hit them with this at the same time as virus affected demand is low is a move of outright financial war and the markets can see that, hence the drops last night. Analysts are saying we can still see lower oil from here as this escalates.

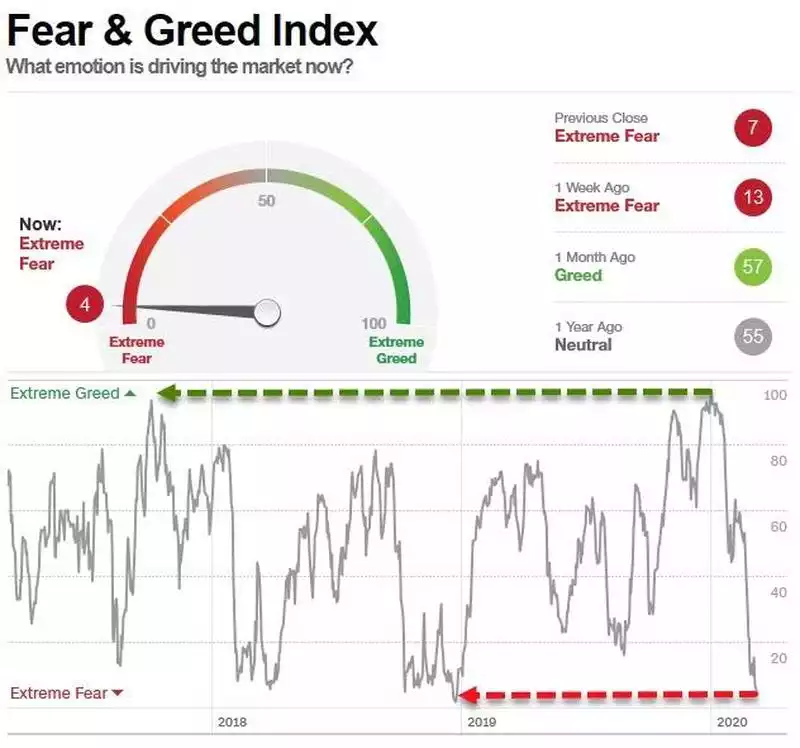

Already markets are calling for heavy rate cuts, effectively 3 in total, before or when the Fed meets next on 18 March. The Fed now has a new force in town; the incredibly deflationary pressure of half price oil combined with a massive hit to exports and energy bonds. The updated Fear & Greed Index chart says it all…