Global Economy Sends Recession Signals as Stimulus Withdrawn

News

|

Posted 16/01/2019

|

6593

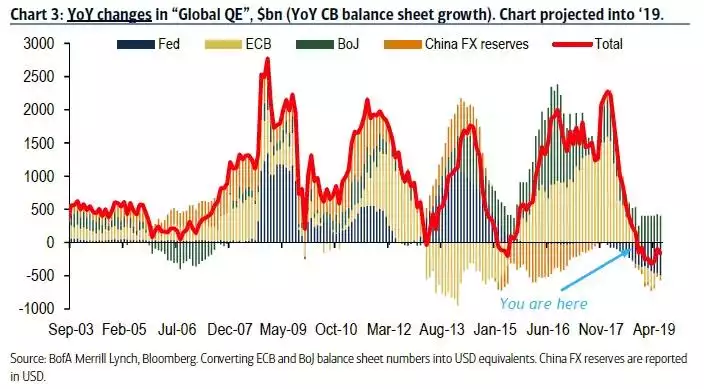

A key determinant in what may trigger the next recession is how the market reacts to the ending of stimulus via the injection of new money into the system by the central banks. Quantitative Easing is quite clearly what saved the world from the GFC fully playing out and has boosted shares ever since. But as we have written numerous times, that Easing is turning to Tightening and so far the global economy hasn’t liked it one little bit. As the chart below shows, only Bank of Japan remains actively printing money against asset purchases. The Fed is clearly unwinding the assets on their balance sheet along with tentative efforts from the ECB.

You can well understand the market’s preoccupation with the Fed’s tightening intentions as raising rates has a similar effect. The debate is muddied by a seemingly strong US economy despite that being largely off the back of short term stimulus in the form of tax cuts etc. The cracks are numerous and showing already.

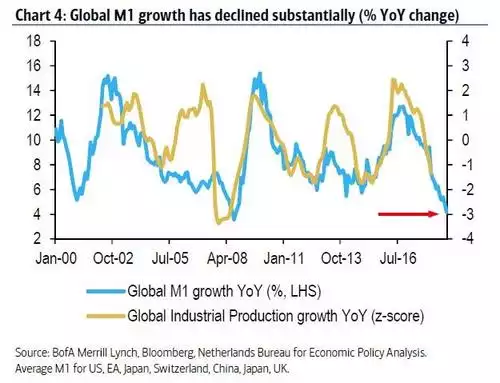

However, globally the effects are much clearer. Using the Global Industrial Production Growth index as a proxy for the world’s economic expansion, Bank of America Merrill Lynch produced the chart below showing that, having settled into negative territory (RHS scale), the world is already in a recessionary environment. Global Monetary Supply (M1), directly correlated with the chart above, hasn’t been this low since just before the GFC and you can see the correlation with economic output.

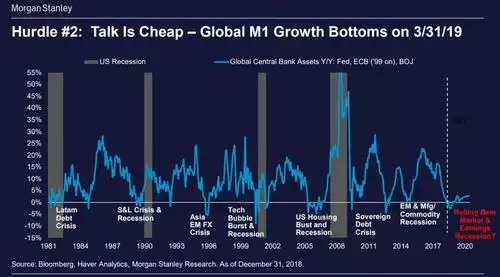

Morgan Stanley completely agree and have just produced the chart below. Using global central bank asset changes as an instructive proxy for M1, they demonstrate that each time that metric ventures into negative territory, as it just did, a financial crisis of some sort ensues. Additionally, the last 4 US recessions occurred shortly afterwards as well.

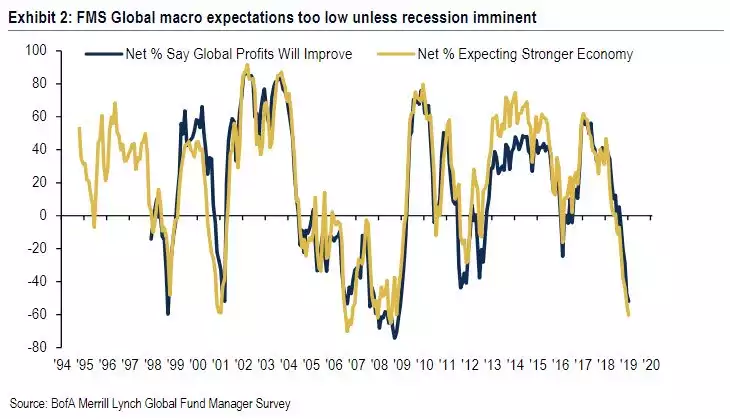

BofAML’s latest Fund Manager Survey reinforced these fears, being as bearish as they have been since the GFC…

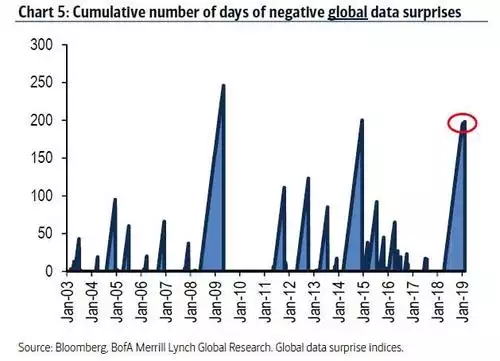

And that should be no surprise as the Global economic data prints that these guys live off and measure against ‘expected’ or forecast results, are approaching the longest stretch of consecutive surprises or ‘misses’ since the GFC… ‘When will they concede to reality’ you ask?

Maybe one of the biggest indicators is the trade numbers for the world’s biggest trader, China. China showed imports fell 7.6% year-on-year in December against expectations of a 5% rise. Exports dropped 4.4%, against a 3% gain expected. That is very telling stuff.

This morning we learned Brexit took a turn for the worse in terms of any certainty for the Euro economy to ‘bank’ just after the Eurozone printed its biggest fall in industrial output in nearly 3 years.

The global warning signs are there. Just how much the Fed and Trump can try and buck this trend will be a huge ask.