GDP Via Debt & Trump Effect

News

|

Posted 08/09/2016

|

5058

GDP (Gross Domestic Output) growth continues to be the metric by which a country’s economy is judged. We have on numerous occasions pointed out what seems to be lost in the mainstream, that you can ‘buy’ GDP with debt. On Monday we showed the US added $645b in debt in Q1 to ‘buy’ just $65b in GDP growth, a ratio of 10:1. Back in April we reported Australia’s 3% GDP growth came at a cost of 6.6% more private sector debt PLUS the public sector racking it up as well. At some stage the debt overwhelms and it all collapses.

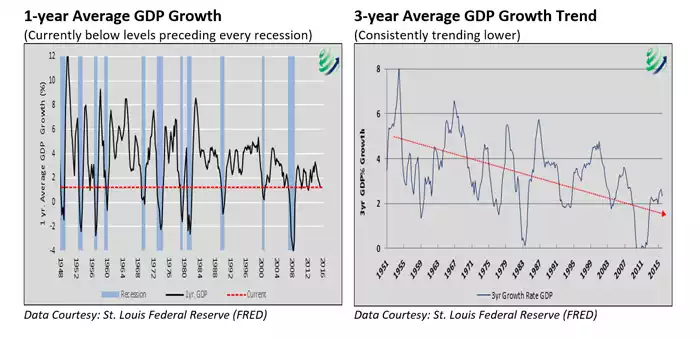

This may well be playing out now in the US as GDP struggles around the 1% mark despite all the stimulus. Indeed right now not only is it continuing a downward trend, it is now in territory that in every instance in the last 60 years has lead to a recession. Check out the graphs below:

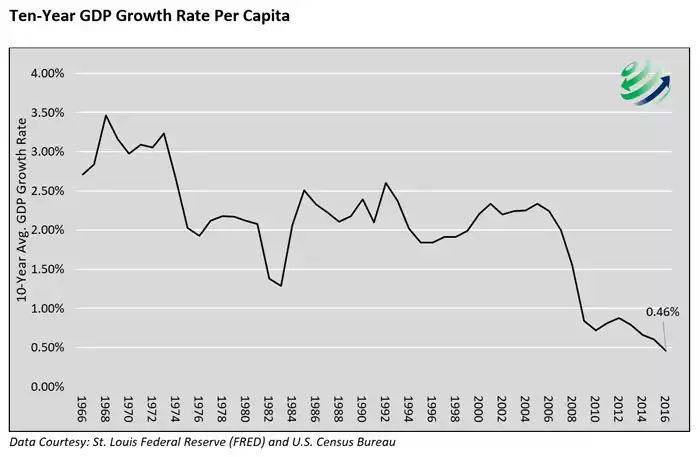

The other key measure that again you never seem to see is the GDP growth per head of population. Per the graph below that is now at its lowest in the last half century. This reinforces too the inequality issue we most recently reported on Friday and why Trump is now ahead in the polls as we’ve discussed here and here.

This is a dangerous cocktail indeed with US shares at record highs on central bank stimulus but with the above chart as a ‘reality backdrop’ and the groundswell of Jo Public discontent seeing the likes of Trump assume power. Many analysts are uniquivecal in their view the market will crash if he is elected. Only time will tell….