FOMC announces no rate hike

News

|

Posted 18/09/2015

|

4748

Recent market turmoil, increasing global risks and lacklustre official inflation figures have given the FOMC the excuse required to keep rates on hold this morning as was widely expected. The announcement saw a jump in both Wall Street and the Aussie dollar but despite the latter, gold priced in Australian dollars for the week remains unchanged as described in today’s weekly audio wrap. The Fed’s usual tightening bias was still retained for December despite a downgrading of the long-term economic outlook.

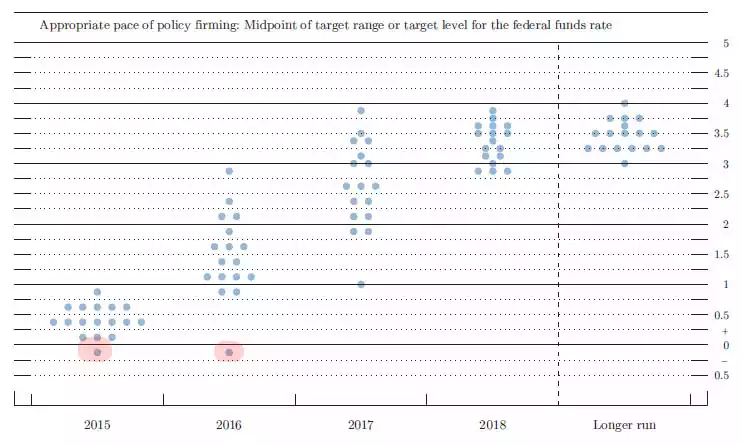

In its released statement, the committee noted that “recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term”. The Fed dot plot shows some interesting developments. Where June saw 15 Fed policymakers predicting a rate hike in 2015, current data now sees that drop to 13. Note that as we are only 3 months away from the last opportunity to do so, there really needs to be significant change for this to eventuate given the reasoning behind today’s announcement. Furthermore, for the first time ever, one FOMC policymaker is predicting negative rates in 2015 and 2016 as illustrated by the red highlights in the chart of the September economic projections courtesy of ZeroHedge below. This fact has not been broadly identified in the media but some commentary this morning focuses on the need to first impose cash and capital flow controls prior to such a decision.

In what has become quite a public show of open central bank communication as we reported in last Friday’s weekly wrap, recent months have seen public endorsements of a September rate lift by some Fed officials including Atlanta Fed president Dennis Lockhart. Ultimately however, today’s decision seems to be the result of a confusing official picture of low unemployment with apparently steady economic growth but an absence of on-target inflation. One economist in New York supported this by saying “The case for not going is that the inflation picture is still extremely murky, especially in light of developments in China”. The PCE index (the Fed’s preferred measure) has printed below the Fed’s target for more than three years now. Again, issues abroad seem to sway the balance with the committee release noting that “the committee continues to see the risks to the outlook for economic activity and the labour market as nearly balanced but is monitoring developments abroad”.

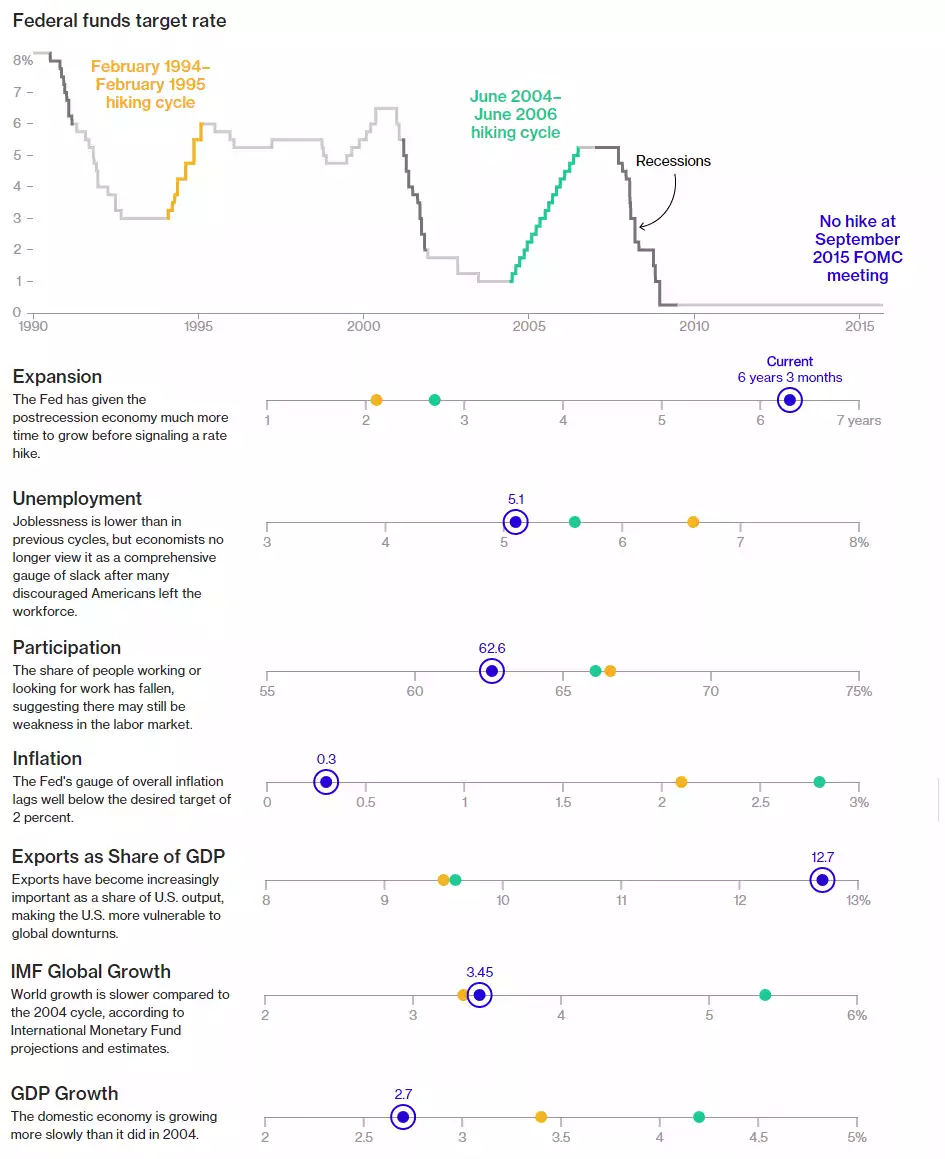

In an attempt to illustrate how skewed the metrics are in current times, see the graph below which is data from Bloomberg amended this morning for conciseness. It displays various metrics comparing current official data with previous tightening cycles of the 1990s and 2000s and some noteworthy observations are evident. Firstly is the fact that, excluding growth and unemployment, data for the previous tightening cycles was generally more consistent than it is now. The duration of expansion currently far exceeds that of the previous cycles and the current export to GDP ratio is much higher than it was previously; the latter point highlighting the Fed’s comments on exposure to global downside risk. What arguably sticks out the most however is the official inflation measure which is anaemic.