Financial Maths 101

News

|

Posted 01/11/2017

|

7531

Regular readers will have seen our oft repeated reminder that if you see a 50% decline in your wealth you need to make a 100% on what’s left just to get back to where you started. It’s just math but it’s math so often overlooked by investors entering a market when valuations are high and fervour abounds. FOMO (fear of missing out) reigns supreme….

Talking percentages rather than dollars or ‘points’ on an index can be a trap. You could buy into a market at 1000 (dollars or points, it doesn’t matter) and make 70% on your money, but it corrects by 50% before you sell. Simplistically you might think you are still 20% ahead, but let’s do the math. 1000 plus 70% = $1700 less 50% = $850. That’s right, you end up 15% behind, NOT 20% ahead.

Sorry to suck eggs for those more mathematically adept, but it is a very common mistake and one that even if not applied quantitatively, is too often overlooked qualitatively. In other words, even people who can do the math seem not to apply it to their investment thinking.

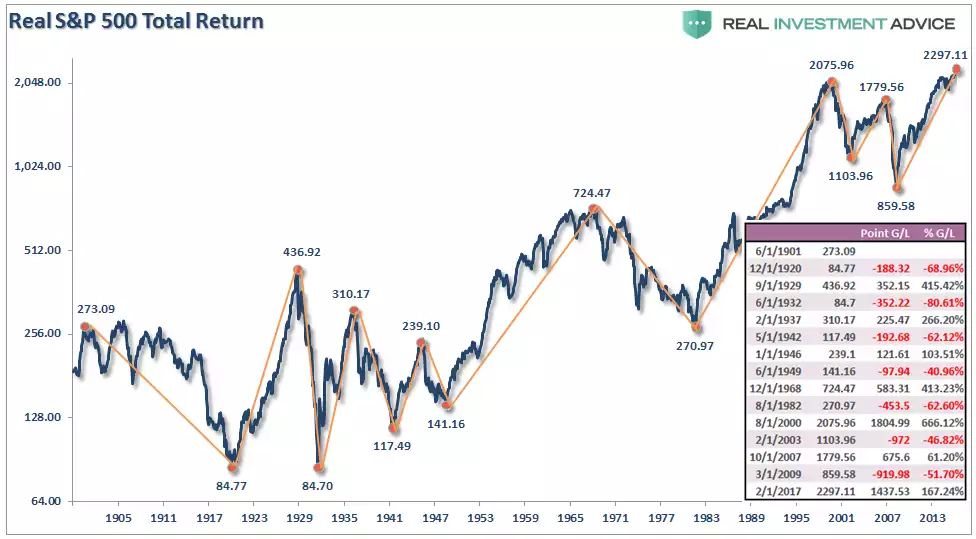

Lance Roberts of Real Investment Advice covered this quite nicely back in March of this year. He produced some charts that everyone should study closely. First the following is a map of inflation adjusted returns on the S&P500 (the world’s largest and most important share index) using Dr Robert Shiller’s monthly data all the way back to 1900. You’ve likely seen this before but have most unlikely seen the table he has added to the right. The dates (in US mm/dd/yyyy format) correspond to each of the ‘peak’ and ‘low’ orange dots and show the actual point gain or loss for each preceding period (together with the percentage equivalent). As you can see there are periods when the entire previous real (point or dollar) gains are completely wiped out.

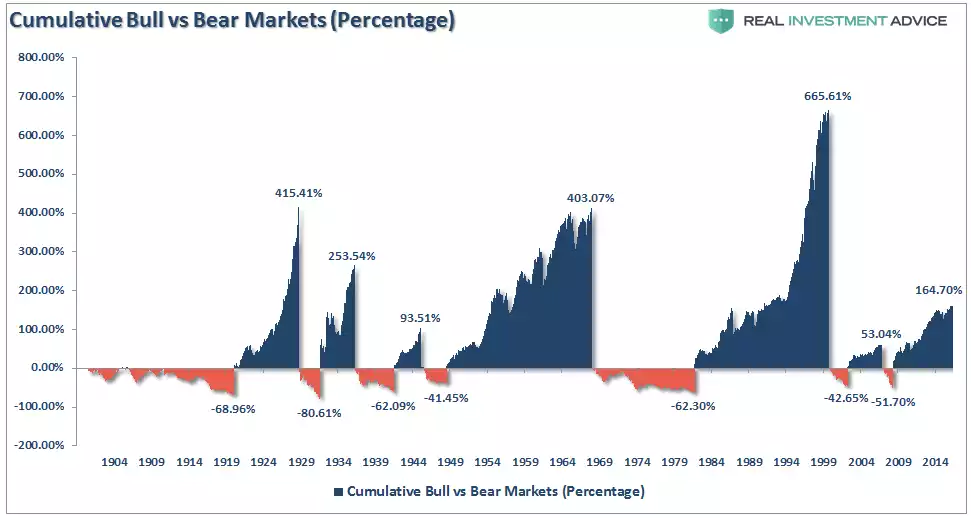

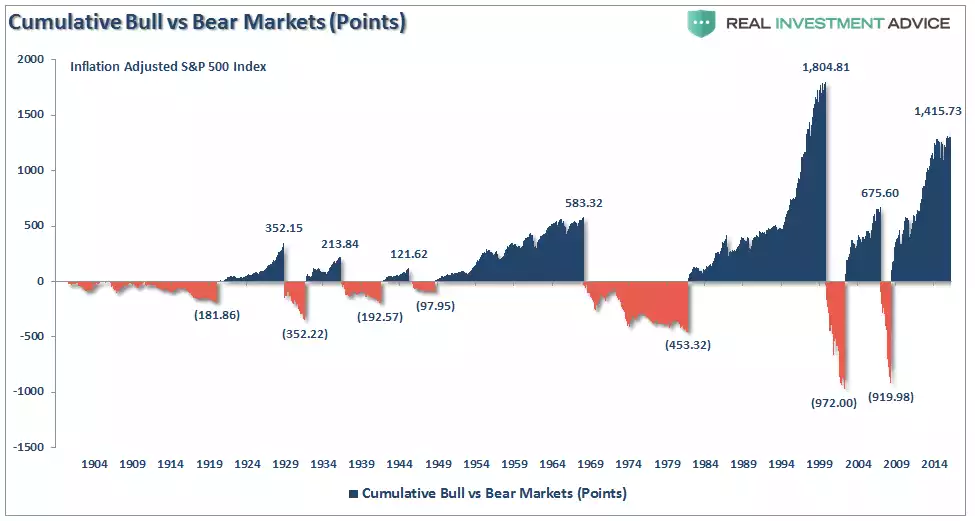

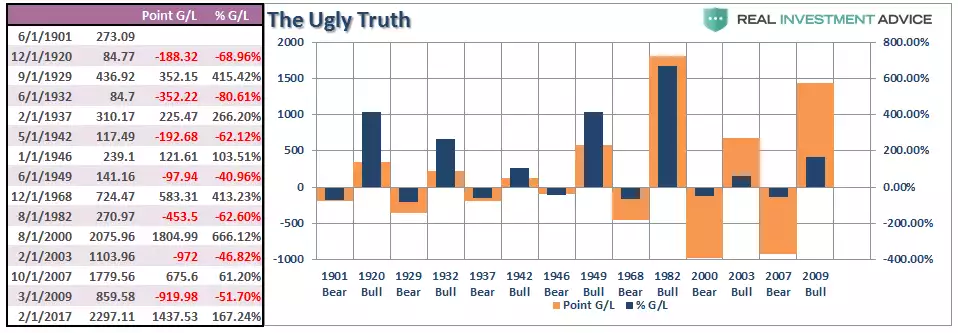

He then illustrates the effect of this table in the following 3 charts:

Firstly by the usual ‘disarming’ percentage measure:

But when reconstructed using actual point gains and losses:

Or in summary:

So as you consider staying ‘fully’ in or entering financial markets now chasing that remaining possible 10 or 20% return, remember the math of what happens if we see another 50% fall before you sell. And if you think you will see it coming, we remind you of our recent article “Why this crash will be fast and furious”