Fed Zombification

News

|

Posted 17/06/2020

|

17872

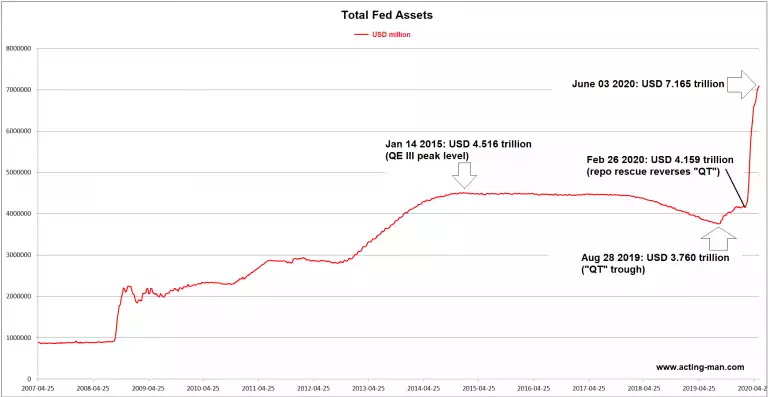

In 2018/19 the US Fed, thinking everything was awesome and they could withdraw the ‘free money’ heroin from the addict, tried so called Quantitative Tightening or QT. We all know now how that ended and the response since it ended has been one for the history books.

First we saw notQE where they supported the rupturing Repo markets with printed money stabilising sharemarkets, then the pandemic hit, purely the ‘prick’ the bubble was waiting for, and they reverted not just to outright QE, but QE unlike we’ve ever seen before. And now they have formalised (though previously announced) that they will now buy corporate debt and ETF’s. But whilst the market knew Santa was coming down the chimney, they didn’t know he was going to buy individual corporate debts rather than baskets through ETF’s and the like. This was a game changer and takes the Japanification of the US to a whole new level. As we’ve reported earlier the Bank of Japan is now the biggest owner of ETF shares in Japan, has monetised all new sovereign debt issuance, and is a massive owner of corporate and mortgage backed debt.

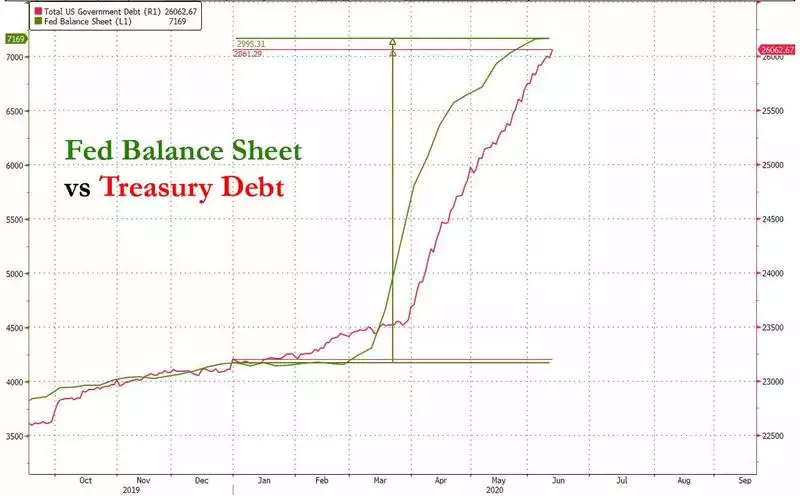

The Fed maintains it has not monetised debt in the same way however the numbers suggest that is just not so. As we discussed last week, US debt has exploded over $26 trillion (and Trump just announced another $1 trillion for infrastructure). So how did it get there? US Treasury debt increased by $2.86 trillion. Coincidentally, the Fed expanded its balance sheet, buying US Treasuries, by…. $3 trillion. We’ve also seen the latest figures this week showing foreign holders reduced their US Treasury holdings in the same period…

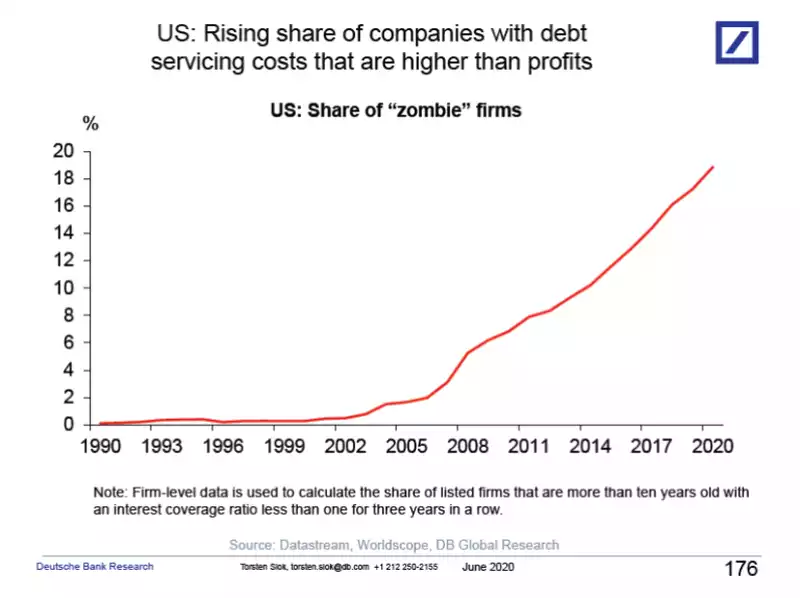

US corporate debt, and particularly the eroding quality of it towards Junk, is still identified by many as one of the key risks remaining in the market as we face the biggest recession of all time. The growing trend of so called “Zombie” companies (those with debt servicing costs higher than profits) is disturbingly on the rise.

That the Fed has stepped up to the plate is huge and begs the question ‘where does this end’. Fed chair Powell testified before the senate last night and as Peter Schiff tweeted:

“Powell just admitted that the Fed's only plan to shrink the exploding balance sheet is to simply stop marking it larger while the economy grows, thus only shrinking the balance sheet as a percentage of GDP. So there's no plan to ever attempt to actually shrink the balance sheet.”

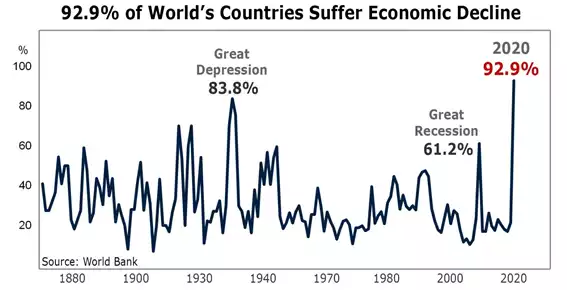

Of course even if you can get past the fixed debt issue, this relies on strongly growing GDP to not become a Zombie of its own. We talked about the OECD projections recently and the World Bank recently gave further insight into the enormity of this recession that markets somehow seem relaxed about. From Weiss Ratings:

“We don’t have economic data from the 14th century when the Black Death swept through Asia, Europe and Africa.

We certainly don’t know much about the great floods that struck the Middle East and Central Asia thousands of years ago.

But we do have reliable GDP numbers going back to the 1800s. And based on that data set, the World Bank has just issued a very startling analysis:

In 2009, the Great Recession reached 61.2% of the world’s countries.

In 1931, the Great Depression impacted 83.8%.

In other periods — the terrible 1880s, World War I and World War II — the collapse rarely reached more than 60% of the countries.

But 2020 is the worst of all.

“The economic depression sweeping the globe is the most widespread in recorded history: A whopping 92.9% of the world’s countries are sinking into the economic morass.” (World Bank)

That’s one alarming fact. Here are four more …

U.S. — worse than Great Depression. The U.S. economy will suffer a steeper plunge this year than it did in the worst year of the Great Depression: In 2020, the World Bank expects GDP to contract by a shocking 6.1%; back in 1932, it sank by “only” 5.3%.

Japan — no better than U.S. despite mild pandemic. Despite the fact that the pandemic in Japan has been far less severe, the depression will be just as bad, with GDP down the same 6.1% as in the United States.

Europe — even worse! The European economy, which was already teetering before the pandemic, will suffer the most of all — GDP will be crushed with an unimaginable decline of 9.1%!

Recoveries in 2021 — anemic. The combined GDP of the U.S., Europe and Japan will sink 7% in 2020, but will only recover by 3.9% in 2021.

All this represents the most current nonpartisan forecast from any major governmental body.”

So sorry folks, but two things become very apparent. We are nowhere near the Fed easing off further expansion of its balance sheet through buying US Treasuries, Mortgage Backed Securities, and now US Corporate Debt and ETF’s directly. We are also clearly nowhere near any magical surge in GDP to make that somehow look like a good ‘investment’ on their balance sheet.

This is all just desperation playing out by the only ‘hope’ left. Sven Henrich of Northman Trader summarises the set up:

“The Fed has created a full on gambling casino and the gamblers have moved in and are pulling the ‘buy’ triggers non stop.

The Fed is not saving the economy, it’s zombifying it and in process of inserting itself ever deeper into markets the Fed itself is becoming too big to fail. The Fed losing control over the asset bubble is now the biggest risk factor to the economy. A rescue model that relies solely on ever higher stock prices ever more divergent from the underlying economy creating an ever larger wealth gap in the process.

It’s a spiral out of control that is masking what is really going on: The structural economy is circling the drain and zombifying the economy will only clog it up with dire consequences to come, consequences for now as markets are still busy chasing every liquidity headline.”