Fed to launch ‘notQE’ & IMF Warns Why

News

|

Posted 09/10/2019

|

8284

Fed to launch ‘notQE’ & IMF Warns Why

Yet again last night saw Wall St shares drop around 1.5% whilst gold rallied 1.5% and silver 2.8% amid more US-China trade tensions and the US Fed announcing it is likely about to unleash more money printing and lower rates again. But just as Hamlet’s Queen Gertrude postulated “thou doth protest too much” and Clinton emphatically “did not have sexual relations with that woman”, the Fed Chairman Powell said “In no sense, is this QE,”…

Indeed all he is talking about, and we quote, is “My colleagues and I will soon announce measures to add to the supply of reserves over time,” but went on to clarify “I want to emphasize that growth of our balance sheet for reserve management purposes should in no way be confused with the large-scale asset purchase programs that we deployed after the financial crisis……Neither the recent technical issues [the ‘technical issue’ of the worlds largest banking Repo market freezing up] nor the purchases of Treasury bills we are contemplating to resolve them should materially affect the stance of monetary policy.”

Of course not…

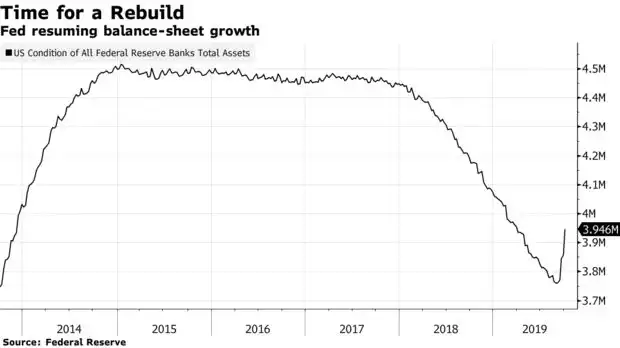

Already the Fed’s injection of newly created ‘money’ into the fracturing Repo market has seen a sizeable reversal of their ‘good work’ in reducing the size of their balance sheet…

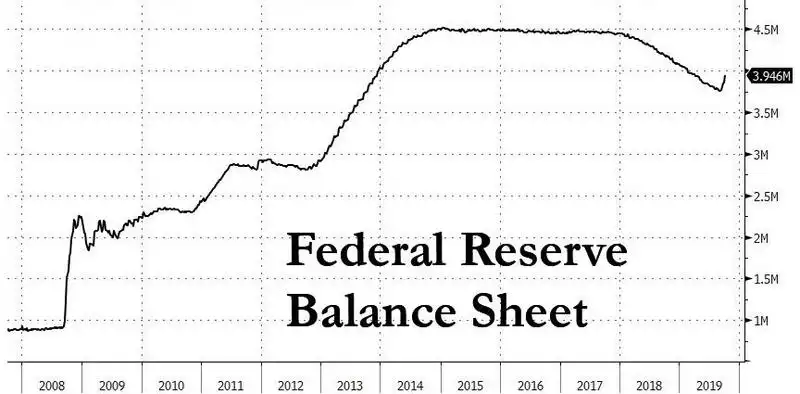

Let’s, however, zoom out a little to see just how hard they went with that “large-scale asset purchase programs that we deployed after the financial crisis”….

That little decline over 2018 saw markets crash. The uptick is the start of their attempt to get things going again. One has to seriously question the market’s ability to accept that this time will yield the same response. Loss of credibility and the ‘this time is different’ narrative are under serious threat.

The Fed can see it needs to act pre-emptively as outside of the weakening US economy there is an even bigger storm brewing. The new IMF head, Kristalina Georgieva, yesterday warned of a more severe global slowdown and the need for a globally coordinated government fiscal stimulus response. From Bloomberg:

““The global economy is now in a synchronized slowdown,” she said, noting that the fund estimates that 90% of of the world is seeing slower growth. By contrast, two years ago, growth was accelerating across three-quarters of the globe in a synchronized upswing, she added.

“Uncertainty -- driven by trade but also by Brexit, and geopolitical tensions -- is holding back economic potential,” Georgieva said. Not only that, but the economic rifts could “last a generation” with possible shifts such as broken supply chains and siloed trade.

“There is also in my view a risk of complacency,” she said in an on-stage conversation with Bloomberg’s Tom Keene in Washington following her speech. “We are decelerating, we are not stopping, and it’s not that bad. And yet, unless we act now, we are risking a potential more-massive slowdown.””

The Fed is acting now. Gold and silver, being real money, will likely thrive as more Fiat/fake money is created in a desperate attempt to keep this addicted beast alive.

Whether you call it QE or “Wonder Soap” to remove a stain from a metaphorical dress, it’s a desperate attempt to prevent the natural order of markets.