Fed Chief warns of “big losses”

News

|

Posted 05/06/2020

|

21336

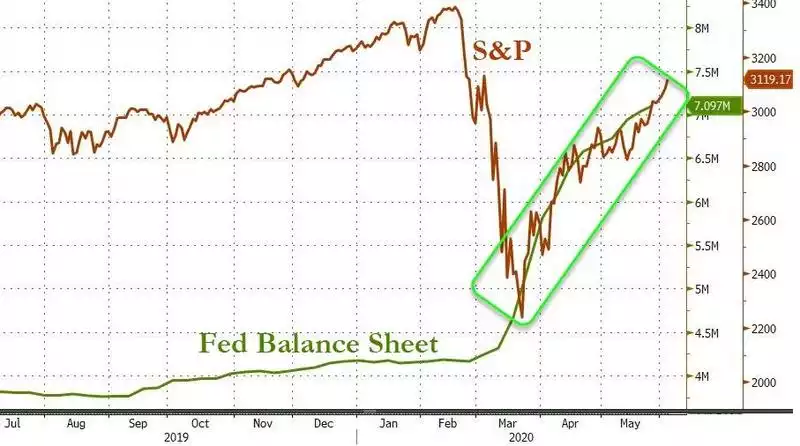

Whilst US and European sharemarkets finished in the red last night (excl DJIA) it was more notable for the NASDAQ coming within a fraction of recapturing it’s all time high in mid February (before it went on to fall 30% to late March). The speed with which the sharemarket in general has bounced back is already one for the record books. We discussed yesterday the role the Fed has played in this extraordinary bounce and the chart below says it all.

Whether it is Pavlovian as discussed yesterday or fundamentally causal, there seems little doubt that the Fed’s monetary stimulus is driving this nonsensical rally. Indeed when BMO, who manage $60b, asked their clients what is driving this bounce:

1. What is driving the swift recovery of equities?

a) Fed – 73%

b) Earnings Optimism – 0%

c) Labor market recovery – 6%

d) Further fiscal stimulus – 5%

e) Progress in treating/preventing Covid-19 – 6%

f) Other (please specify) – Reopening Optimism/ All of the Above/ Underinvestment

GMO’s Jeremy Grantham was quoted yesterday after they slashed their exposure to equities. From Bloomberg:

““We have never lived in a period where the future was so uncertain,” Grantham, 81, wrote. “The key here is uncertainty, which in some ways seems the highest in my experience.”

The coronavirus pandemic has taken a toll on the economy that isn’t being reflected in stock prices, he said.

The legendary money manager, who co-founded Boston-based GMO and is its long-term investment strategist, said that the price-to-earnings ratio for stocks is now in the top 10% historically, while the U.S. economy is in the worst 10%, or perhaps the worst 1%.

“This is apparently one of the most impressive mismatches in history,” he wrote.”

It is somewhat ironic too that this Fed fuelled bubble led by now Fed Chair Jerome Powell was foretold by then ordinary FOMC committee member Jerome Powell in 2012 (via official minutes):

“The market in most cases will cheer us for doing more. It will never be enough for the market. Our models will always tell us that we are helping the economy, and I will probably always feel that those benefits are overestimated. And we will be able to tell ourselves that market function is not impaired and that inflation expectations are under control. What is to stop us, other than much faster economic growth, which it is probably not in our power to produce?

I think we are actually at a point of encouraging risk-taking, and that should give us pause. Investors really do understand now that we will be there to prevent serious losses. It is not that it is easy for them to make money but that they have every incentive to take more risk, and they are doing so. Meanwhile, we look like we are blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road. You can almost say that that is our strategy.”

Just read that again. Written by the head of the world’s biggest central bank. This rally is all according to prophecy it seems…

Tonight will see the May NFP employment figures for the US with expectations of 8 million job losses and a 19.5% unemployment figure, the worst since the Great Depression. Last night saw another 1.88m jobless claims for the week ending 30 May, notable for it being the first sub 2m number since layoffs started in mid March. Continuing claims (the total number of Americans claiming unemployment benefits) increased to 21.5 million. Things may be improving since reopening but clearly they are still bad. Senior Bloomberg economist Yelena Shulyatyeva:

“Stubbornly elevated jobless claims are yet another statistic showing that labor market recovery will not be swift. The latest claims data comes on the back of the non-manufacturing ISM survey, which showed the employment subindex barely budged in May from a record-low in April, contradicting the signal from a better-than-expected ADP employment.”

All great grounds for record high share valuations yeah?

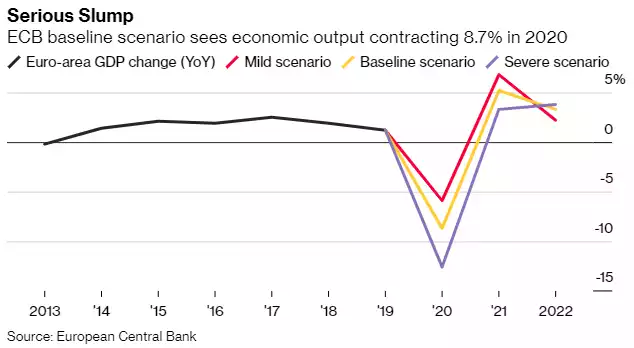

The Fed is of course not the only show in town and last night the ECB announced a surprise Eur600 billion (against Eur500b expected) expansion of their QE program, effectively doubling it to Eur1.35 trillion and extending it out to June 2021 all whilst keeping interest rates at -0.5%. From Bloomberg:

““Action had to be taken,” [ECB chief] Lagarde said in a press conference. While there are nascent signs of the downturn bottoming out, “the improvement has so far been tepid.”

Lagarde revealed sweeping downward revisions to the ECB’s projections for growth and inflation in the region. In 2020, the bloc will likely see a contraction of 8.7% before rebounding by 5.2% in 2021. Under a more severe scenario with a strong resurgence of infections, output could shrink by as much as 12.6% this year.

Inflation, which she said is the ultimate justification for the stimulus, will accelerate only slowly, and is seen averaging 1.3% by 2022 -- far below the goal of just under 2%.”

The mantra may be ‘don’t fight the Fed’ (or BoJ/PBOC/ECB/BoE/RBA etc) but the head of that very same Fed has warned doing so “will result in big losses”. Be prepared.