Fed Capitulates on Transitory Narrative

News

|

Posted 16/12/2021

|

6628

Last night saw the much anticipated US Fed meeting outcome after a lead up of ever present and expanding inflation. Just yesterday we saw the highest EVER Producer Prices Index (PPI) print, measuring inflation at the factory door, of 9.6% for November. Not only was that hotter than expected but another big jump from the 8.6% in October.

As we have written many times, the PPI print is the indicator of what is to come OR businesses somehow absorb these cost increases which reduces earnings. Either way they portend pain ahead for the market.

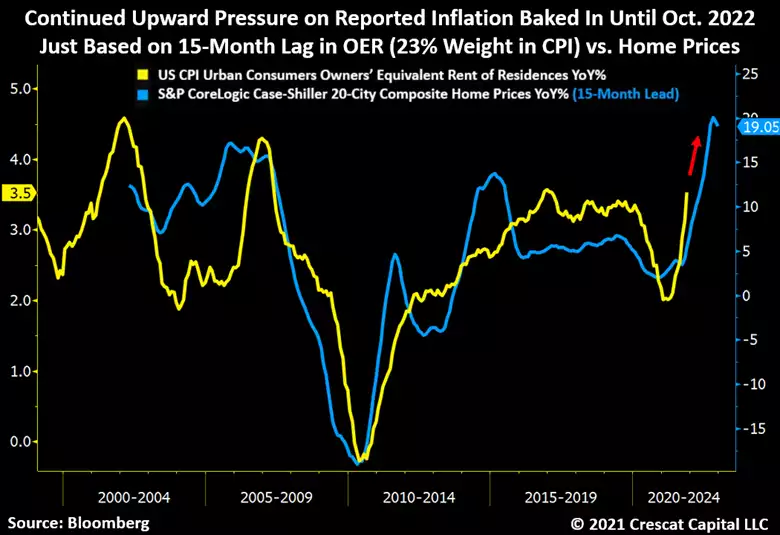

Another leading indicator is house prices. As we wrote earlier this week, even though they changed the CPI composition from using house prices to ‘Owner’s Equivalent Rent’ (which would otherwise have seen that 6.8% CPI become 11%!) there is an historic connection and lag between the two. Keeping in mind that rent makes up around 40% of the CPI basket let’s see what Crescat recently had to say:

“The Fed was overly optimistic in its inflation forecasting this year and has been proven horribly wrong. With CPI just clocking in at 6.8% year over year for November, inflation is already much higher than the central bank forecasted four months ago when it sold itself and the world on the idea that inflation would be “transitory”. To maintain its credibility, the Fed must now lay out a path to tighten monetary policy at a more aggressive pace.

Inflationary forces in the real world and inside the CPI data are not likely to ease up soon. Based on what home prices have already signalled, and the fact that there is a fifteen-month lag in Owner’s Equivalent Rent, the 23%-weighted OER component of CPI appears poised to keep going higher until at least October 2022.”

“But inflation is also likely to be around for longer and at a higher rate due to structural shortages in the commodity and natural resources sectors of the economy based on years of deteriorating capital investment trends. Meanwhile, tightness in the labor market is also portending a future wage-price spiral that could continue for years. Because of these factors, we think investors are poised to rotate out of the bubble in large cap growth, mega-cap tech, uber-low yielding long duration fixed income, and into stocks and commodities that offer high intermediate-term growth, low valuations, and inflation protection.”

And so, right on cue, last night the Fed announced it was doubling the pace of tapering its QE program with a view to finishing in March not June as previously anticipated just a month ago. Also, just a month ago they expected only 1 rate hike in 2022 and even that only had 50/50 support in the committee. They are now anticipating 3 rate hikes in 2022. The bond market (who don’t need to dance to the Fed’s drum) are pricing in a 90% chance of the first rate hike in April… the very next month after tapering finishes…

The market reaction, so far, was relatively subdued as this was largely anticipated.

The giant elephant in the room then is how does the easy money addicted market handle the juice being removed? Arguably last night’s reaction means they either believe the Fed will capitulate and ease again after the inevitable withdrawal tantrum or are drinking the Cool-aid that ‘this time is different’.

Wrapping up today and yesterday’s discussions, Crescat’s December Research letter summarises nicely:

“The recent weakness in the broad US equity market is being masked by the outperformance of mega-market cap companies that remain near record valuations. With that in mind, it is remarkable to us how the NASDAQ Composite is just 2.6% from all-time highs while only 35% of its members are above the 200-day moving average. Such a disconnect is corrosive. This backdrop of deteriorating market breadth is present at a time when significantly rising inflation is putting pressure on the Fed to accelerate its taper and begin raising rates sooner than it has signalled to date. With the Fed out of the liquidity pump game, weak stock market internals suggest that the long overdue reckoning of the most inflated financial asset bubble in US stock and bond history is close at hand. We believe there is substantial risk of a significant equity market selloff in the near term, even before year-end. We exclude the energy and materials sectors from this warning where equity fundamentals are driven much more by currently low valuations, scarce supplies, and robust demand.”

Crescat funds are heavily invested in gold and silver related investments and address the pullback in price we have seen since the middle of this year head on:

“After having two of the top 10 hedge funds according to Bloomberg in 2020 and delivering over 235% in the first year our recently launched Precious Metals fund, in a down year for gold and silver, it is only natural that we are experiencing a pullback. We believe that such retracements are great opportunities for new and existing clients to add capital. We feel more confident than ever in the underlying value and future appreciation potential of our portfolio.”

Such funds, which weight into speculative shares, are more prone to losses. At Ainslie you can cut out the management, regulatory, geopolitical, and hedging risk of equities and buy the metal directly. Bullion has NO counterparty risk.