Fed & BoJ – Last Night Explained

News

|

Posted 22/09/2016

|

5378

Yesterday and last night saw both the Bank of Japan and the US Fed announce their latest monetary policies. Both saw good gains in gold and silver prices ensue.

BoJ, whilst holding their negative 0.1% rate and Y80 trillion ($1trillion) per year bond buying program (plus another $75b ETF’s), flagged changing the way in which they buy their bonds (JGB) to try and steepen their yield curve, get the 10 year bonds to at least zero and keep their banks happier. Enter the new term “QQE with yield curve control” (quantitative and qualitative easing). You gotta hand it to them, they are not giving up on their quest for inflation and will keep mixing it up…

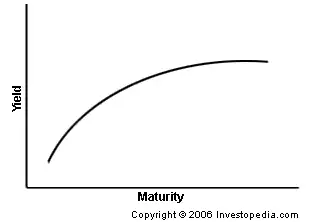

For those new to this (and we suspect you are going to hear a lot more about yield curves going forward)… the yield curve is a plot of yields (interest rate a bond ‘pays’) on the vertical axis versus the maturity date on the horizontal axis. A ‘normal’ curve (depicted below) rises from short term (say 3 month) out to, say, the 30 year long term bond (as we discussed in last week’s Weekly Wrap, Australia has only just introduced 30 years).

Banks make their money borrowing cheap and lending dear, effectively playing that curve. Of late, given fears about the future economy and rampant bond buying by central banks (of shorter maturity bonds – hence depressing the price and raising the yield), the yield curve has been relatively flat – not ideal. Throw in negative yields (i.e. the bank PAYING to hold the bonds) and it gets a bit nasty for them. If banks hurt, the “1%” hurt, and that’s just not on. The problem is too that BoJ have been SO rampant in their JGB buying that they now own over a third of all outstanding Japanese sovereign debt! This change in tack is seen then too as an admission they have pretty much exhausted their purchases. To date they have only be allowed to buy 7 to 12 year bonds and this new policy will give them more flexibility to vary that to manipulate the curve.

The funny thing is that they are still part of a global market and whilst the US Treasury (UST) yield curve (the global benchmark) did indeed steepen on the BoJ announcement, it got thoroughly smashed on the Fed announcement last night… nice segue…

Yes, surprise surprise, the US Fed kicked the can a little further last night and held rates unchanged at 0.5%. The speech was not unlike all the others with the theme of ‘nearly there’ continuing and the usual contradictions like "economic activity appears to have picked up" but then revising down their 2016 GDP forecast to 1.7-1.9% from 1.9-2.0% just a few months ago, but reassuringly said "Our decision not to raise rates does not reflect our lack of confidence in the economy"…. oh brother….

Of course one of the core reasons they actually need to raise rates is they are continuing to inflate fundamental-less asset bubbles – setting us up for an even bigger bust when it comes, or in her words "we don't want the economy to overheat”. When asked specifically about this Yellen ‘reassuringly’ said "we routinely monitor asset valuations... nobody can know for sure what valuation represents a bubble". History shows they have an absolutely shocking record of getting that wrong.

And so, right on cue, shares, bonds, gold and (the star of the night) silver all surged. But here’s a clue as to what is likely to come… 2 of that list of 4 assets are already over inflated and 2 are just coming off cyclic lows….