Exter’s Pyramid & This September

News

|

Posted 17/08/2015

|

6481

Two widely respected economists talk about periods of ‘hot money’ fleeing risky assets into safe assets. John Exter is the ex Vice President of the US Federal Reserve in the 1950’s, when money was backed by gold but was still an economist commenting on the post gold standard era we find ourselves in now (albeit towards the end according to many). He famously had this to say:

“We are in a world of irredeemable paper money – a state of affairs unprecedented in history.”

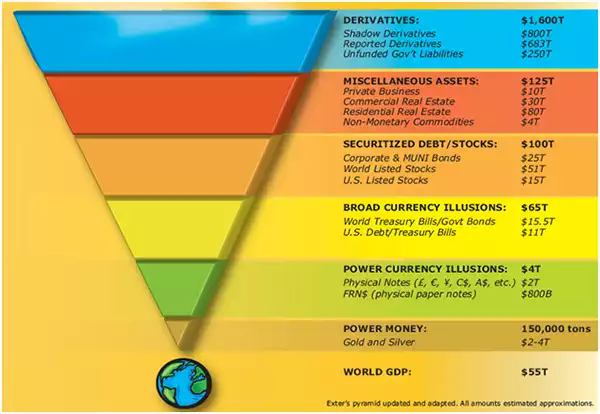

More famously though, John Exter developed what is now commonly referred to as Exter’s Pyramid (a modern illustration included below) to illustrate the financial system without that gold standard. In essence it is a layered, inverted pyramid with the riskiest assets at the top reducing down to the least risky at the bottom. When markets start to realise the inherent instability of an inverted pyramid he describes:

“…creditors in the debt pyramid will move down the pyramid out of the most illiquid debtors at the top of the pyramid…Creditors will try to get out of those weak debtors & go down the debt pyramid, to the very bottom."

We have seen 3 small glimpses of this this year alone. Firstly in January when the Swiss National Bank unpegged the Frank from the Euro, again mid this year over Greece’s near default, and last week with China devaluing their yuan peg to the USD. In each event we saw a modest flight to gold. But we must stress these are relatively small events compared to what is coming.

Another famous economist is Martin Armstrong who authored the similarly based but more instructive “Economic Confidence Model” or ECM. It is more instructive as it maps what has been a remarkably accurate cycle of 8.6 years. It predicted the 2007.15 timing of the GFC and adding 8.6 to that gives us 2015.75 which is of course September this year.

When you combine both you see the rush of ‘hot money’ from the top to the bottom of the pyramid potentially happening next month. But note the small base of an inverted pyramid not only aptly describes instability, it also describes the small ‘space’ for all that hot money to flow into. When that much money tries to get into that small a space, supply and demand dictates only one price and availability outcome for that asset. You have the opportunity to buy yours now to take the ‘availability’ part out of the equation and then simply enjoy the ‘price’ part….