Everything You Need to Know About the ETH Merge

News

|

Posted 09/08/2022

|

8802

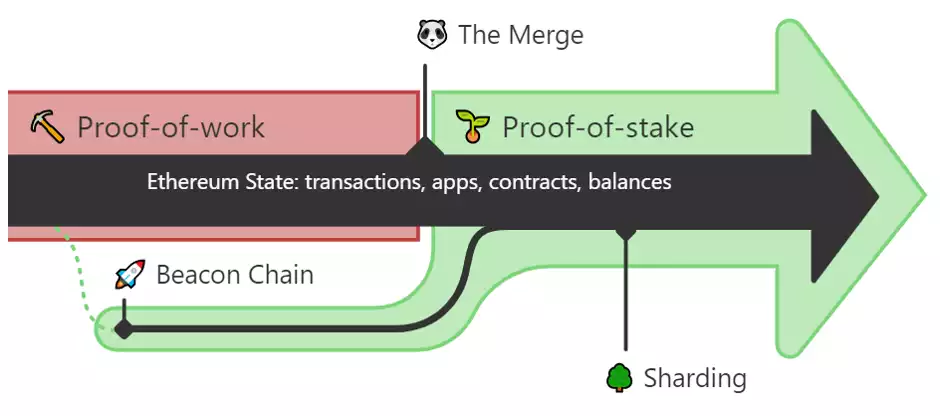

“The Merge” represents the joining of the existing execution layer of Ethereum (the Mainnet we use today) with its new proof-of-stake (PoS) consensus layer, the Beacon Chain. It eliminates the need for energy-intensive mining and instead secures the network using staked ETH.

Before diving into what the merge is, it’s essential to understand these two crypto consensus mechanisms:

- Proof-of-work (PoW) is a decentralised consensus mechanism that requires members of a network to expend effort solving an arbitrary mathematical puzzle to prevent users from gaming the system. This method requires a lot of electricity.

- Proof-of-stake (PoS) is a consensus mechanism that requires blockchain networks to employ validators who stake their own crypto assets in exchange for the chance to validate new transactions on the blockchain. An initial winner is selected to validate a new block, and other validators can attest to its accuracy. Once a certain validation threshold is met, the network creates a new block on the blockchain, and all participating validators earn an award in the native crypto on the network. This method requires less computational energy and is much faster.

The Ethereum merge is the point at which the network plans to move off proof-of-work (PoW) and transition to PoS. It sounds like a simple task, but technologically, it will require a serious push.

The Merge is expected to land within Q3/Q4 2022. The client developers are currently working to a soft deadline of 19th September 2022, but this could change depending upon the success of the final testnet merge this month, continued client refinements and the hash rate of the existing miners continuing predictably.

So, what does this mean for the price of ETH? Let’s look to see how market participants are positioning themselves.

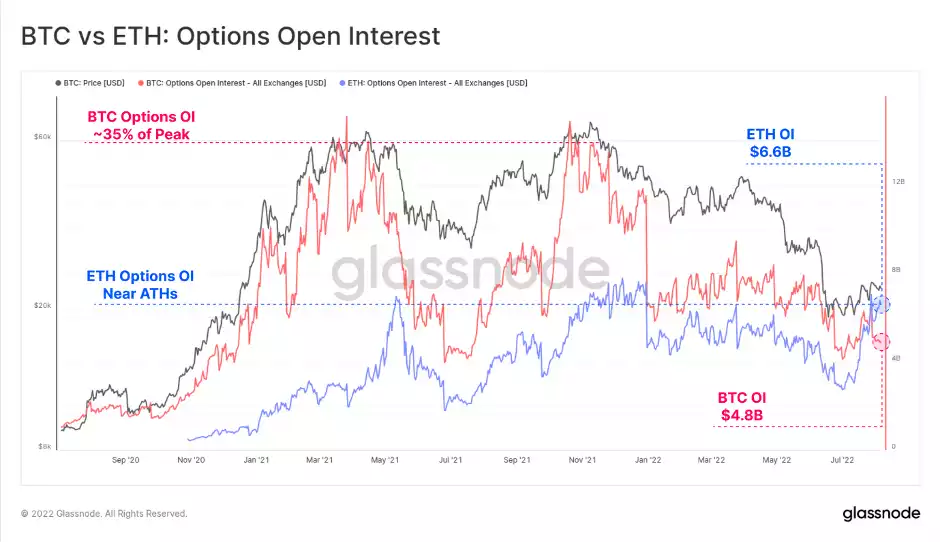

Derivatives traders are placing directionally obvious bets for Ethereum, specifically relating to the upcoming Merge planned on 19 September. For the first time in history, the Ethereum option's open interest at $6.6B is now higher than for Bitcoin at $4.8B.

Whilst not an all-time-high yet, ETH options OI is close to setting a new one, whilst Bitcoin open interest remains well below the peak at just 35% of the ATH.

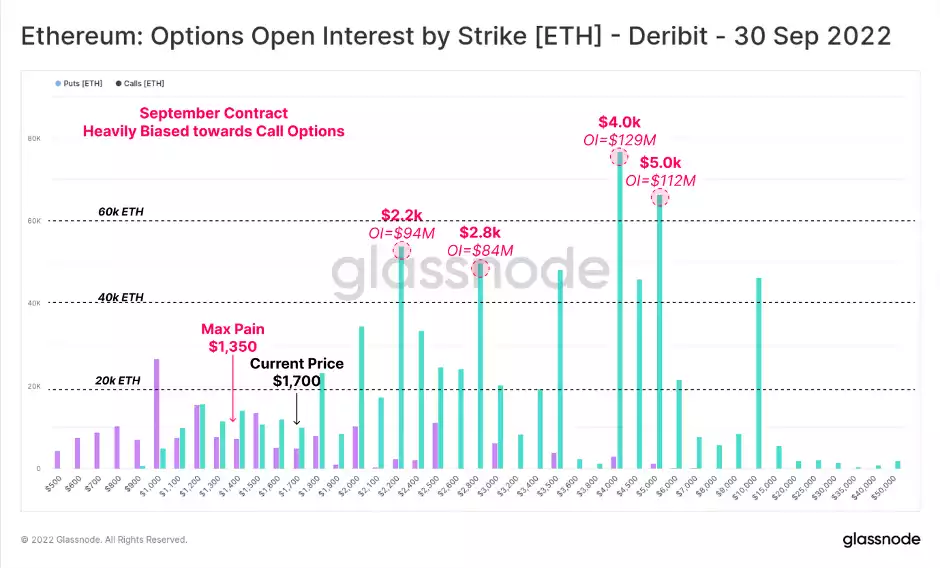

Call options dwarf put options for size, with traders betting on ETH prices upwards of $2.2k, with significant open interest even out to $5.0k.

The max pain price however is currently at around $1.35k, which would lead to the maximum number of options expiring out of the money. Given this is below the spot price as of today, it sets up for a very interesting month ahead.

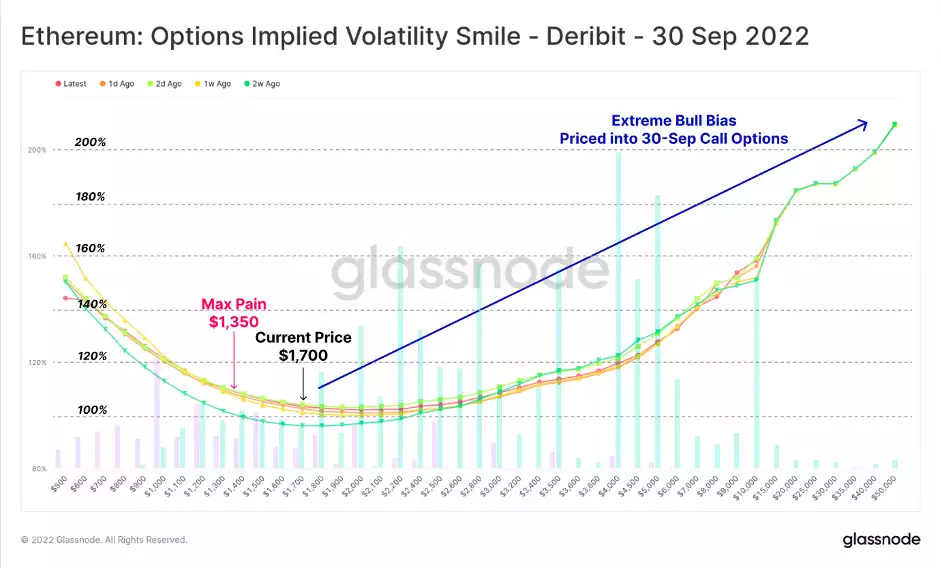

This large buy-side demand for ETH call options expiring in September has pushed the volatility smile into a state of extreme bullish bias. Overlaid on this chart are open interest bars, where it can be seen that the upwards slope is driven heavily by traders willing to pay a premium for long call exposure.

Implied volatility for this contract is well above 100% at almost all strike prices. The most bullish traders, who are buying call options above $5k, are willing to pay a premium of over 130% implied volatility.

ETH traders are clearly holding a long bias, expressed heavily in options contracts centred in September. Both futures and options markets are in backwardation after September, suggesting traders are expecting the Merge to be a 'buy the rumour, sell the news' style event, and have positioned accordingly.

What the long-term spot market does is highly debated. A comparably significant event to "The Merge" was the BTC Halving on May 11th, 2020. Both “The Merge” and the BTC Halving fundamentally changed network supply dynamics. In the case of the BTC Halving, we saw the price increase 450%+ in the 12 months that followed. Time will tell what “The Merge” does for the Ethereum price…