Everyone Is Now Talking About The Dollar

News

|

Posted 01/08/2017

|

5821

On this day in 1498, less than six years prior to his death, the Italian explorer Christopher Columbus first stood on the American mainland at a location in present-day Venezuela. At the time he called it “Isla Santa” thinking he was standing on an island.

Sadly 519 years later, despite controlling some of the world’s largest oil reserves, Venezuela is enduring incredible suffering at the hands of economic mismanagement. It is the most obvious modern example of the consequences of unrestrained money printing. We’ve covered Venezuela on numerous occasions and discussed the country’s gold draw down last year.

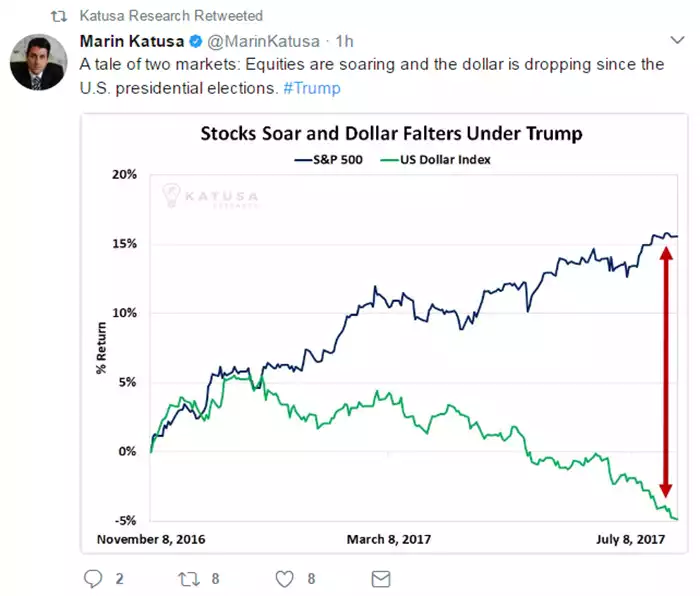

The prompt for this brief journey through the history of currency demise comes from the fact that this morning’s news theme seems undeniably focused on the US Dollar bear market currently playing out. Indeed the Dollar Index has fallen by approximately 9% for the year to date making 2017 the worst start to a year for the USD since 2002. This is something illustrated very well by Marin Katusa on twitter only an hour ago at the time of writing.

Only 2 hours ago, Reuters published an article discussing both the dollar and the fact that gold is now sitting at an approximate seven week high.

Citing “U.S. economic data that cast doubt on whether the Federal Reserve will raise rates again this year”, the article states that the dollar isn’t just falling against the heavily weighted Euro but against most major currencies.

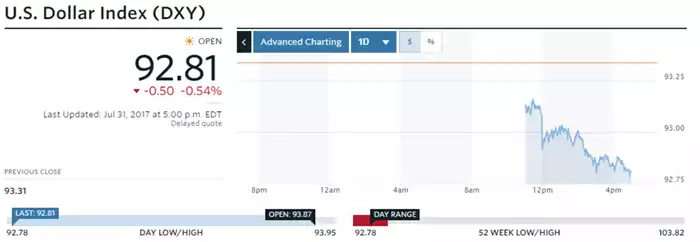

Eugen Weinberg, an analyst at Commerzbank goes on to say that "U.S. politics is a mess and U.S. data has not been inspiring." Furthermore, considering that the USD is now at its lowest in over a year (a fact not missed again by Katusa Research as pictured below), Standard Chartered concludes similarly that "rising geopolitical tensions and political uncertainty, weak U.S. macro data and a weaker U.S. dollar have buoyed gold prices".

The consensus of analysts seems to be that subdued headline inflation along with anaemic wage growth have eroded the case for another Federal Reserve rate rise this year.

Edward Meir of INTL FCStone joined the chorus by saying "we think that there is more upside on gold. A combination of a weaker dollar and falling U.S. bond yields should propel the precious metal higher, with North Korea being a wild card."

Only 13 hours ago came further confirmation from investing.com which covered the fall of the DXY citing it at 93.25 after seeing a fall of 0.6% during Friday’s session. At the time of writing, the DXY has fallen further to 92.81.

“The dollar remained on the back foot after data on Friday showing that while U.S. economic growth accelerated in the second quarter wage growth and inflation remained sluggish” referring to the fact that Q2 GDP printed 2.6% versus an expected 2.7%, and core PCE dropped to 0.9% from a downward revised 1.8%.

Moving on to work from David Lawder who 3 days ago reported on claims by the IMF that despite recent falls, the “U.S. dollar was overvalued by 10 percent to 20 percent based on U.S. near-term economic fundamentals”.

David goes on to say that “the IMF's External Sector Report - an annual assessment of currencies and external surpluses and deficits of major economies - showed that external current account deficits were becoming more concentrated in certain advanced economies such as the United States and Britain, while surpluses remained persistent in China and Germany”.

Even CNBC reported last Thursday on the dollar’s impact on gold prices and other commodities, arguing that the inverse relationship between the dollar and dollar priced commodities may no longer hold.

Citing material from Citi Research, the article interestingly argues that the correlation is now gone.

"Commodity prices have traded in a strong inverse relationship with the U.S. dollar over the past decade or so, but this relationship broke down in late 2016 and the breakdown looks here to stay.

Case in point—commodities generated strong returns in the fourth quarter of 2016 with the Goldman Sachs Commodity Index moving 9 percent higher despite a stronger greenback which gained about 7 percent against major currencies.”

To succinctly summarise, we are seeing strong capitulation in the world reserve currency and the upward momentum in gold at the moment may not be halted by any recovery that the USD may manage. This is more broadly a part of something unprecedented in financial history and worthy of the investor’s attention. To that end, today we conclude with one of our own pieces of work:

“Philip Haslam’s post-GFC (2014) book “When money destroys nations” as a study of Zimbabwe’s hyper-inflation is one excellent example of the value of hard assets to the investor. One of the numerous anecdotes contained within includes the wide-spread purchasing of motor vehicles (despite the lack of fuel to drive them) in a desperate attempt to acquire anything physical instead of holding cash”.