Euro Reality Woes Spark Sell Off – Crypto Surges

News

|

Posted 23/04/2018

|

6894

It was another rough day on Wall Street Friday. One of the main catalysts was warning signs out of Europe which also saw the US Dollar slightly stronger and a little pressure down on gold and silver. The winner Friday (and through the weekend) was crypto with strong gains nearly across the board. Bitcoin is up 12.5% over the last week, Ethereum up 26%, Ripple up 39%, Bitcoin Cash up an astonishing 65%, and Litecoin up 19%.

So what happened on financial markets Friday? There were more concerns around the flattening yield curve we discussed that day, and in contrast to the ‘everything’s awesome, we’re going to tighten our Quantitative Easing’ narrative the ECB has been spruiking for some time, their chief Mario Draghi conceded on Friday that Euro area growth may have peaked. He dialled back their 2019 inflation forecast to just 1.4% and delivered probably the quote of the day…. "An ample degree of monetary stimulus remains necessary." Not so ‘awesome’ it seems… Indeed Citi’s Economic Surprise Index for the Eurozone plunged to lows not seen since the 2012 Euro debt crisis:

So in our world where everything is relative, the beleaguered USD rose whilst the Euro plunged.

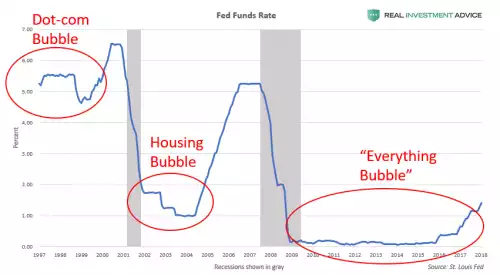

The ECB admission comes, of course, just as their US counterparts, the Federal Reserve, are faced with their rate hike agenda in the face of the yield curve heading to inversion. Real Investment Advice posted the timely reminder below of what happens each time the Fed hike rates after juicing the market with cheap money:

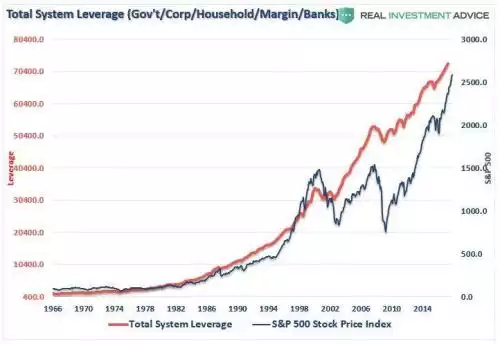

The difference this time is the market has gone MUCH harder in terms of loading up on all that cheap debt:

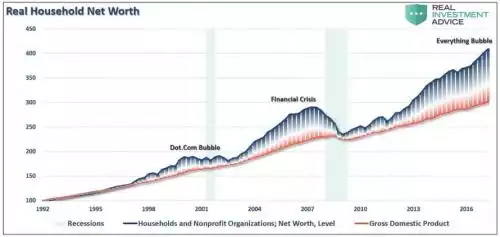

Logic dictates that the bigger that leveraged ‘growth’, the bigger the fall. We put ‘growth’ in inverted commas as we have reported time and again the growth, measured as GDP, has been bought with debt far exceeding the growth produced (read here and here for more). The following graph clearly illustrates that whenever our combined ‘wealth’ outstrips real GDP with each bubble, it inevitably reverts to meet it.

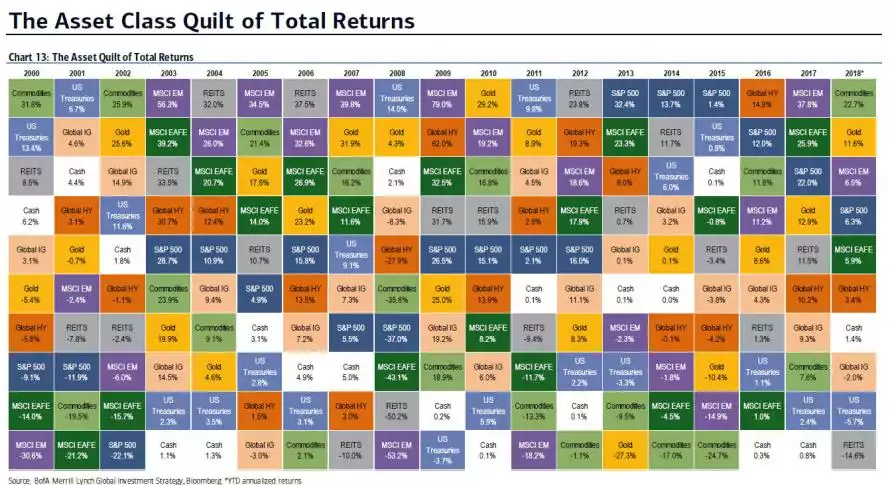

Note the blue line is Household net wealth. The GFC taught us it is the unwitting private investor who loses most in a crash. Let us finish with a look at Bank of America Merrill Lynch’s latest Asset Class Quilt of Total returns, year to date. Note the rise of gold over the last couple of years and the fall of the S&P500. The smart money, it would seem, is getting into safety already…

The recent surge in crypto could well be more of that money looking for an uncorrelated home as well.