Euro Banks – The Next Lehman?

News

|

Posted 29/06/2016

|

5397

Yesterday we spoke of the contagion effect on bonds post Brexit. The other financial sector at real risk are the big banks exposed to currency fluctuations, capital plunges, sovereign debt default and systemic risk.

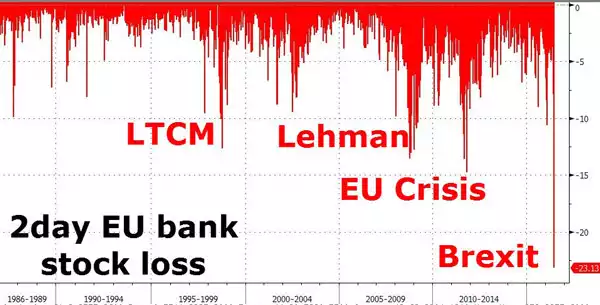

A picture paints a thousand words and the chart below (courtesy of ZeroHedge) shows Euro banks saw the biggest plunge in just the first 2 days post Brexit ever, eclipsing the crises of LTCM, the GFC and 2012 Euro crisis. Euro bank shares plunged over 23% in just 2 days.

And again it is the Italians most in the spot light, to the extent that on Monday their government revealed they are preparing to launch a Eur40 billion rescue package. This of course is in direct contravention of the EU rules outlawing government bail-outs in favour of shareholder and depositor bail-ins so there are tense discussions with the EU over its implementation.

Italian bank shares have more than halved this year, wiping enormous amounts off their capital base in the process. They also have a horrific 18% of non performing (bad) loans on the balance sheet, the result of Italy’s well publicised economic issues of low growth and high unemployment since the GFC. The bailout proposal comes after late last year where thousands of depositors lost their savings when 4 regional banks went under, something the government doesn’t want to see again and on a much larger scale. Of course the Eur40 billion bailout would be courtesy of even more government debt (via bonds) when their debt to GDP ratio is already over 135%.

But this is not just an Italian problem and it’s not just because of Brexit. It is a much deeper and more dangerous problem. Over the past year, shares of Germany’s biggest bank, Deutsche Bank, have plunged 56%. Swiss and global banking giant Credit Suisse is down an incredible 62% over the same period. The Euro STOXX Banks, encompassing 48 of Europe’s largest banks, is down 48% over the past year and earnings of some of the biggest have halved, it’s not just ‘sentiment’. This is way bigger than Brexit, but Brexit could be the trigger for that next Lehman moment….