Economics 101 & Gold

News

|

Posted 28/10/2015

|

3668

Supply and demand is one of the most basic principles of economics. The principle states, simplistically, that with limited supply and strong demand the price will rise to reduce demand in line with supply. The much discussed supply squeeze in September this year did indeed see a modest rise in the USD spot price of gold and silver, but not in proportion to the supply / demand dynamic playing out. Why? We’ve discussed at length the fact the spot price is (currently) largely dictated by COMEX futures trades, which whilst huge in value, rarely see actual metal change hands and of which have a fraction of that traded in physical metal on account backing it up. Recent discussions on this were here and more briefly recently this week here.

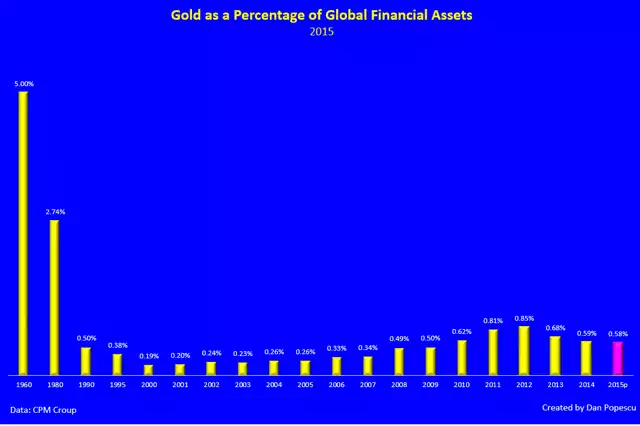

On Friday we talked about the percentage of investment in silver and what that represents against total fabrication capacity. We consider it a must read for anyone weighing up silver right now. Along the same vein, consider the graph below on gold. We discussed earlier this year the fact that the total financial assets value was c$294t and that available gold represented about $1.5t (it’s very much worth a revisit here). The graph below shows very clearly that statistic with historical context, importantly showing that prior to the commencement of this epic credit based financial assets expansion gold represented 5% of investment portfolios or 10 times that currently. The chorus of experts warning we are very near the catastrophic end of that debt splurge is growing strongly. So if even a small fraction of that $294 trillion tries to move into physical gold, the fundamental principal of supply and demand can only have one outcome. Physical supply / demand simply must overcome this paper based sham sometime and its feeling sooner than it has for some time. September was simply a small preview…