Diversification with your monetary assets

News

|

Posted 06/11/2019

|

12836

Whilst on Monday we spoke to both shares and gold rising in unison, last night saw a more typically uncorrelated price action between the two. Based purely on hope, shares finished slightly up but gold and silver took a hit on expectations of everything suddenly being awesome again.

Whilst gold and silver have well proven long term negative correlations with shares, crypto is still too young to truly prove as much, but the early signs are very encouraging. However there appears only limited correlation between the two ‘monetary’ assets of precious metals and crypto as well. That lack of correlation presents a hedge within a hedge opportunity for people looking to diversify their wealth.

The crypto market collectively is up nearly 1% over the last 24 hours with the likes of Ether up 1.7%, XRP up 1%, and Litecoin up 2.7%. Stellar has a stellar run, up nearly 17% last night. By comparison gold was down 1.75% and silver 2.72%.

Year to date gold is up 17%, silver up 15%, Bitcoin up 158%, Ethereum up 47%, Litecoin up 115%, Ripple down 12% and Bitcoin Cash up 92%.

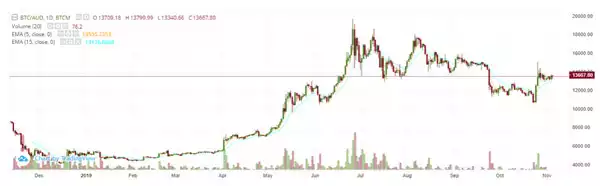

Bitcoin has been range-bound ever since its price jumped by more than 40% in one day on October 26th. The top cryptocurrency opened the week on a negative note by shedding 3.56% over Sunday night and Monday morning before jumping 3.5% yesterday and then settling again.

After facing some downward pressure yesterday, Bitcoin has been able to incur some upwards momentum which has allowed it to climb back to (in AUD terms) $13,650, which marks a slight climb from its daily low of $13,190 yesterday.

It is important to note that the past couple of weeks have marked a consolidation period for the cryptocurrency, which has been ranging between $13,000 and $13,800 ever since it incurred its rally to $15,130. The asset needs to go through these range-bound periods after a quick price increase so that the market can cool down and the weak hands can move to the strong hands, setting it up for the next phase of a rally.

Analysts are now observing that Bitcoin is currently wedged within a wide descending channel over a long timeframe, but a bullish formation that it is currently caught within on a lower timeframe may mean that a breakout of the upper boundary of this channel is imminent.

Bitcoin might be indeed on the brink of another turning point after weeks of low volatility. After being stuck in the $15,000 range for weeks, Bitcoin tanked to the $12,100 level on September 25th and it took it more than a month to experience a price relief, giving bulls plenty of time to load up again. We are still yet to be trading above the highs of September, which is the first price targets in further establishing the 2019 bull market.

When looking at the chart for bitcoin over the last year, we can already see a healthier and more sustainable market than that of late 2017. The market is moving more gradually, unlike the exponential rise in 2017, and is taking longer consolidation periods to re-establish key price support levels. The 'big' price target is the yearly high. If the assets surpass that level, it has nothing holding it back from taking a charge towards an all-time high. However, for the shorter term, we need to cross the price before the drop off in September ($15,100) and in the medium-term, take out the highs of May ($19,700).

Many will have seen the reports yesterday about a ‘single anonymous market manipulator’ causing the $20,000 top of BTC in 2017. Whilst that large player may well have spoofed the market higher we are calling BS on the assertion they were somehow solely responsible. The story goes hand in hand with the fake exchange volumes as well. We can speak with some authority on this as we know what our volumes were in Ainslie Wealth at that time and our OTC platform removes any reason for fake volumes. On their math and knowing what we were dealing directly, person to person in that period, one would have to think that comparatively little Ainslie Wealth in little Australia was somehow a material component of that volume. Yes we were extremely busy, but material in a global context?.... ohhh please…

-----

Finally, if you are interested there is a movie called Cryptopia showing for one night on Wednesday 20 November at the Elizabeth Picture Theatre in Brisbane City. Click on the image below to purchase your tickets.