DeFi – Undoubtedly the Future

News

|

Posted 15/09/2020

|

8317

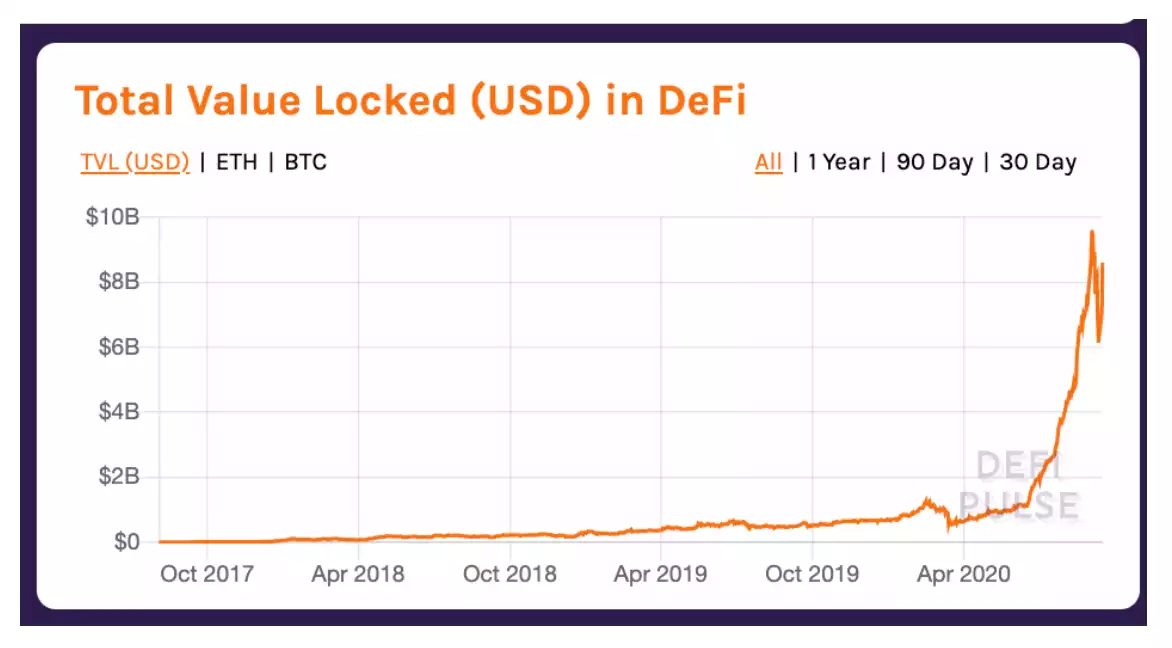

Decentralised finance, or DeFi, aims to give users an alternative by removing the need to trust centralised parties and traditional financial institutions by opening its doors to the world. This is achieved by building digital services in an open, permissionless, and decentralised manner.

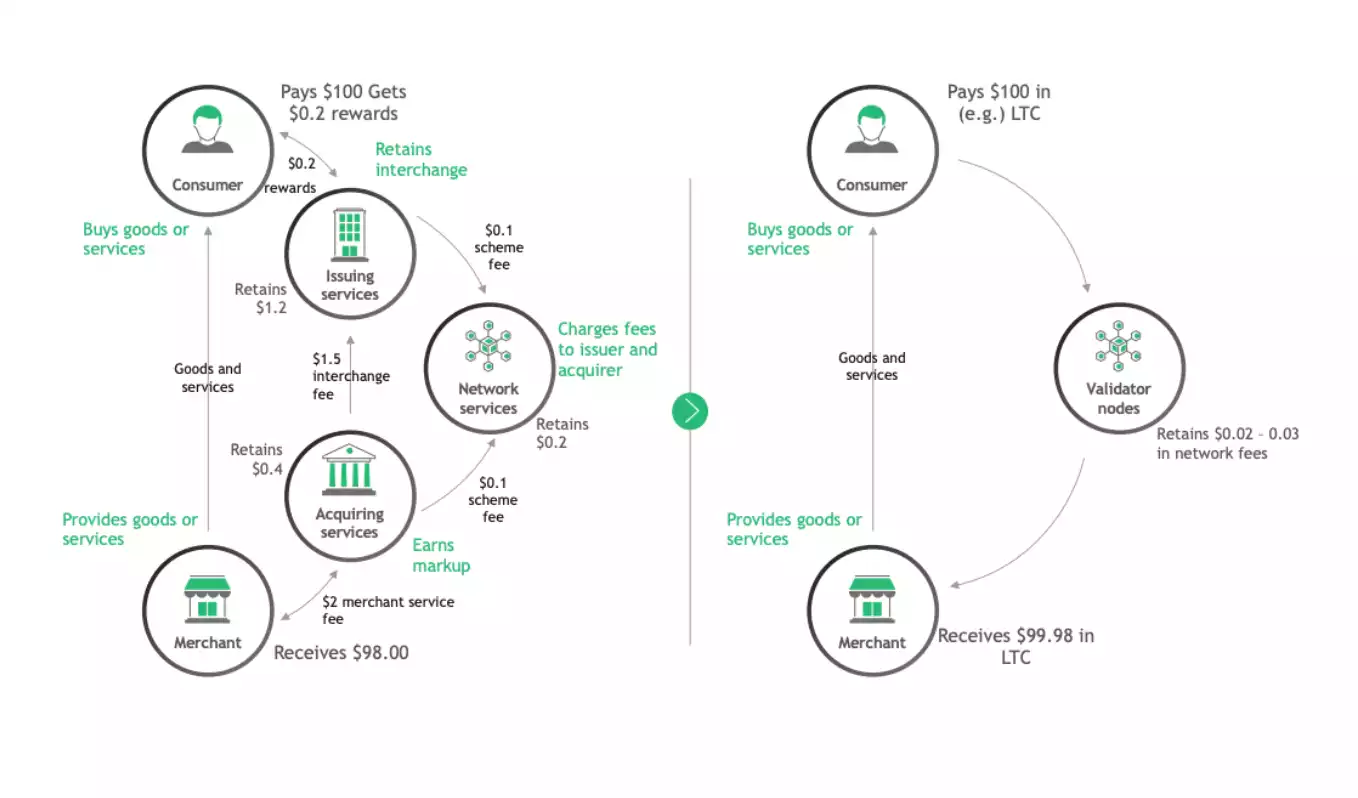

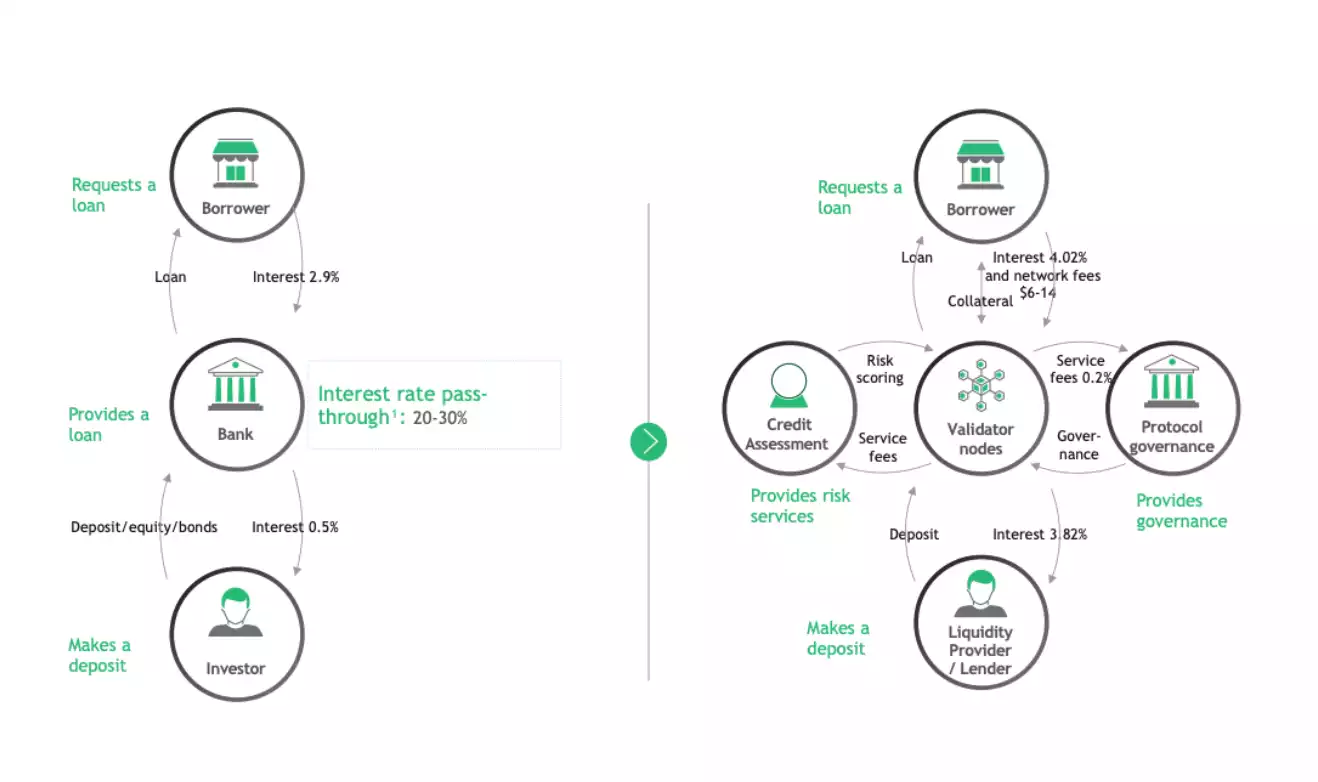

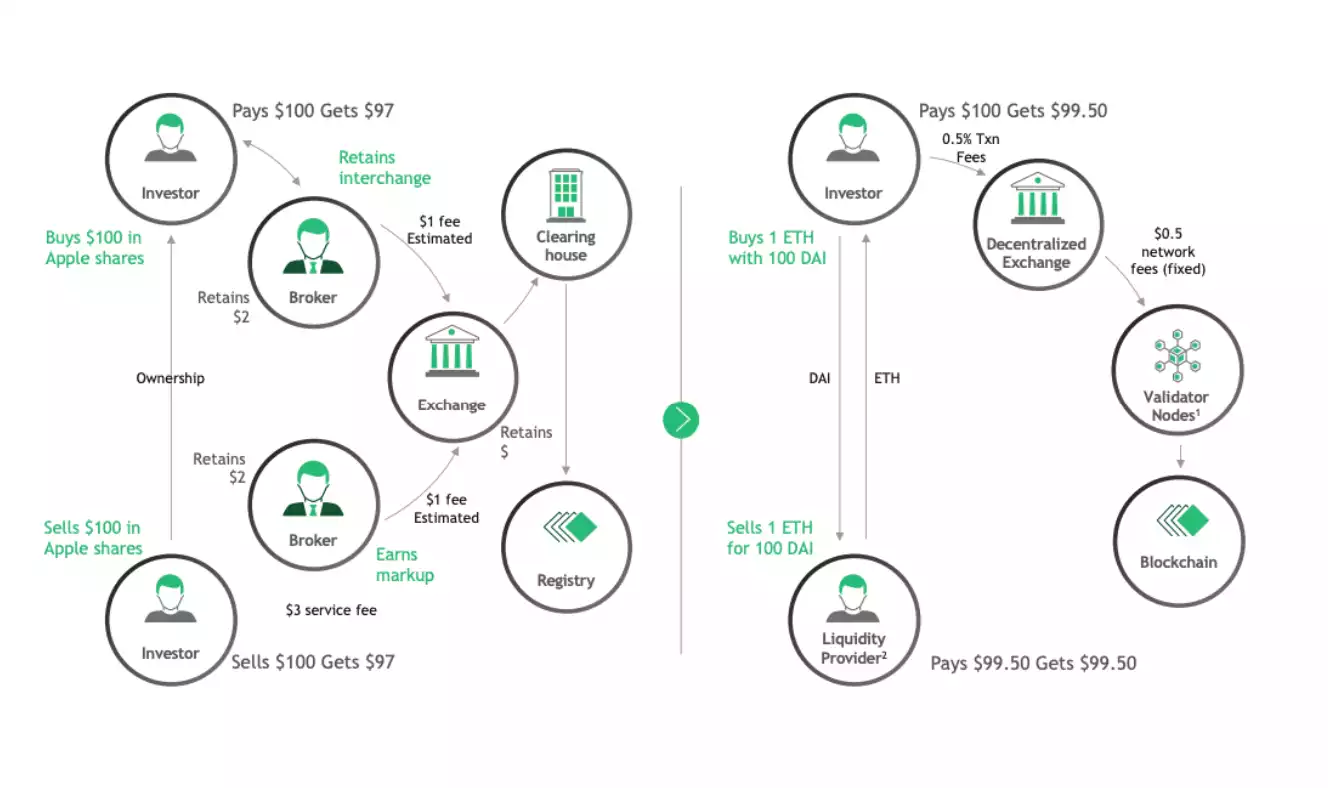

By removing the intermediary and automating many functions of the traditional institutions, DeFi can provide lower costs, higher degrees of security and privacy, resist censorship, increase accessibility and promote a decision-making democracy.

The ability to borrow funds, take out loans, deposit funds into a savings account, or trade complex financial products, all without asking anyone for permission, is gaining traction.

Due to its degree of accessibility, DeFi is ostensibly well-suited for emerging economies and demographics with limited access to financial services, potentially giving access to credit, exchange, and investment opportunities which would have been expensive and inefficient before. The only thing holding back DeFi currently is the overcollateralization required for borrowers to access DeFi loans which makes it impractical for these groups, unless they are already crypto owners. Additionally, many DeFi protocols require a specific degree of knowledge to use safely, without which users can be inadvertently exposed to risks – such as losing funds completely.

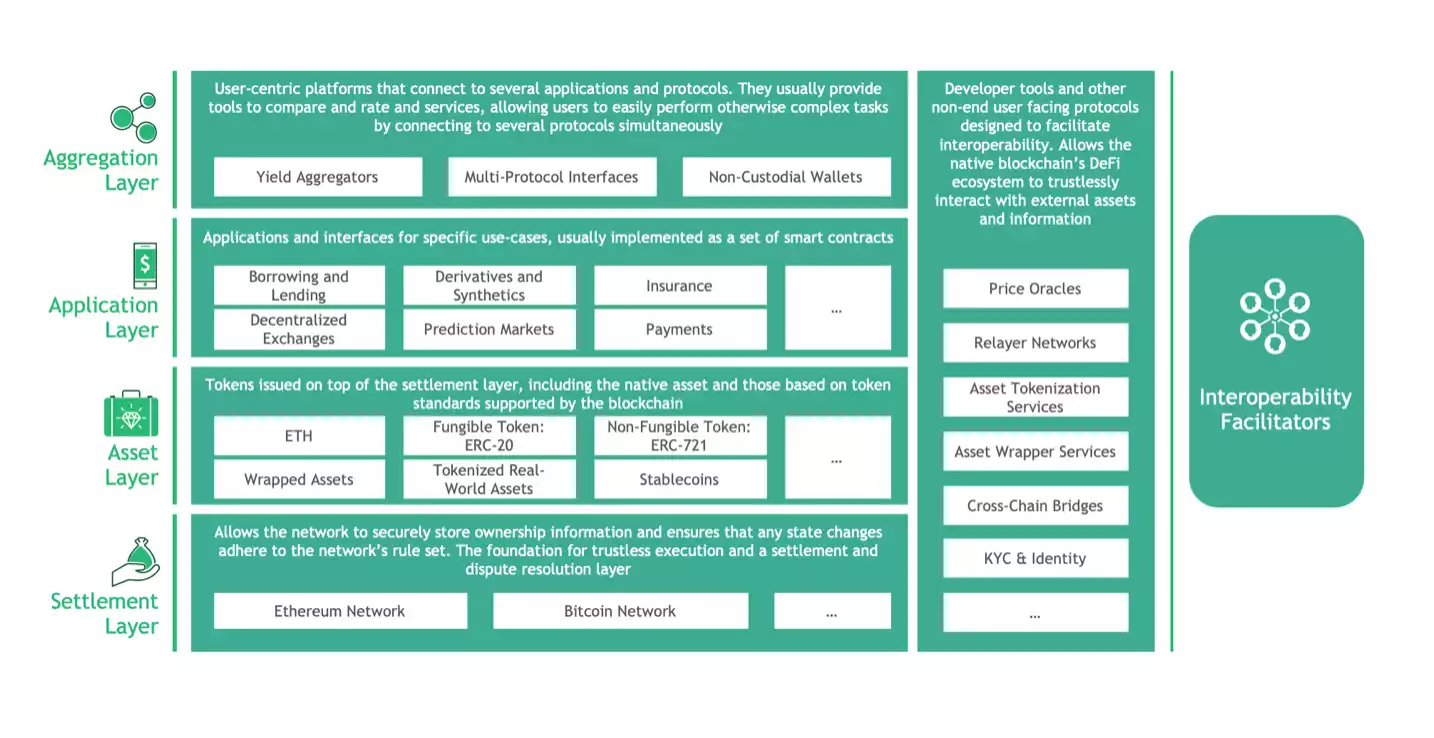

The Structure of DeFi

DeFi refers to financial services that are built on public blockchains (mostly the Ethereum blockchain) and based on open protocols and decentralised applications (dApps), allowing all aspects of the platform to be automated and performed without a central authority or intermediary. Conversely traditional finance relies on intermediaries and centralised institutions, increasing costs and stifling efficiency.

Although many cryptocurrencies such as Bitcoin and Ethereum are decentralised and have no intermediaries, the tokens themselves are not a financial service or platform. DeFi only refers to financial services built on programmable blockchains, with the most popular being the Ethereum blockchain (ETH token acting as the fuel for the entire system).

The challenges for DeFi are widely recognised, and the development community is trouble-shooting problems with better code and new forms of interoperability like atomic swaps and wrapped tokens.

Audits, bug bounties, open-source commitments and a community-led approach to security concerns will also add to a new level of trust in DeFi. And governments will also begin to regulate over assets, which will be a welcomed framework for traditional investors who are obliged to stay within legal parameters.

Solutions that facilitate liquidity are also imperative; a liquid market will increase the user-base, providing frictionless transfer across different blockchains and their DApps. For example, in order to improve the capacity of the Ethereum network, developers are planning to introduce Ethereum 2.0. By introducing upgraded infrastructure, significant gains can be made in the speed of transactions and capacity – solving Ethereum’s very apparent scalability issue.

Why DeFi over Centralised Finance?

There are 3 key areas of tradition or centralised finance that will be impacted with the growth of DeFi – payments, lending and exchanges.

- Payments

2. Lending

3. Exchanges

Regulation and governance have meant that the centralised finance industry excludes an enormous proportion of the world from access to financial instruments, increasing the wealth divide.

DeFi has the potential to bridge the gap and disrupt traditional finance by making money, payments and other financial services universally accessible and cheaper. This does not mean it will immediately threaten traditional institutions - Instead DeFi is encouraging commercial financial institutions, central banks and the crypto community to start collaborating today and build a new-generation of politically and technologically resilient financial solutions - not just for emerging economies but also companies looking to innovate or locked out of traditional finance in developed economies.

As globalisation progresses and the business ecosystem further shifts towards new-generation business models built upon shared governance and decentralisation, there will be a growing demand for solutions like DeFi which will provide new ways banking, trading and investing - perhaps even setting the standard for economies to climb out of the shadows.

Ainslie Wealth trades 2 of the key DeFi facilitating cryptocurrencies, Ethereum (ETH) (upon which most DeFi is built and whose ETH tokens are the ‘gas’ that makes it work) and ChainLink (LINK) which brings a trustless interface between traditional and decentralised finance. Go to Ainslie Wealth to easily and securely trade or call us (1800 987 648) to deal with a human.