DeFi – The ‘Bank’ of the Future

News

|

Posted 27/05/2020

|

18669

You can now listen to the article and all our daily news, via YouTube and Anchor

The traditional finance market is centralised. Central authorities, like the government and banks, issue the regular currency that drives our economy and used for every trade. Therefore, the power to manage and regulate the flow and supply of such currencies in the market resides with them. We also pass the control of our assets to various financial organisations like banks in expectations of getting higher returns. The problem with this is since all the control and funding is centralised, the risk is also at the centre.

All the issues arise because of the centralisation of the finance that underpins the global economy, but it is definitely not an open system. The solution is to decentralise.

Bitcoin and other early crypto coins have offered a way of secure peer-to-peer trading without the need for intermediaries like a bank for trade settlement. This gives users complete control over their assets.

However, keep in mind that these cryptocurrencies have not decentralised the financial system. They have just decentralised the issuing of money and its storage. There are a couple of problems which are hindering blockchain from making the financial system genuinely decentralised:

- While the cryptocurrencies are decentralised, they can mostly be accessed via centralised access points such as exchanges.

- Most of these crypto projects are managed through centralized companies that lack accountability or transparency.

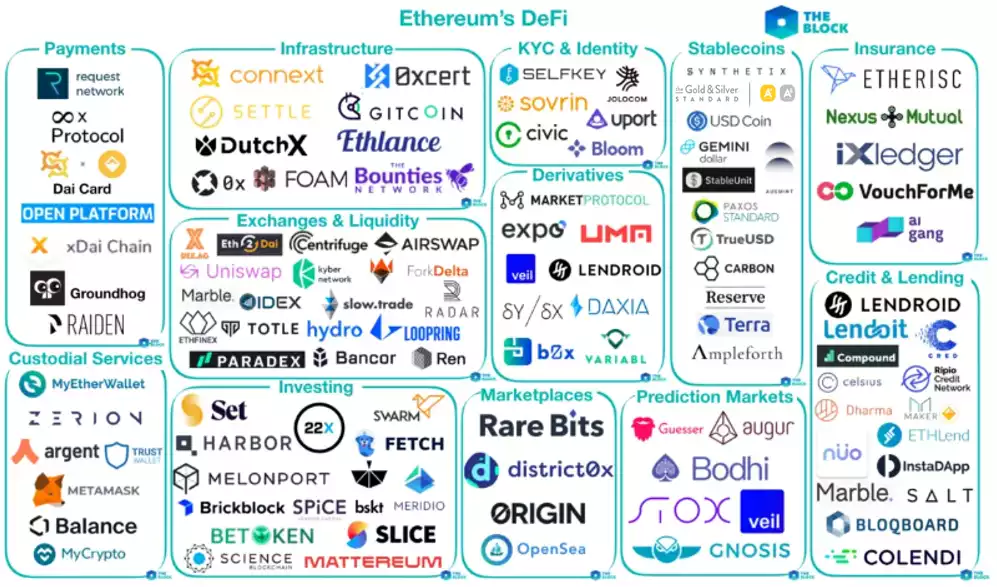

Decentralised Finance includes digital assets, protocols, smart contracts, and dApps built on a blockchain.

Given the flexibility and amount of development, the Ethereum platform is the primary choice for the DeFi application, but that doesn’t mean it’s the only blockchain platform.

Think of DeFi as an open financial ecosystem where you can build various small financial tools and services in a decentralised manner. Since these are applications built on a particular blockchain, they can be combined, modified, and integrated according to your needs.

DeFi is offering you control of your own assets.

Though many new-age banks and fintech firms promise to provide more control to the users, in reality you are still trusting them to manage your funds. The objective of DeFi is to give you full control of your assets, and it can because of decentralisation and blockchain technology. Also, many developers of financial apps are adopting open-source protocols for trading through decentralised exchanges.

The fact that all protocols are open-source allows anyone to build new financial products on top of them. Developers across the globe can collaborate to create new products leading to faster innovation and a secure network.

Anyone can store, trade, and invest their assets in the blockchain securely and earn a much higher return than from the traditional financial system. Since there are no intermediaries handling your asset, you have complete control over your investments. You become your own bank.

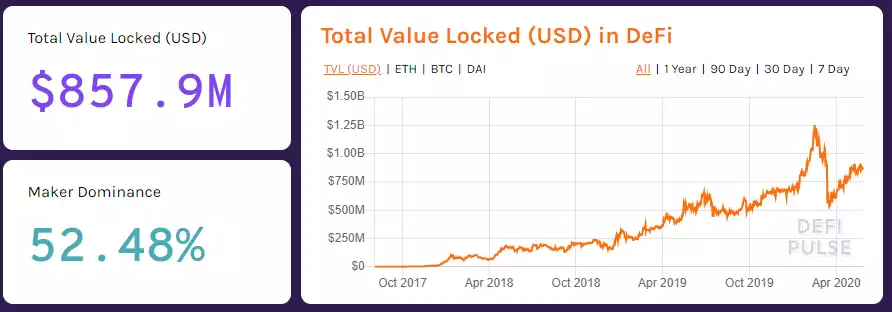

A system is decentralised only as its most central component. The DeFi market is tiny compared to traditional finance, but it has picked up its pace rapidly during the last few years. With more projects and financial dApps we can expect to reach a genuinely decentralised financial reality where the traditional finance market is interoperating with digital assets and blockchain in perfect sync.

Since 2019, the value of assets locked up in the DeFi ecosystem has risen from $240 million to $10 billion, and analysts believe that the growth in popularity and number of assets staked across DeFi platforms will increase demand for Ether and support a steady rise in the altcoin’s price.