Debt… No New Way to Go Broke

News

|

Posted 21/03/2017

|

5888

We often say there is no new way to go broke.. it is ALWAYS too much debt. Debt has been by far and away the biggest facilitator of our economic growth since the GFC (and ironically up to and ultimately causing the GFC). We say ‘ironically’ because we are doing the same thing but on a bigger scale now. Vern Gowdie of The Daily Reckoning put it well yesterday:

“Over the centuries, we’ve made huge advancements by learning from the mistakes of our predecessors. The rapid progress in technology, medical science, space travel and healthcare is all thanks to our willingness to learn and evolve.

Ironically, though, when it comes to markets and the economy, we are still as naïve and stupid as the tulip-buyers of 400 years ago.

We think we are smarter, but our actions prove otherwise.

History tells us emphatically that debt crises always — without exception — end badly.

Debts are defaulted on. Businesses go bankrupt. Creditors lose money.

That’s how debt is expunged from the system…very, very painfully.

Based on the laws of ‘yin and yang’, the more debt that’s in the system, the more painful the process of expunging it becomes. It’s not rocket science to comprehend the process which says that, the higher you climb, the harder you fall.

Here we are sitting atop THE greatest debt pile in history — US$60 trillion more than we had in 2008 — and such is our misplaced mindset that we expect to add even more debt to this pile, without the slightest risk of triggering an avalanche.

Seriously, how stupid are we?”

Well, quite stupid it seems. There are a plethora of examples but let’s look at just 3 this last couple of days. From the front page of today’s Australian Financial Review:

“Regulators are preparing to impose a fresh wave of constraints on the banks to slow investor lending growth, crack down on interest-only loans, and force buyers to stump up more equity on purchases as they scramble to manage a rampant property boom.

Warning that financial and economic risks have grown in recent months, particularly across east coast property markets, the nation's top financial regulators and Treasurer Scott Morrison unleashed co-ordinated calls for fresh restraint from banks.”

The article goes on to describe the risks of the current property bubble and the sort of stupidity Vern speaks of. From the mouth of our chair of ASIC:

“A major concern is that many buyers are suffering a fear of missing out and are rushing to buy at current prices, Mr Medcraft said.

"It is worrying because when you are in a market like this, people rush in and say 'I can't miss out, because it might keep going'. You can understand that [but] that's what happens in a booming market."”

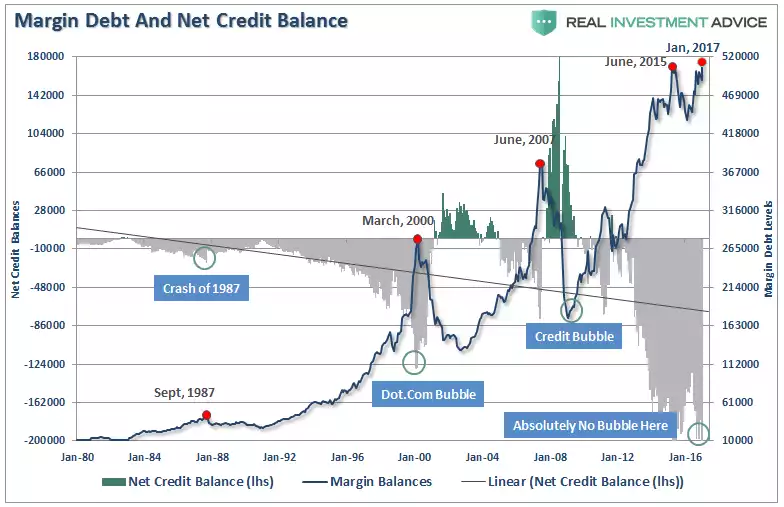

Now let’s look at debt supporting the biggest sharemarket in the world, the US. The graph below shows the amount of margin debt in the US sharemarket. Such is the mindset of the herd that not only are they piling into the sharemarket, they are doing so on record amounts of borrowed money.

To state the obvious, this has the potential waterfall effect of when the market turns and margin calls come in, the selling feeds on itself and prices free fall.

Finally let’s look a little closer at the very companies these investors are buying shares in.

We learned a few days ago that US companies are issuing corporate bonds (raising debt) this year to date at the fastest pace since the dot com mania of 1999. $360b worth in less than 2 ½ months! Whilst the rate is extraordinarily high, you will know this is not new. Since the GFC, US companies have borrowed over $9.5 trillion via bond issues. To put that into perspective that is more than 60% more than in the same period leading up to the GFC.

If this were being done in a strong environment with healthy cash reserves it may not be cause for concern but it’s not, and after debt levels were reduced (against cash reserves) immediately after the GFC, we have been on the same slide down since late 2010 where we are now seeing cash reserves to debt at less than 18%, the lowest since 2009 and only marginally better than just before the GFC.

But don’t waste your money on defensive assets such as gold and silver, you might miss out on higher gains yet… Over to Vern again for the last word on these debt levels…

“The very toxin that created the 2008/09 crisis is supposedly meant to cure us this time…apparently, this time must be different.”