DE-RISKING AHEAD OF THE GLOBAL GROWTH SLOWDOWN” - Nomura

News

|

Posted 24/05/2019

|

6544

There was more volatility on the markets last night across the globe off the back of heightened concerns on the US China trade war, a range of terrible manufacturing index and confidence prints, and of course the Brexit debacle continuing. The flight to safety saw gold and silver up solidly and likewise US Treasuries. The 10Y plunged below a yield of just 2.3% but the bid across the board with everything between 5Y and 30Y hitting lows not seen since 2017. Not only did yields fall but we saw the 3M 10Y yield curve crash back into inversion (explained here).

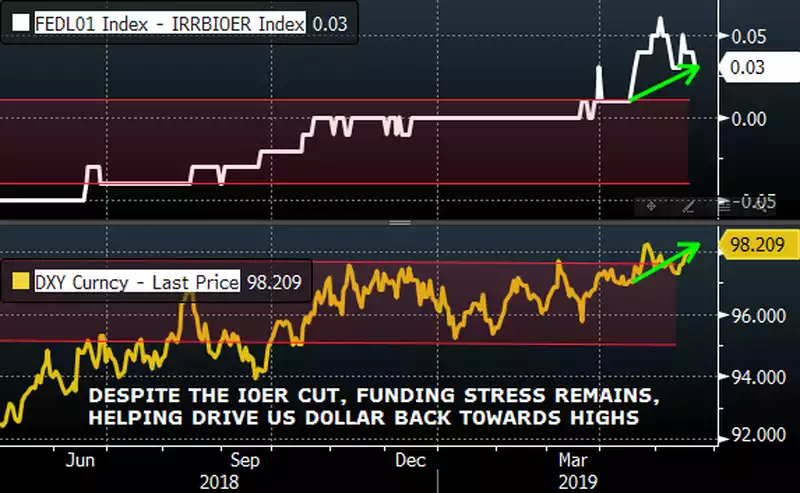

The Fed minutes came out this week giving a very clear impression they were in no hurry to drop rates and instead stressed a ‘patient’ stance would be adopted. That’s in defiance of a market pricing in a 46bp drop this year and an Effective Fed Funds rate (EFF) persistently above the IOER (that we explained previously here).

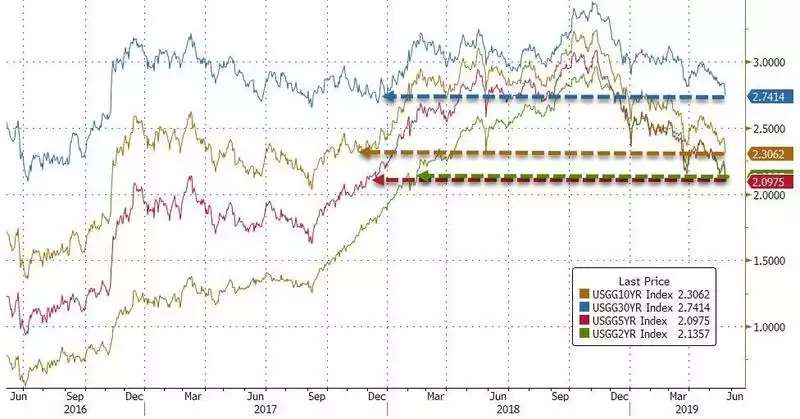

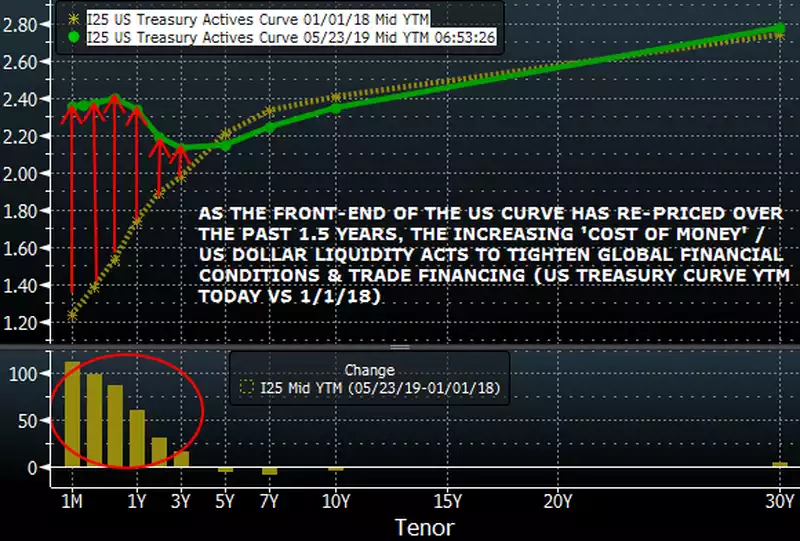

This resulting ‘USD shortage’ and its cost is starting to concern analysts. Looking at the first chart of the US Treasury yields above you can see that tightening of spreads (flatting of the curve) over the last year and a half clearly. The chart below illustrates that exactly:

That higher cost of money for the globally traded USD is going to hurt more and more amid an already weak trade environment as we illustrated this week.

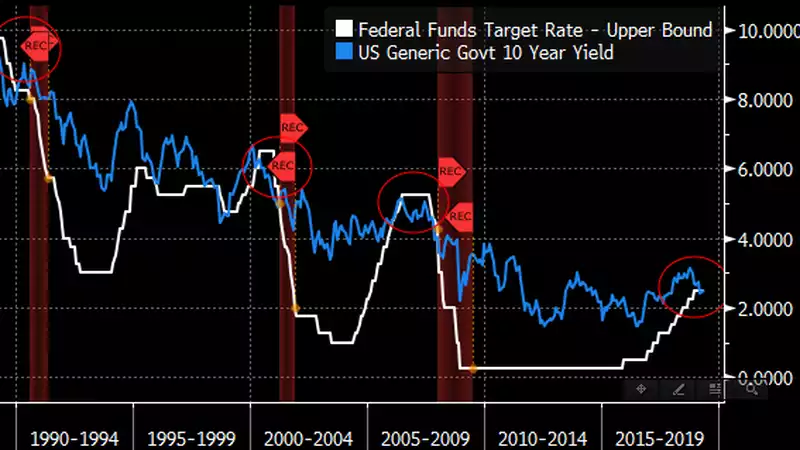

The determination of the Fed to hold strong is a repeat of previous attempts denoted by the plateaus of the Fed rate in the chart below. If as the market and analysts predict, the next move is indeed down, you can see what has happened in nearly every such occurrence over the last 30 years… a recession.

Asian finance giant Nomura’s Charlie McElligott puts forward what he describes as a "pretty simple logic equation":

China / US trade war acceleration dynamic

+ Dollar strength (“USD Shortage” thesis picking-up new catalysts)

+ defiant “patient” Fed

= further economic downside trajectory

= DE-RISKING AHEAD OF THE GLOBAL GROWTH SLOWDOWN

As last night demonstrated, gold and silver are still a preferred home when such “de-risking” occurs.