Currency Wars & You

News

|

Posted 12/08/2019

|

8199

With China devaluing their Yuan in retaliation for the US sanctions the US wheeled out its 30 year old cannon, the Omnibus Trade and Competitiveness Act of 1988, and fired off a “Currency Manipulator” shot to China. This declaration, the first in 25 years, triggers the IMF to come in on the action together with the US Treasurer. What they can achieve is highly questionable. We wrote about the implications last week here. But how does this whole currency war affect the ‘man in the street’ really. We came across this succinct take by Daniel Lacalle:”

“A currency war is a conflict between nations trying to artificially devalue their domestic currency in order to be more competitive internationally but also to hurt their opponents. Using the currency to make the other nations less competitive while at the same time weakening their power.

It is based on a myth.

That devaluation helps competitiveness and that having a strong currency is negative. Devaluation is not a tool for exports, it is a tool for cronyism, and destroys the purchasing power of salaries and savings to benefit low productivity sectors and the government. It is a transfer of wealth from citizens to the government.

The decision of the US Administration to consider China a currency manipulator is very relevant and can have significant implications for markets and the global economy, including:

Excluding Chinese firms from US government procurements.

Block or stop trade deals.

Calling for heightened IMF surveillance.

Sanctions to firms trading Yuan and actions at the IMF to take away China’s currency status.

It is very easy to prove that a country is not a currency manipulator. Eliminating capital controls and exchange rate fixing. The US would have never been able to consider China a currency manipulator if the yuan was not artificially fixed daily and capital restrictions had been eliminated.

The problem is that China needs, on the one hand, a strong currency that guarantees the purchasing power of wages and savings in a country where inflation is already underestimated in official figures (read) and, on the other, a weak yuan to artificially make weak sectors appear competitive and increase exports.

Devaluing is not a tool to export, it is a tool to disguise structural imbalances and always harms much more than it benefits.

Unfortunately, in the United States, there are voices that want to “weaponize the dollar” (politically intervene the currency) defending the obsolete and pointless policy of devaluation, which would be the biggest mistake in history and put the US economy and its status as a reserve currency at risk.

If the world gets into a currency war, with the assault on wages and savings that devaluation entails, no one wins.

A currency war is a war against citizens, their salaries and their savings, to benefit inefficient and indebted sectors.

A currency war would devastate the purchasing power of salaries and suppress investment and consumption decisions. When governments attack the currency, the economic agents’ reaction is not to invest and consume more, but a generalized slump in spending and capital allocation.

If a country enters a currency war, it disproportionately hurts its own citizens. If China and the US do it, it will likely lead to a severe global crisis.

A currency war is not about who wins, but who loses the most. And if countries embark on an assault on their citizens’ wealth via devaluation the message to the world is only one: buy a reserve of value assets and hide.”

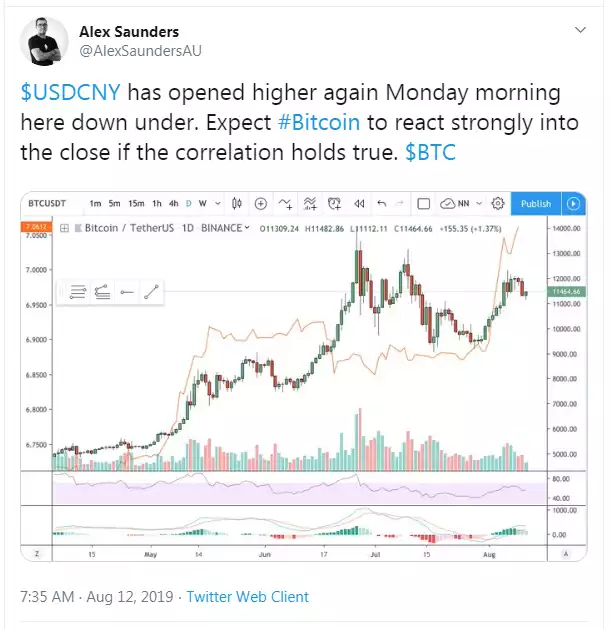

Value assets are hard assets that sit outside this Fiat currency and inexplicably linked financial system. The proven king of them is Gold and Silver but don’t forget the new kids on the block of Bitcoin etc. Of late Bitcoin has been establishing a correlation with this whole USD / CNY game playing out as Nugget Tweeted this morning, today could be an interesting one to watch…