Crypto Markets Update

News

|

Posted 21/04/2020

|

13671

After dipping early last week, bitcoin jumped back over $11,000 on Saturday, as other major cryptocurrencies enjoyed a weekend of gains as well. With the highly anticipated bitcoin halving less than a month away, investors are still unsure how the market is primed to react. A drop in supply could be a catalyst for bitcoin, but bears say miners who can no longer turn a profit could flee the market.

Crypto analytics company Coin Metrics projected crypto miner revenue to drop to USD 3.3 billion in 2020 from USD 5.5 billion in 2019, which could temporarily pressure these companies to sell.

Bitcoin is set to see its coin reward to miners fall from 12.5 bitcoin per block to 6.25 on May 13, 22 days from now, with the cryptocurrency community already looking forward to what's expected to be one of the biggest ever events in crypto.

"As the third halving event to occur, there are opportunities for what might come after, with history telling us that the bitcoin price will typically begin to rise significantly within the 12 months following a halving—something that can be simply put down to supply and demand," said Danny Scott, the chief executive of Isle of Man-based bitcoin and crypto exchange CoinCorner, adding he expects the bitcoin price to surge back to its all-time high of around USD 20,000 per bitcoin this year.

There have already been two bitcoin halvings since bitcoin launched in 2009, one in 2012 and another in 2016. Bitcoin halvings are scheduled to continue roughly once every four years until the maximum supply of 21 million bitcoins has been generated by the network—which isn't expected to happen until well into the next century.

Bitcoin and cryptocurrency prices have broadly climbed this week, somewhat in anticipation of the upcoming halvings, but the global coronavirus crisis and government's extraordinary lockdown measures have dominated traditional and crypto markets.

Bitcoin and its forks' upcoming halvings put them directly at odds with the massive stimulus measures and quantitative easing unleashed by the U.S. government, the Federal Reserve and other central banks around the world to spur economic activity as countries shut down to try to contain the coronavirus COVID-19.

Bitcoin's halving has "recently been dubbed the 'quantitative hardening,'" according to Scott, with CoinCorner reporting that March was its busiest trading month in two years.

Some have suggested surging bitcoin demand could result in a bull run to rival bitcoin's epic 2017 rally that saw the bitcoin price climb from under USD 1,000 to around USD 20,000 in less than 12 months.

Other bitcoin and crypto exchanges have reported a similar uptick in activity over the last month with year-on-year U.S. registrations for London-based bitcoin and crypto specialist broker eToro soaring 221% in March.

"People are coming to us to invest in crypto-assets so we are still very bullish on its long-term potential," said Guy Hirsch, eToro's U.S. managing director, adding: "There is a growing consensus that due to the Fed announcing unlimited quantitative easing, investors could soon be looking to bitcoin as an inflation hedge against a depreciating dollar."

Other bitcoin and crypto market watchers are similarly upbeat, betting on bitcoin as a "store of value" due to its "scarcity."

"Whilst halving events have previously generated major bitcoin price runs, I believe that other key drivers will have a more significant, longer-term impact on the price of the digital currency," said Nigel Green, the chief executive of financial advisory group deVere, pointing to central banks cutting interest rates to zero in an attempt to offset the economic turmoil wrought by the historic coronavirus pandemic.

"In this time of economic turbulence, the growing consensus that bitcoin is becoming a flight-to-safety asset has further strengthened," Green said.

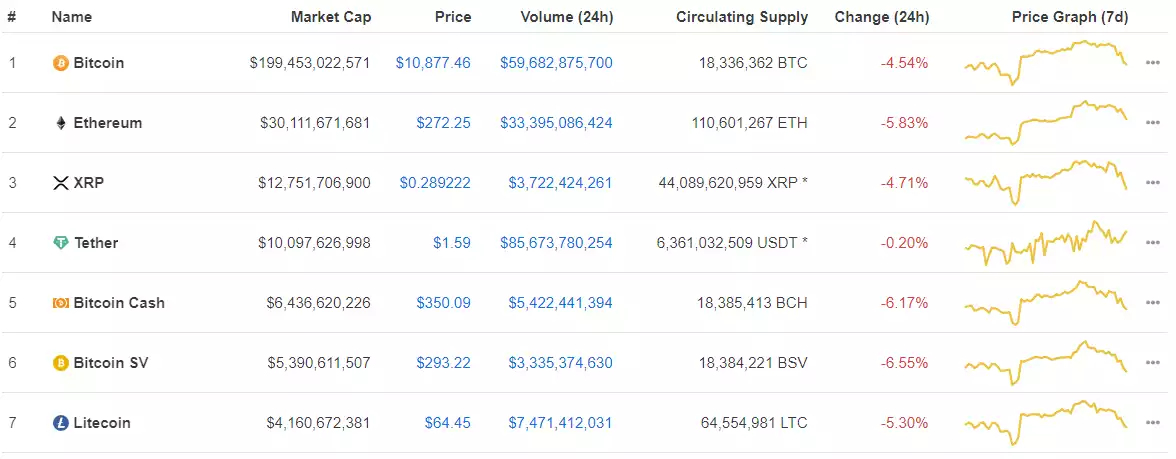

The silver to bitcoin’s gold, Ethereum, has also been buoyed by a huge lift in its use in the DeFi, or Decentralised Finance space, and as you can see from the most recent figures below, has 24 trading volume in excess of its entire market cap.

As you can see last night crypto markets corrected after the gains over the weekend however Bitcoin is maintain its steady climb out of the big 12 March sell off.

And likewise Ethereum: