Crypto Market Opts for Safety

News

|

Posted 15/02/2022

|

5540

Bitcoin investors have de-risked as global macro headwinds increase. In particular, traders eye the proposed Fed rate hikes in March, opting for protective insurance over speculative calls.

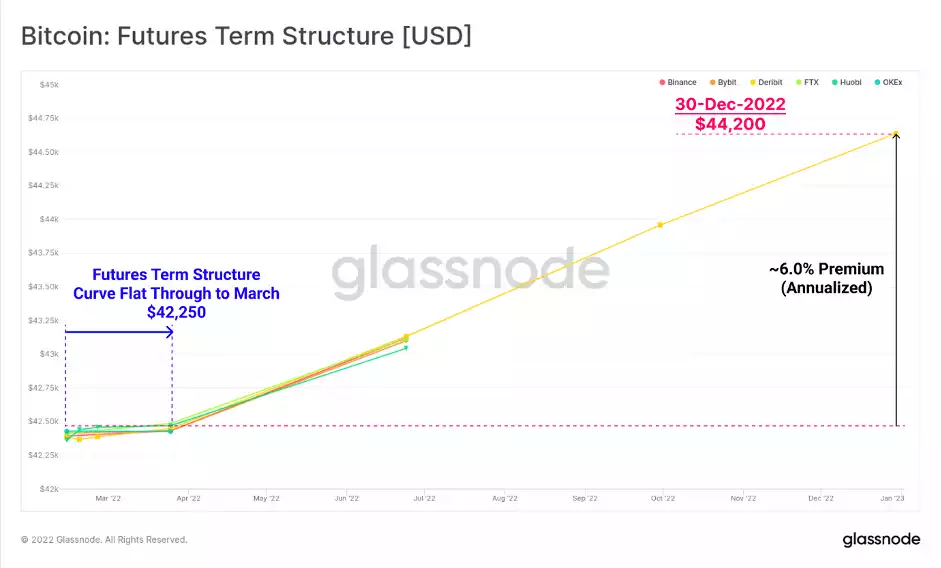

The Bitcoin market continues to grapple with numerous macro headwinds, from the tightening of Fed policy expected in March, and now fears of a potential conflict escalation in Ukraine. This week has seen Bitcoin derivatives markets pricing in this uncertainty, with a flattening out of the futures term structure curve until March. Futures premiums out to the end of 2022 are notably low, trading at just 6% annualised, and the market is expressing a strong preference for protective put options.

Simultaneously, on-chain supply dynamics are remarkably stable, a likely indication that investors are prepared to ride out whatever storm lies ahead, preferring to utilise derivatives to hedge out risks. Overall, this speaks to the continuing maturation of the Bitcoin market, as liquidity deepens, and more comprehensive risk management instruments become available. This differs greatly in comparison to historical Bitcoin market cycles where de-risking was possible only by the sale of coins in spot markets.

Quite to the contrary, current spot holdings and flows on-chain continue to display to be constructive characteristics, rather than a mass exit driven by fear or panic.

As Bitcoin derivative markets mature and liquidity deepens, we can draw increasingly useful information from futures and options pricing. Across all of the exchanges, the futures term structure has flattened out through to March, equivalent with the expected rate hikes proposed by the Federal Reserve. This speaks to a clear investor uncertainty regarding the wider economic impact of a tighter US dollar, given the preceding decades of loose monetary policy.

Futures out to the end of 2022 are currently trading with a very modest 6% annualised premium, suggesting the market is quite far from anticipating a wild bullish impulse any time soon.

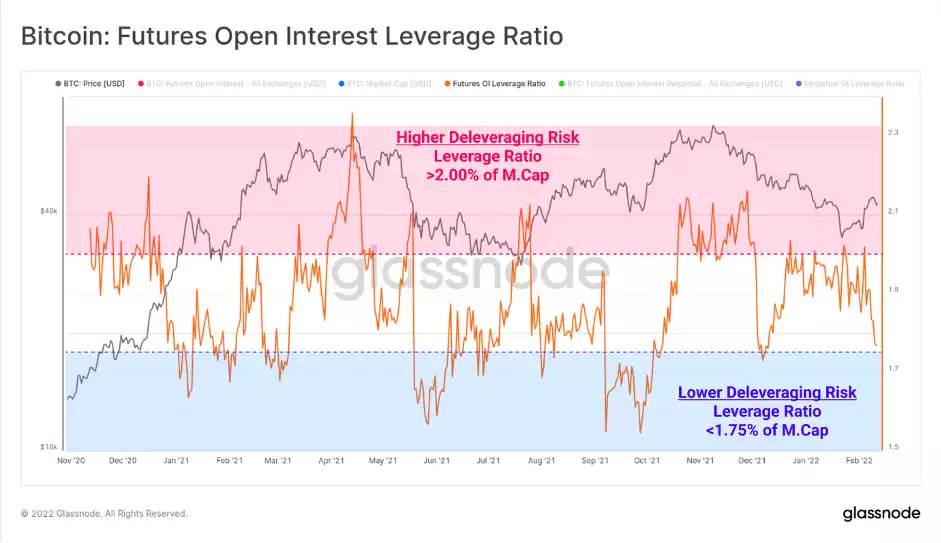

There has also been a notable de-leveraging across futures markets this week, however not a result of the infamous liquidation cascade that punctuated so many moments in 2021. The primary driver appears to be traders opting to close out their futures positions, rather than a forced sale/bid due to liquidations and volatile pricing. The market appears to be de-risking and curtailing leverage in response to the plethora of macro uncertainties.

Total futures open interest has now declined from 2.0% to 1.76% of the market cap. Relative leverage of this magnitude has shown to be a considerably more stable range for the market throughout 2021 and was last reached after the 4-Dec-21 de-leveraging event.

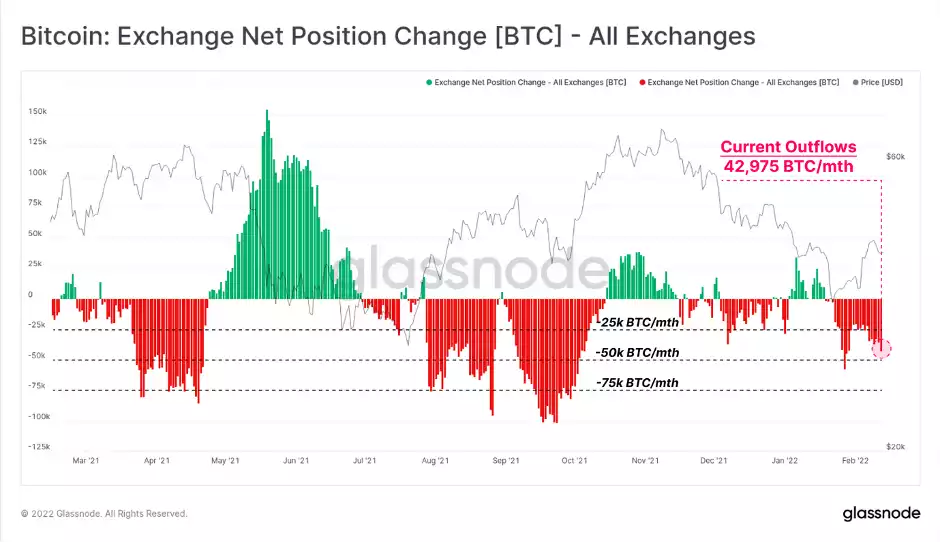

Investor de-risking in prior Bitcoin market cycles was best expressed by the sale of coins in spot markets, as investors reduced their exposure. In this instance, we would usually expect to see a period of net coin inflows to exchanges, a phenomenon that was observed from May to July 2021.

However, in the current market, we continue to see net coin outflows at a non-trivial rate. Across all exchanges BTC is flowing out of reserves and into investor wallets at a rate of 42.9k BTC per month. This trend of net outflows has now been sustained for around 3-weeks, supporting the current price bounce from the recent $33.5k lows.

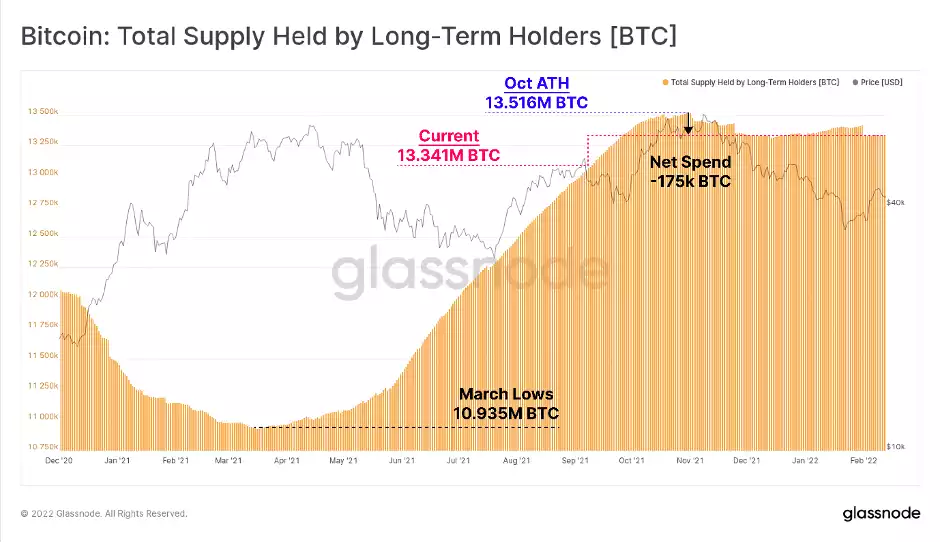

Long-Term Holder (LTH) supply has continued to hold a sideways trend, with a total supply held of around 13.341M BTC. There is almost always a consistent flow of coins maturing from Short into Long-term holder status. As such, this indicates that the degree of LTH spending is approximately equal and opposite to the degree of coin maturation.

Since the October ATH, LTHs have spent only 175k BTC on net, demonstrating a remarkably resilient cohort of hodlers, despite the prevailing macro headwinds.

In summary this week, it appears that investors are deleveraging and utilising derivatives markets to hedge out risk and buy downside protection, with a keen eye on the Fed rate hikes expected in March. Meanwhile, overall, on-chain supply dynamics appear to be in a form of equilibrium. Both Long- and Short-Term holder supplies are range-bound, miner balances are on aggregate flat to slightly higher over the last few weeks, and whale supply (100-10k BTC wallets) have been flat since December.

Unlike previous Bitcoin cycles, the sale of spot holdings does not appear to be the preferred de-risking strategy. This reflects an increasingly mature market, with a growing suite of derivative instruments available for risk managers.