Corporate Debt “Perfect Storm”

News

|

Posted 05/04/2019

|

5845

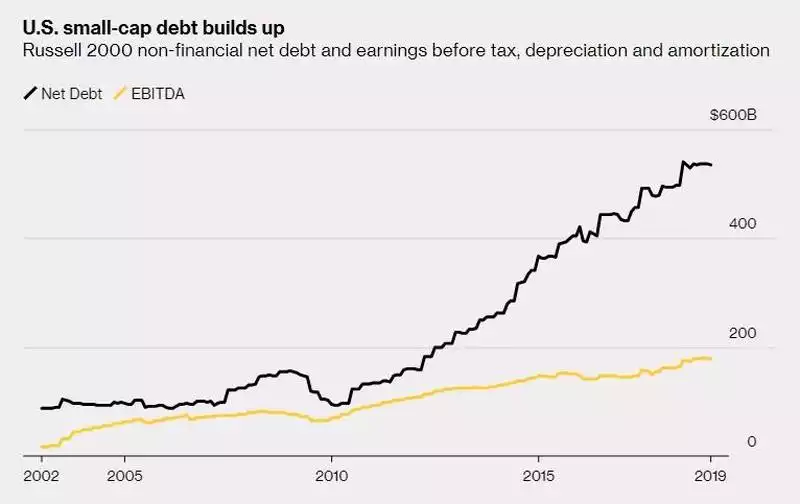

We often refer to the corporate debt issue in the US as one of the key risks for an uncontrolled crisis as the subprime debt was for the GFC (last article here). The world, post GFC, is in most measures even more strung out than before it. Whilst most are debt related, they are many and varied. We came across two charts this morning that pictorially speak volumes to the risk at hand. Please keep in mind that we are presenting these at a time when we have had multiple real world, hard data warnings that a recession may be close. Record corporate debt may be fine in an expanding economy where growing earnings can pay for it, but that is clearly not the case. And keep in mind too that much of the wind in the sharemarket’s sails is corporate buybacks fuelled by this very same debt. Removing the FAANGs and other monsters from the equation it is worth looking at the ‘real world’ index of the Russell 2000, the US small cap index. Just digest the following chart of how much debt this sector has taken on compared to earnings growth:

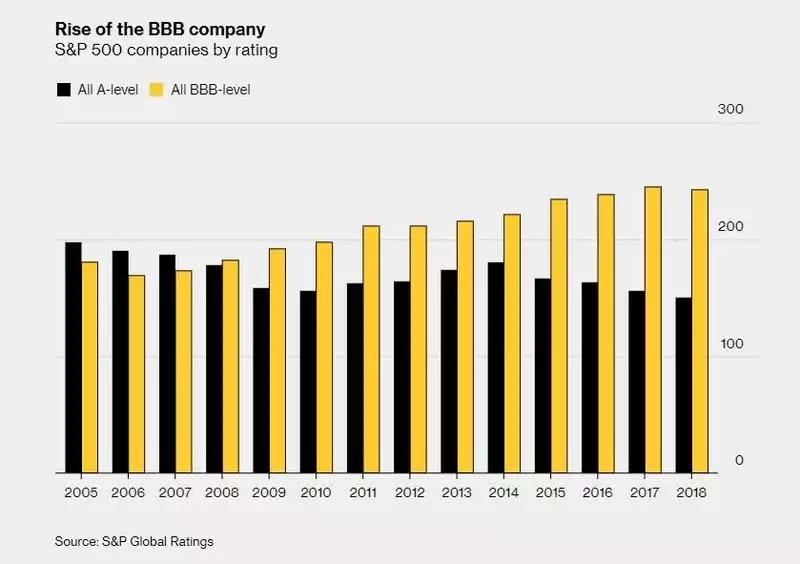

But perhaps even more concerning is the growing risk profile across the board. From Bloomberg:

“Big companies have enjoyed big profits, fattened by widening margins as wages stagnate. That’s allowed them to sustain a huge debt load. But drilling down shows that credit quality, as viewed by ratings companies, has tumbled. According to S&P Global Ratings, the companies rated BBB+, BBB, or BBB- (the three lowest investment grades before they would hit “junk” status and face much higher interest payments) now outnumber all of the companies with some level of A-rated debt. It looks as though companies are “gaming” the ratings companies, borrowing as much as they can get away with.”

We wrote about this quality deterioration recently here and if you missed it, it’s worth reading.

And thus the prospect of a messy unwinding if a recession hits. When companies slip into “junk” territory rates jump. You then have the ‘perfect storm’ of reduced ability to service all your debt off reduced earnings, a jump in the cost of servicing your debt, and a plummeting share price.

The US Fed can see this coming. They have paused tightening as that would only have brought this on sooner. But it may be too late to prevent it happening at all.