COMEX Signals Get Even More Bullish

News

|

Posted 23/05/2017

|

6453

It was remiss of us yesterday not to update you on the COMEX positioning for both silver and gold (via Saturday’s Commitment of Traders Report) – because it appears very bullish for both. If you haven’t read last week’s report on these developments you should before reading on…. (click here)

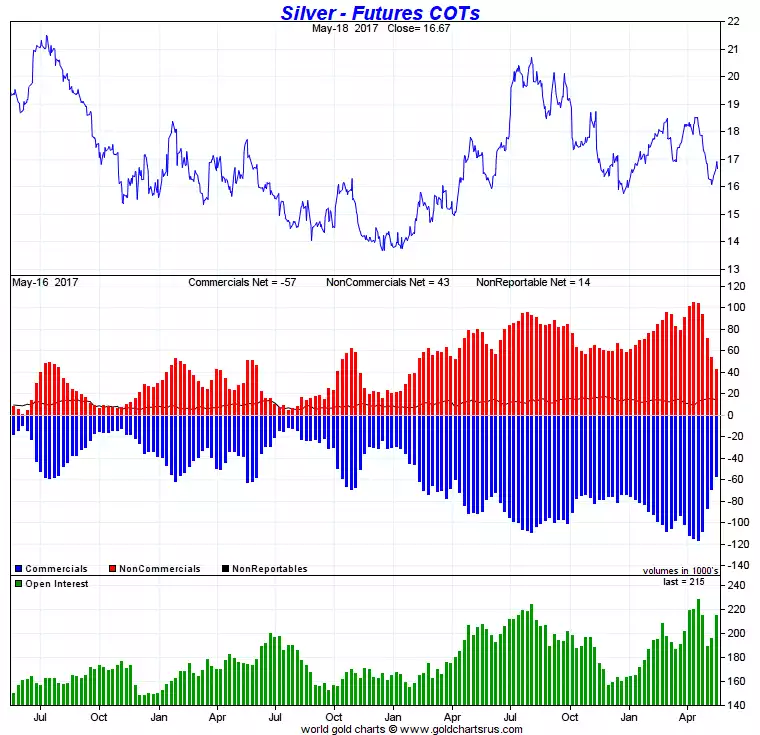

As of the report on Saturday, the net short position in silver from the Commercials dropped another whopping 17% whilst the speculative hedge fund Managed Money increased their shorts and ended up reducing their net long position by 19.9%, a huge move on any measure. Like last week, the chart below tells the story and you can see the correlation with such moves in the past being bullish for price gains:

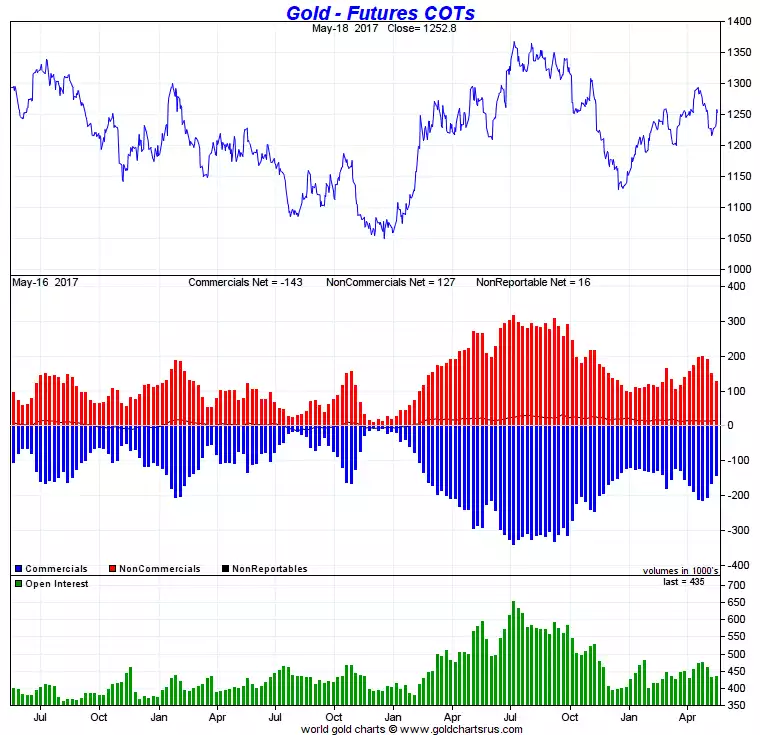

In gold the story was similar with the net short position from the Commercials dropping another, big, 13% whilst the speculative hedge fund Managed Money increased their shorts and ended up reducing their net long position by 15.5%.

Analyst Ted Butler certainly isn’t retracting from his predictions last week of ‘this could be it’, and had this to say earlier in the week:

“As an analyst observing the repetitive cycle of COMEX positioning for more than three decades, it is fitting that I would become more cautious on price as the technical funds [Managed Money] load up on the long side and more bullish when they abandon the long side and load up on the short side. I know many have expressed surprise that I have recently come out with the opinion that the big move in silver is close at hand, but my basic analysis demands it. If one is to be bullish after the technical funds have sold, should not he or she be most bullish after the technical funds have sold the most in history?”