COMEX Short Squeeze Getting Close?

News

|

Posted 15/10/2018

|

6485

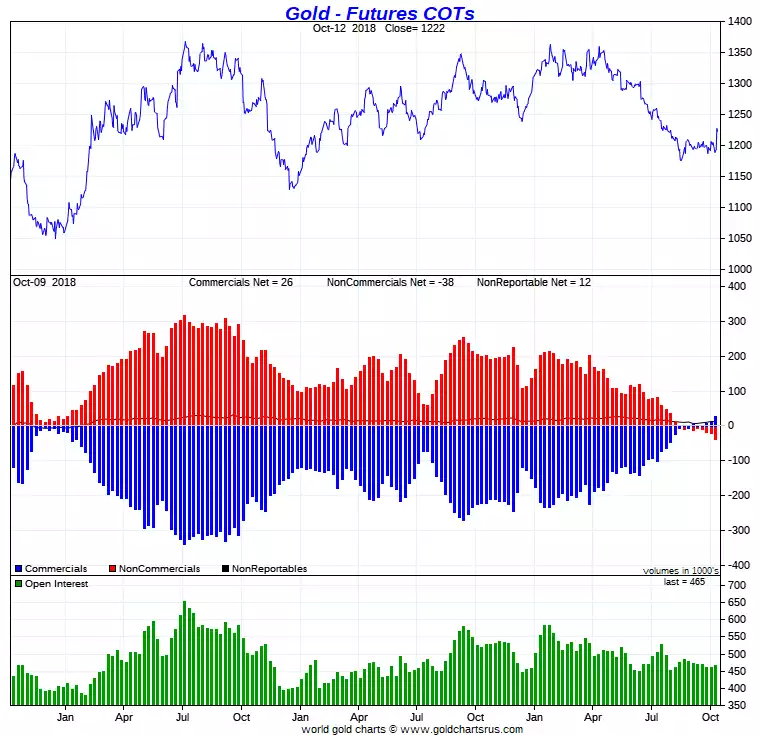

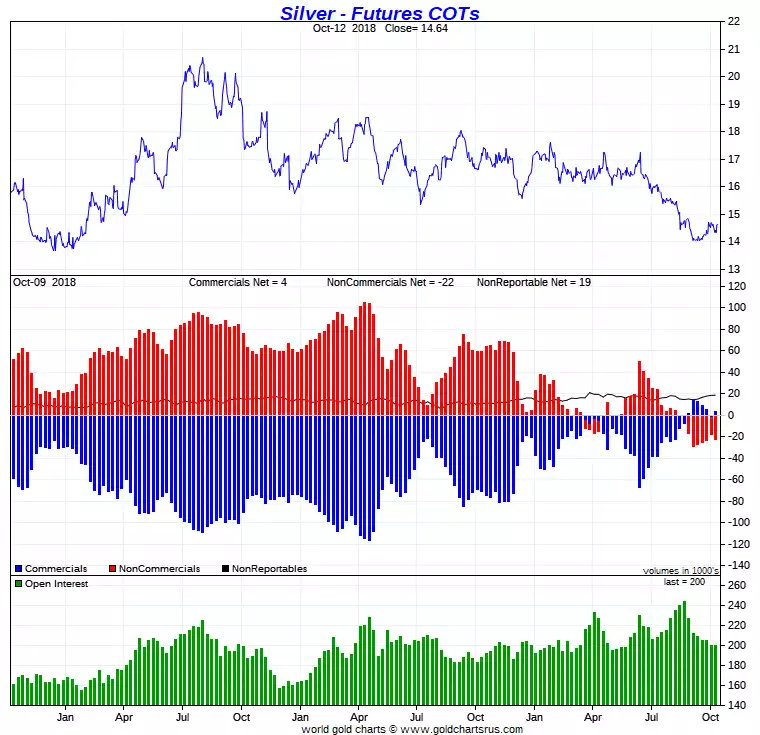

Last week’s Commitment of Traders report, before the market rout late in the week, shows a further move of the speculators net short and the commercials long at an unprecedented level. This unbalance is incredibly enticing as the speculators have a strong track record of being wrong at the extremes.

As you can see below we haven’t seen anything like this before:

Such a setup, as we saw just a glimpse of last week when financial markets fell whilst gold and silver popped, means the prospect of a short squeeze is always present. All those short contracts (bets of further price falls) have to be very quickly covered when the price goes the other way and they get caught out. Given the size of the short position and the precarious nature of markets at present, that short squeeze could see dramatic price rises in a very short space of time as the scramble ensues.