COMEX Setup Just Gets Better!

News

|

Posted 13/08/2018

|

7266

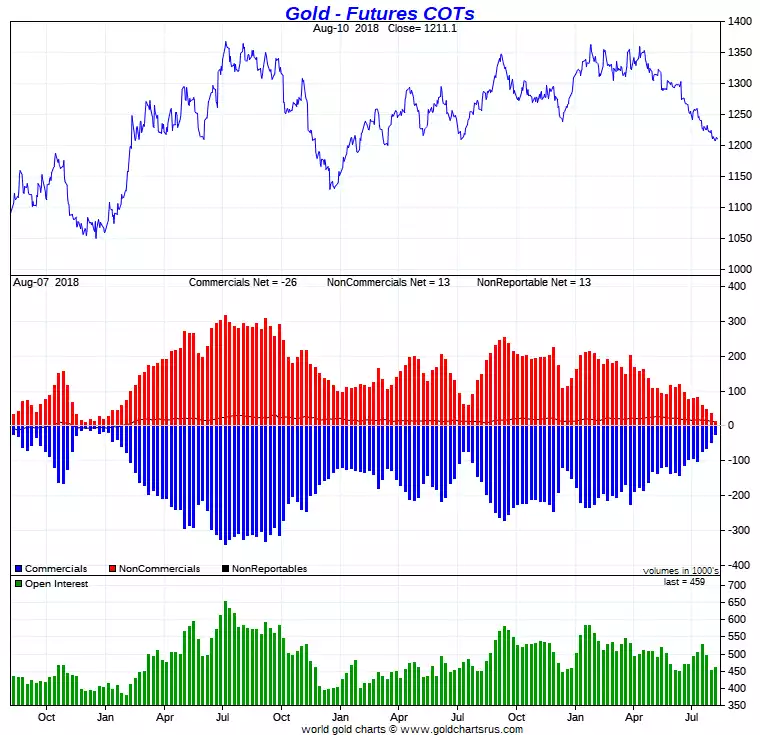

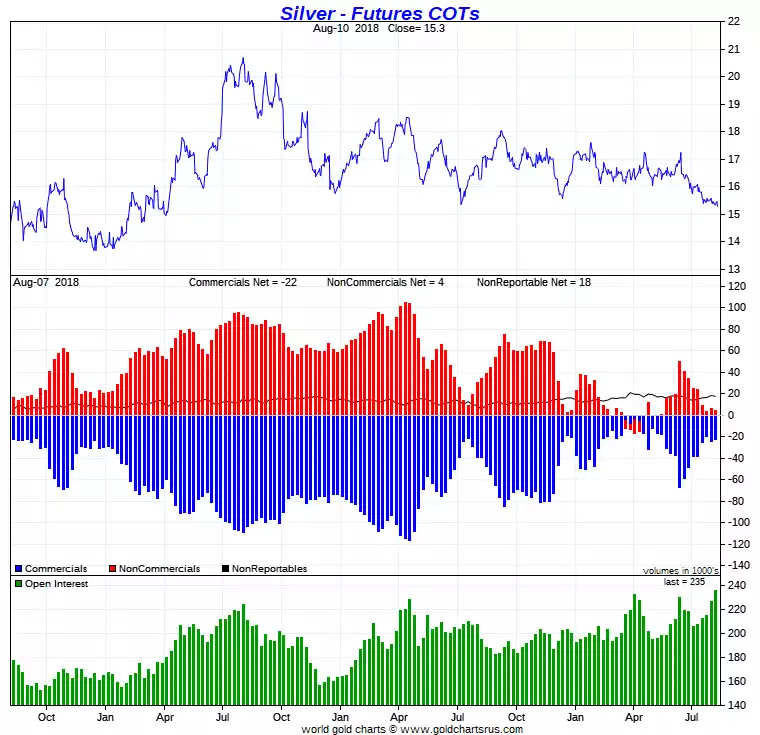

Last week we discussed the very (historically) bullish setup on the gold and silver futures market (here and here). The latest Commitment of Traders (CoT) report released on Saturday for the week ending last Tuesday shows this remarkable setup has got even more bullish.

Firstly in gold we saw a further reduction in the Speculators long position and Commercial’s short position by a chunky 2.23m oz of paper gold.

In silver we also saw the same reduction to the tune of 10.2m oz of paper silver and open interest reach its highest level in a very very long time.

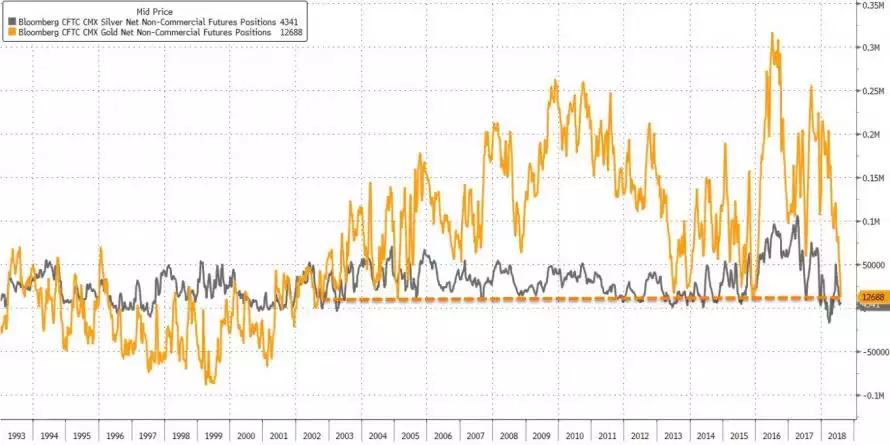

Looking collectively you can see we are in a situation not dissimilar to what preceded that epic 2002 to 2011 bull run.

History may not be an accurate predictor of future performance but few graphs show the kind of correlation you can see yourself above.