Chinese Gold & Silver Consumption in Context

News

|

Posted 21/06/2016

|

4935

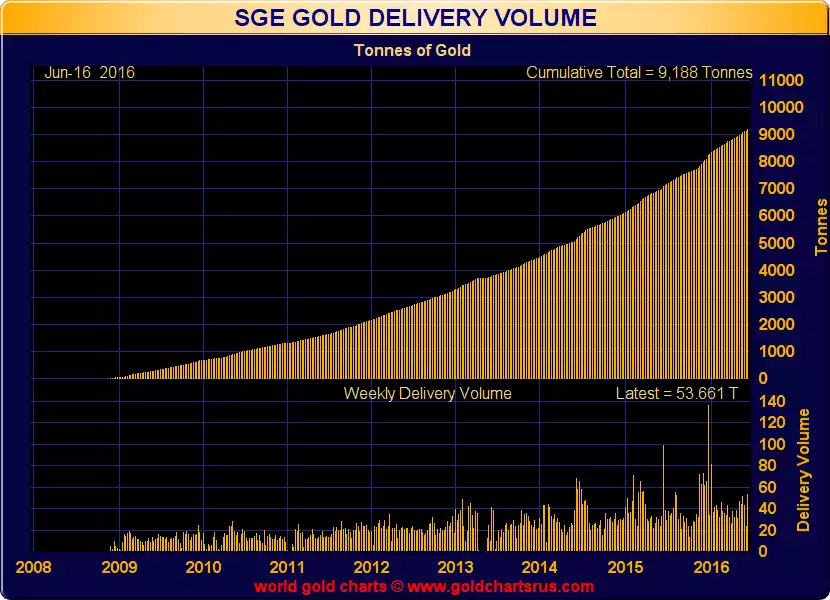

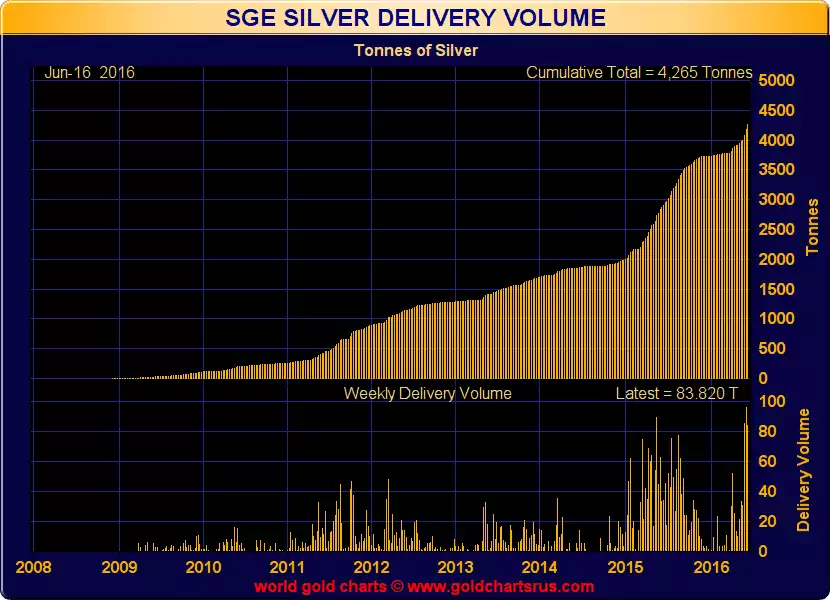

There has been some press about the fall this year in Chinese demand for physical gold through the Shanghai Gold Exchange, being down nearly 18% on 2015. Like most single observations, context is always important to add. 2015 broke all records for global gold consumption with China consuming 2,597 tonne, a number all the more remarkable against total global mine production of just 3,114 tonne. On current numbers China is still on track to consume around 2,000 tonne this year and the drop in their consumption has been made up in the jump in ETF consumption. As you can see from the graphs below we are still witnessing a massive, and many think very strategic, move into gold by the Chinese. The second graph, though it gets less airplay, is becoming the more remarkable story, and that is the prodigious amount of physical silver they are consuming.