China Sends Another Clear Buy Signal

News

|

Posted 16/05/2017

|

6636

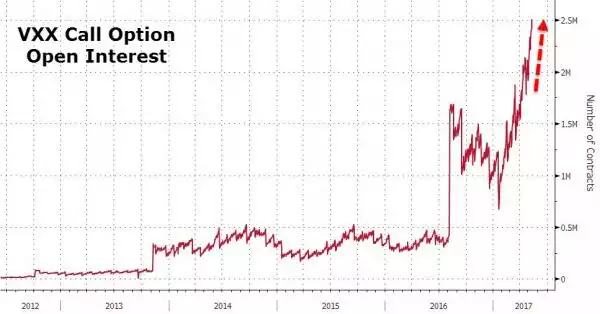

The economic wobbles in the Chinese economy are gaining more and more attention and the implications for the Aussie dollar also. We’ve recently reported on the economic warning signs from China (here and here) and yet the S&P500 and NASDAQ both hit new highs last night and the VIX extended its all time record streak of closing below 11 to 15 straight days, 50% more than the next longest. Everything is absolutely awesome. HOWEVER… Bloomberg have just reported that VXX trades, long futures trades (calls) betting on a jump in the VIX, have shot to a record high relative to puts.

Apart from the disconnect on share price fundamentals, geo political uncertainty, and bubbles everywhere, there is another clear warning sign in the historic lagged correlation between the China Credit Impulse (as we discussed last week) and VIX. That drop (graph is inverted) in Chinese Credit Impulse has already happened… a VIX spike seems baked in and maybe the smart money sees this and is buying up VXX?

We’ve written before of the direct historic correlation between the gold price and VIX. However given this is China there is a double benefit for Aussie gold and silver holders and that is the AUD. We finished our article on this last week talking about money leaving the AUD ‘in droves’ and according to a recent Bloomberg article that is exactly what is happening.

“Hedge funds are giving up on the Australian dollar.

Leveraged funds cut net long positions to 12,879 contracts in the week through May 9, the sixth straight reduction and down from as high as 53,601 at the start of March, according to data from the Commodity Futures Trading Commission. Optimism has evaporated as the prices for iron ore, Australia’s biggest export earner, plunged.”

A softening Chinese economy sees a softening in ore demand:

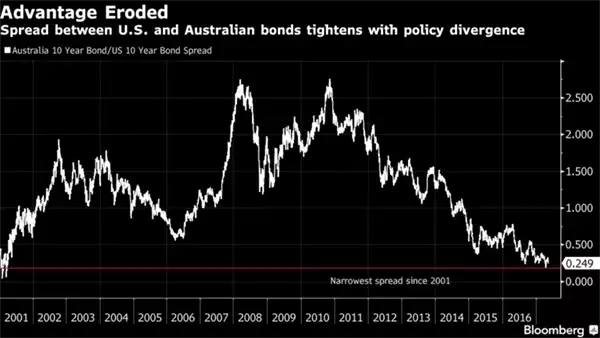

And reinforcing our article last week, so too is the attractiveness of our yield over US treasuries