China’s “Own Goal”

News

|

Posted 25/06/2021

|

8554

Much of what has driven the price of Bitcoin down has to do with environmental concerns and the crack down on mining by the Chinese government. What many do not appreciate is that the latter could and should fundamentally be a great thing for Bitcoin in the longer term. But emotional markets take on FUD over fact too readily. So why could this be great for Bitcoin?

Firstly, one of the initial catalysts for this big correction in Bitcoin was Elon Musk tweeting that Tesla would no longer accept BTC for payment for their cars due to concerns about its environmental impacts through high energy use. China was a dominant host to Bitcoin miners and much of that using dirty coal power. After being educated on the huge existing and future moves to renewable powered mining Musk subsequently came out and confirmed he would revisit the issue on evidence. Musk wasn’t the first mind you, as institutional investors take sizable positions in Bitcoin the bigger public ones have required assurances of source of supply to meet their ESG (Environment, Social, Governance) directives and hence we are seeing an explosion of sustainably and ethically source mining emerge.

The other thing not being widely acknowledged is that there existed amongst sceptics, concern that China wielded too much power in having over 50% of the mining hashpower and could somehow collectively combine and orchestrate the feared but widely misunderstood ‘51% attack’. Despite the FUD around this prospect, the reality is that even if 51% of all the miners somehow colluded they still can’t steal anyone’s BTC, change the consensus rules, nor make invalid transactions valid. All they could theoretically do is orchestrate a ‘double spend’ of their own BTC. However modern exchanges mean that would be incredibly hard to capitalise on in a profitable way. If you want to learn more there is an excellent, easy to understand explanation here. Regardless, ill informed mud/fud sticks and the fact that China has now voluntarily and forcibly reduced their combined hashpower means this argument is potentially put to bed. So in one move they have improved the ESG credentials (both the E and the G) of Bitcoin. The market should be celebrating not capitulating…

Macro Insiders’ Raoul Pal recently wrote to this nicely:

“The market initially became too speculative with too much leverage, and Elon Musk plus China news pushed it over the edge in a massive wipeout of leveraged Asian traders. The next thing was the Chinese clampdown on Chinese miners. It is my view that this has everything to do with their use of energy source (coal) and overall usage of electricity, and that the Chinese decided they need to keep energy prices low and so, getting rid of mining in many places was strategically important. Don’t forget, the Chinese did a similar thing in 2013, 2017 and 2018.

These miners are selling inventory as they close down and that is weighing on prices. Institutional adoption has slowed due to the ESG FUD (Fear, Uncertainty and Doubt) but I’m hearing via backchannels that much of this will be resolved in the coming month with some major announcements. I am also hearing of many, very large investors going through onboarding in order to invest in BTC and ETH. They will pull that trigger once prices turn, which is likely to come any day now as the Chinese are mainly done.

Hash rates – the computational power needed to mine BTC – are now down 36% as miners close in China. This is likely to be absorbed by US and other miners in due course and the issue of the 51% of mining that resides in China will be diminished, as will the energy footprint because China has a lot of coal-powered miners. I take this as all good news.”

Ainslie present a unique way to buy and hold (store) Bitcoin. At Ainslie:

- You deal with a human in person or by phone (or webshop with InstantPay if you prefer).

- Our consultants are happy to explain things and help you through the whole process

- Buy your crypto and then pay (not try and deposit, wait, work an exchange order book, etc). There is no upper limit to the value of transaction, we can do $10’s million trades.

- Get your own cold / offline unhackable Ainslie Crypto Wallet included (in store only – Brisbane or Melbourne)

- Cost effective option of fully allocated, vaulted, unhackable cold storage where we look after it all for you – no stress, no accidental loss, no online hack risk.

- Or simply sent to your own wallet address (we sell Ledger Nano X and Trezor hardware wallets too)

- Not just Bitcoin, but ANY alt coin with decent market liquidity.

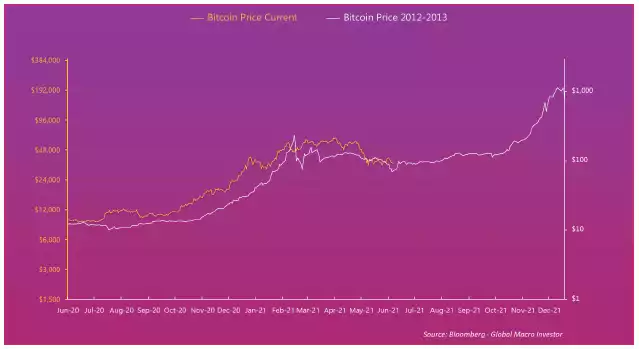

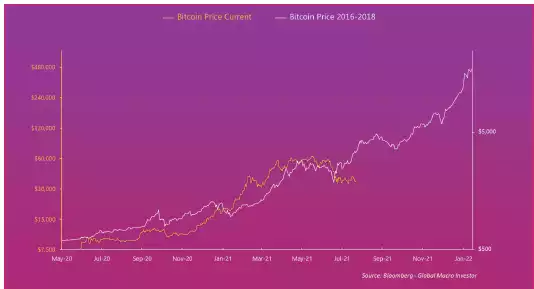

“Dip?” you say. Raoul also reminded us where we are now compared to both the 2012-13 and 2016-18 cycles (note the $ axis is log scale).