China Crackdown Bodes Trouble Ahead (unless you own gold?)

News

|

Posted 28/07/2021

|

6435

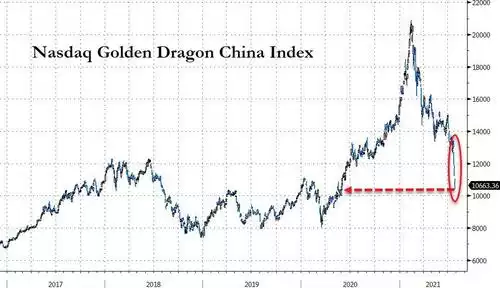

Wall Street tumbled last night largely off the news of the plummeting Chinese sharemarket (and also the news of new mask mandates in the US), or more particularly its tech shares. The New York NASDAQ traded Golden Dragon China Index which tracks these shares is now down 50% from highs just seen in February of this year. Nearly half that fall has been just in the last couple of weeks.

As with the recent crackdown on Bitcoin mining, the CCP is cracking down on tech, and particularly privately held companies (not in its direct control) that it perceives are exacerbating inequality and financial risk and whose size and reach may be seen to challenge their authority. One could flippantly say that the CCP is rediscovering Marxism/Leninism having embraced quasi capitalism, but the reality may not be far from the truth and the repercussions world wide substantial.

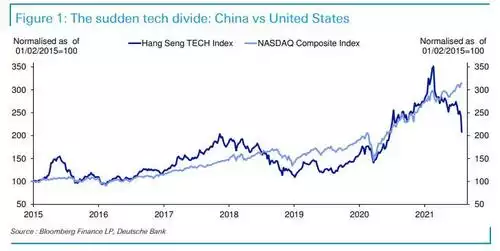

Many have been looking at the tech sector in the US with wonder as it exceeds even the dot.com bubble levels with gusto. The collapse of the Chinese sector has some analysts quite worried about it being the trigger for the same on the NASDAQ and by default the tech heavy S&P500. The chart below shows the extent to which they are correlated and the disconnect now.

The parallels and the threat are beyond just both being tech per se. Biden has an agenda of reigning in the power of the tech sector and as DeutscheBank’s credit strategist Jim Reid quips "we've all been closely watching for signs big US tech will be heavily regulated going forward but it's actually been China that has aggressively moved on this."

The troubles playing out in the Chinese economy are becoming more and more concerning. We touched on this recently here and last night Bloomberg noting this crackdown “has shocked even some of the most seasoned China watchers, prompting a rethink of how far Xi Jinping’s Communist Party is willing to go as it tightens its grip on the world’s second-largest economy”

Broadly it appears the CCP are trying to simultaneously address the demographic crisis the one child policy has created by reducing the cost of living, particularly having children, as with the west it has created a massive inequity in wealth distribution and wants to reign that in, as well as the West style capitalist excesses of their ‘free market’ experiment.

Additionally the relationship between the US and China appears to go from worse to worse. The latest attempts at diplomatic talks did not go well at all with China issuing essentially 3 demands to be met before relations can be re-established. Politico’s Stuart Lau summarises:

- Ideological: US shall not challenge/overthrow China’s communist system;

- Economic: US shall not obstruct China’s development by sanctions/tariffs;

- Sovereignty: US shall not infringe on its rights in HK, Xinjiang, Tibet, and Taiwan

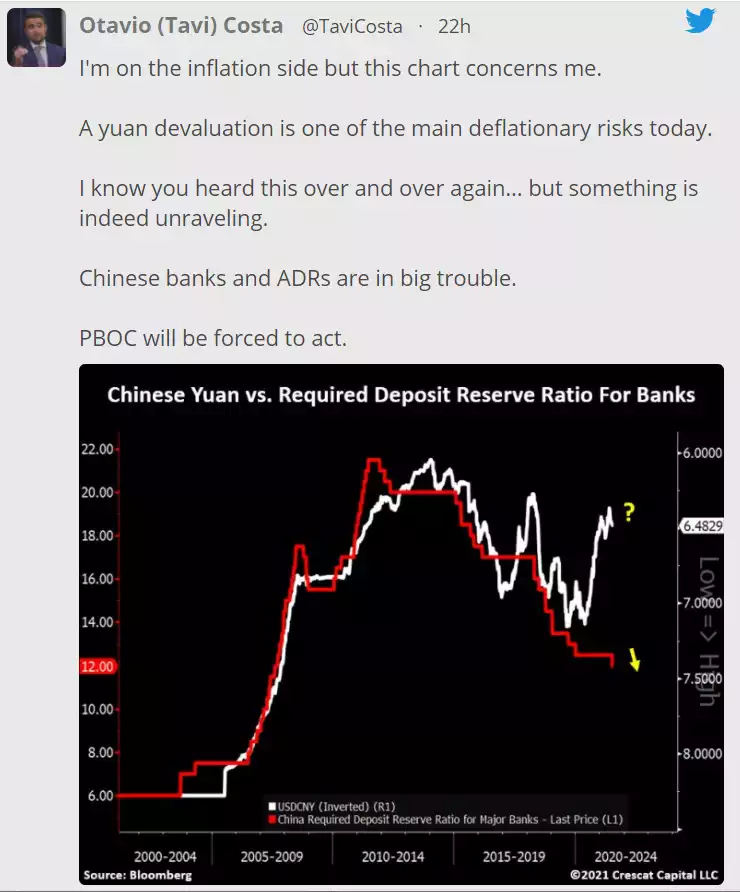

China’s agenda therefore is becoming clear and such shocks as we have seen with bitcoin mining and tech shares may continue. Not surprisingly then there is an exodus of USD from China which is putting pressure on the Yuan (dropping to its lowest in 3 months) and threatens the stability of the world’s biggest debt pile as well. Crescat’s Otavio Costa shared his concerns via twitter:

The implications for Australia in particular are massive. China is our biggest trading partner and the relationship is already sour. If we start to see more protectionism and more economic instability the impacts will be global but we are arguably more susceptible.

As China continues to, and possibly accelerates, its sale of USD Treasuries it is most logical that the world’s biggest consumer of gold will replace those reserves with gold.

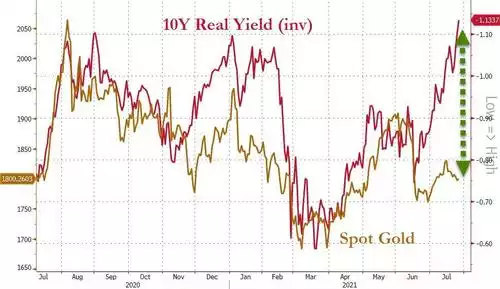

Speaking of US Treasuries and gold, with the buy up of UST’s, fall of yields and increasing inflation, the historic correlation between real 10yr yields and gold is currently hugely distorted suggesting gold is due for a big breakout.

And hence gold holders in Australia may benefit from a trifecta of increased gold demand, economic fundamentals price pressure, and a falling AUD. Only time will tell but all eyes will be increasingly drawn to China.