China Banking Crisis Near

News

|

Posted 20/09/2016

|

6293

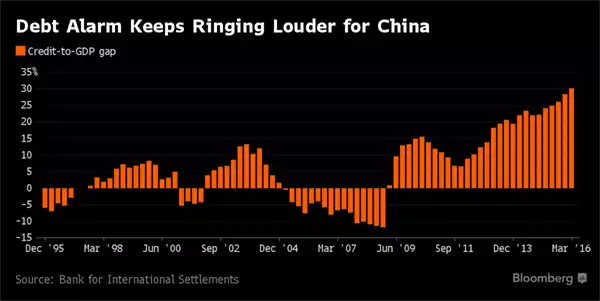

While the world is pre-occupied with whether the Fed will raise rates tomorrow or BoJ holds or capitulates with more stimulus, the world’s central banks’ central bank the Bank of International Settlements (BIS) has delivered a serious warning from another part of the world… China. The world’s top financial watchdog warned that China faces a full blown banking crisis as its credit-to-GDP gap, a key measure of economic vulnerability, is now 3 times the generally accepted ‘danger level’ of 10. Per the graph below you can see China has been above 10 for most of the period since the GFC, but never in all of history has it been as high as it is now at 30.1, and nowhere else in the world is it this high. This from the world’s second biggest economy.

So what does it mean? The famed economist Hyman Minsky (of Minsky Moment fame) found that over 60 years of analysis of banking crises, there was no better indicator than the credit to GDP gap, and that 10 was the magic number above which careful monitoring was required. 30 screams a bust is close.

China’s total official credit at the end of last year reached $28 trillion or 255% of GDP, nearly doubling since the GFC, still rising fast, and considered dangerously high for a developing economy. What is particularly concerning is that 171% of that 255% debt to GDP is corporate debt. How much, if any, of China’s infamous and massive shadow banking sector debt is captured is unknown.

When you consider too that $28 trillion is more than the entire bank loan books of both the US and Japan combined you soon understand BIS’s concerns.

BIS determined too that just a 250 basis point rise in interest rates sees it fail. This warning was authored before last week’s global sell off of bonds with the corresponding increase in yields.

This too will be weighing on the Fed’s mind as the consequences of raising rates could be catastrophic for emerging markets carrying enormous amounts of USD debt. China is leading the way of dumping US Treasuries, now down to their lowest level since 2012, but still at an incredible $1.22 trillion worth. Good luck Janet… no pressure…