Chasing That Final 10-20%

News

|

Posted 29/05/2017

|

6616

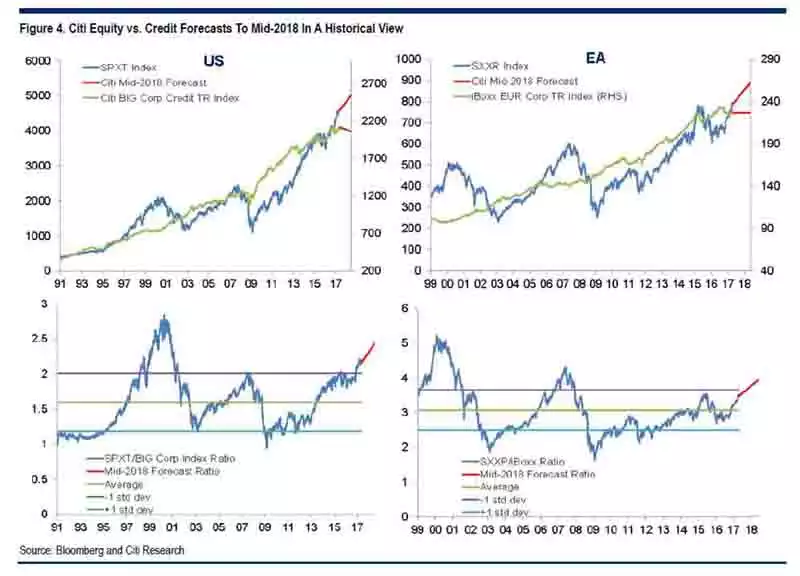

Yet another bank joined the chorus of warning clients of the market looking set for a crash on Friday. We’ve written of BofA (in particular), JP Morgan and Goldman Sachs’ recent warnings and now Citi issued a report including the admission “eight years into the cycle - and one where QE has been the asset market driver – virtually every market appears rich”. Beyond the usual warnings on equities valuations they point out the lack of value across the board, including bonds and credit. “Rich” avoids any outright ‘alarm’ in their note and they do point out they have a divergence of opinion within their asset class ranks. The credit guys are seeing things coming off while the equities guys still see more in the market. The graphs below show US (lhs) and Eurozone (rhs) equites (blue lines) and corporate debt (green lines). You will note the divergence predicted and this is not new to regular readers (last discussed here), the credit tightening over recent weeks is grabbing the attention of some analysts. So whilst the red lines indicate more gains to be made in shares even Citi notes “such a divergence may well happen, but historically is somewhat of an anomaly”. So… its different this time….

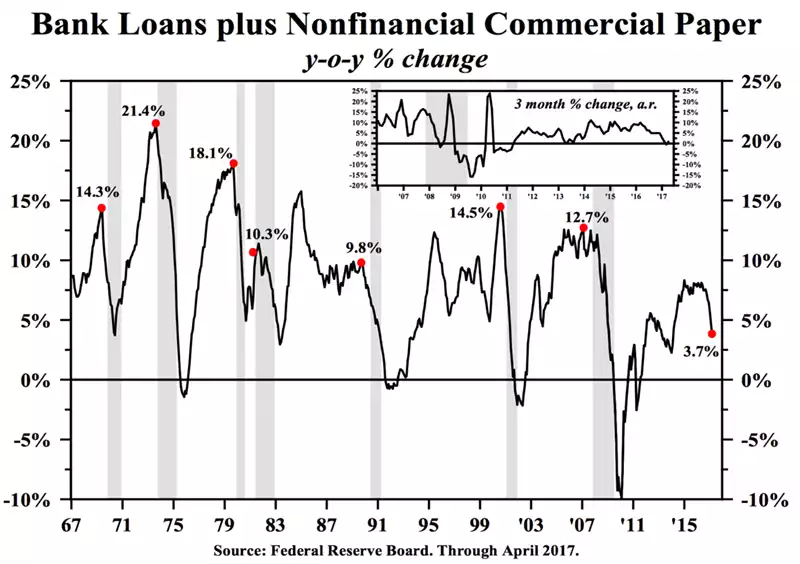

The chart below maps this out a little clearer from an historic perspective (and adding bank loans to the above corporate bonds) courtesy of Mark Yusko of Morgan Creek Capital Management.

Yusko, when presenting this chart at a conference last week, said:

“I’m telling you right now, the US is going to have a crash and it will be massive”

However, going back to Chart 4 from Citi above, we remind you that we are not professing sell everything and put it all into gold and silver. What we are reminding you is that, yes you may well see some more gains (particularly in Euro shares is Citi’s advice) but such ‘anomalies’ as Citi themselves warn, can precede a crash. Be aware and have your uncorrelated assets in place whilst you flirt with danger.

Remember too that chasing the final 10 or 20 percent in a sharemarket needs to be done in the context of a market that could drop (say) 50-80% without warning. A 50% loss means you have to make 100% on what’s left to get back to even. A balanced portfolio means something else in your portfolio may have done a lot of that heavy lifting simultaneously….