Central Banks Buying Gold – Don’t Do As I Do, Do as I Say

News

|

Posted 24/11/2021

|

7203

Sovereign states are again piling into gold. The world’s central banks net bought 393 tonne of gold in the first 3 quarters of this year, more than all of the full year’s 255 tonne bought in 2020. Early signs are that this trend of growth will continue in Q4. As we reported in the World Gold Council Q3 Demands Report, the WGC believe central bank net purchases are “poised to reach a significant total in 2021”.

Central Bank reserves are the backbone of the global financial system. The ECB defines it nicely as “Reserves are the most liquid and risk-free asset available in the financial system and play a pivotal role in settling payments; as such, they are the backbone of banks' liquidity management.”

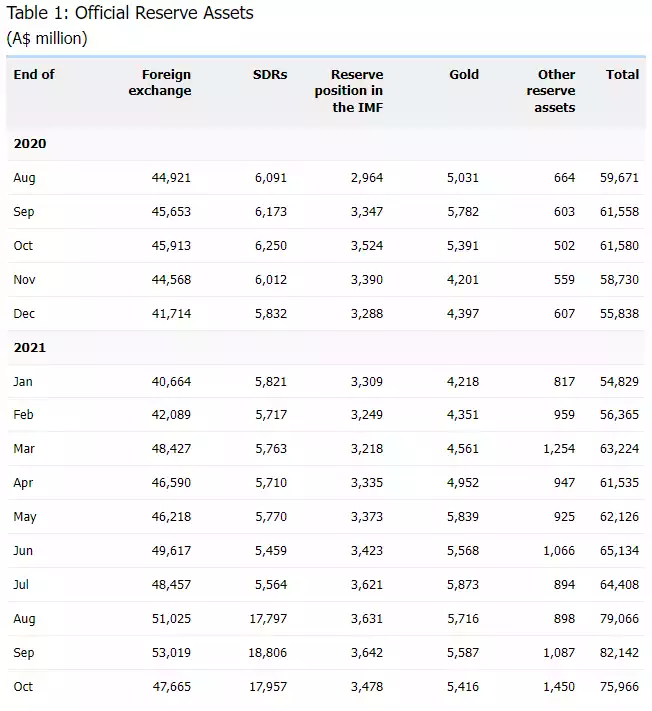

Australia’s reserves over the last year are broken up as follows:

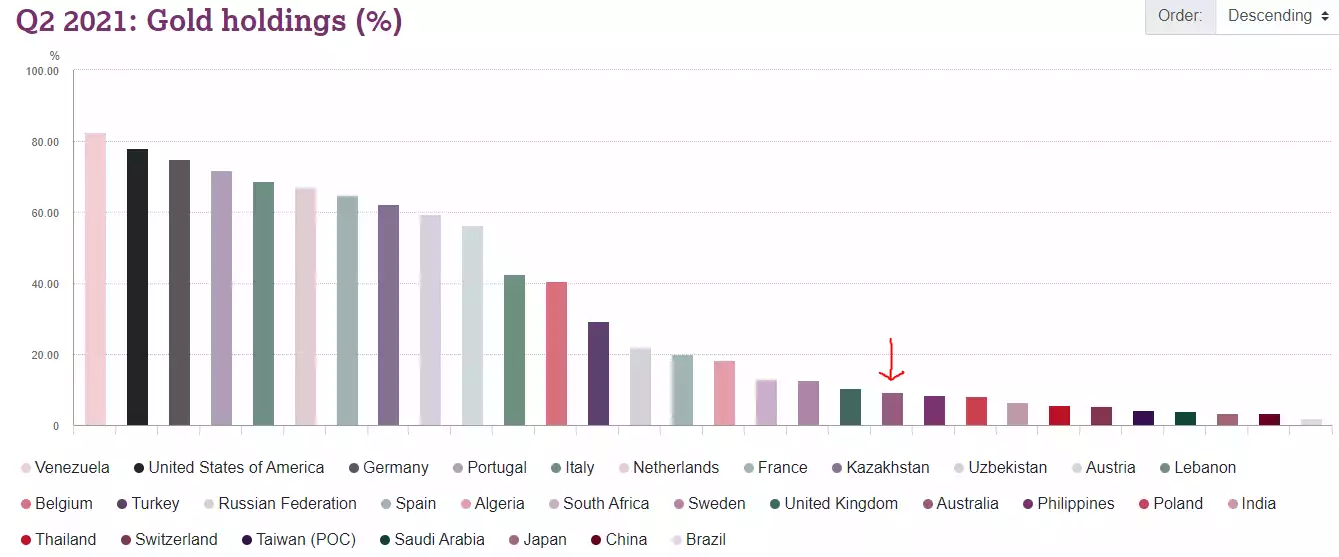

You will note that our central bank holds just $5.4b of gold. The chart below shows, in percentage terms how that compares to our peer nations…

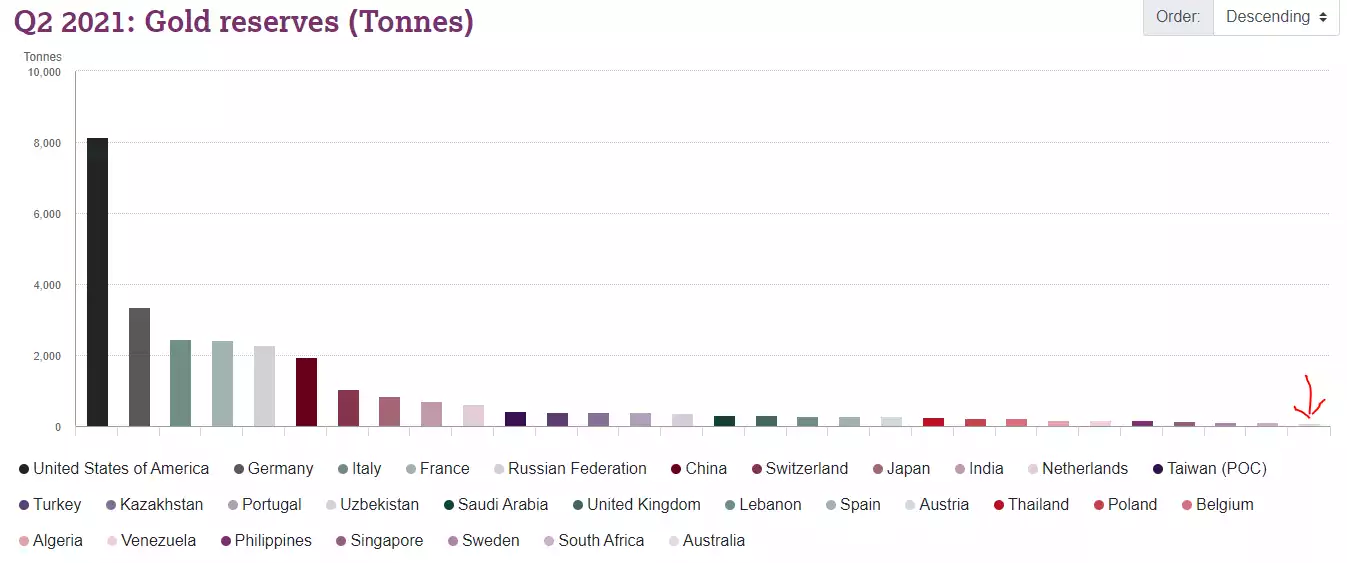

You can see (just) our 79.85 tonne below on the far right…

As we and many others have commented in the past, no one believes that is really China’s real gold holdings. They conveniently keep most of theirs off the PBOC balance sheet in the entity not a little ironically called SAFE (State Administration of Foreign Exchange) and even then it is terribly opaque. As the world’s largest gold producer (of which none leaves their shores) and importer, one can do the math.

Indeed, after going a little quiet recently, China is back with vengeance in buying up gold. From Lawrie Williams “The latest figures for October for gold withdrawals from the Shanghai Gold Exchange (SGE), which we equate to total Chinese gold demand, have come in at 136.62 tonnes. This is lower than for September, but October tends to be an anomalous month as it contains a week-long public holiday period when the SGE remains closed. In point of fact the latest October figure is the highest for that month since 2018 when October SGE gold withdrawals for that month totalled 142.94 tonnes and the full year figure was 2,054.54 tonnes. While we don’t see China's full year 2021 SGE gold withdrawals coming in as high as this we do think there’s a strong chance of the full year total at least being the highest level for 3 years at over 1,650 tonnes which demonstrates how strong the recovery from the Covid outbreak has been in that country.”

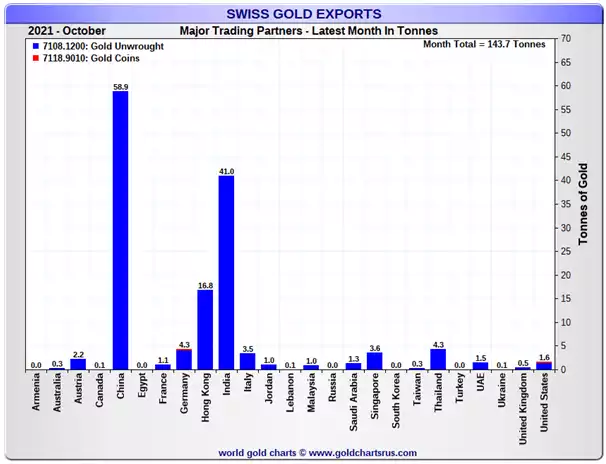

And as mentioned above, despite being the world’s biggest producer, China is again now the world’s biggest importer ex Swiss export figures, overtaking India again which has been in the #1 spot for several months. Again from Williams “If one adds in gold exports to Hong Kong, greater China imported some 75.7 tonnes of refined Swiss gold in October, around 52.7% of that small European country’s gold exports that month. China and Hong Kong combined were followed by India which took in 41 tonnes of Swiss gold.”

But it’s not all about China and India. Russia has also notably stepped back up to the plate buying 100,000oz of gold in October taking their holdings to 2,302 tonne.

So why gold? Well apart from it being highly liquid, fungible and without counterparty risk, Poland’s central bank president gave the following insights when announcing they will buy another 100 tonne in 2022:

“Gold will retain its value even when someone cuts off the power to the global financial system, destroying traditional assets based on electronic accounting records. Of course, we do not assume that this will happen. But as the saying goes – forewarned is always insured. And the central bank is required to be prepared for even the most unfavourable circumstances. That is why we see a special place for gold in our foreign exchange management process.”, and

“After all, gold is free from credit risk and cannot be devalued by any country’s economic policy. Besides, it is extremely durable, virtually indestructible.” And finally:

“Gold is characterized by a relatively low correlation with the main asset classes – especially the US dollar dominating the NBP reserve portfolio – which means that including gold in the reserves reduces the financial risk in the process of investing them.”

In other words, the very architects of this global unprecedented monetary stimulus program amassing unprecedented debt, blowing unprecedented valuations in financial assets, and causing social inequality of an order preceding previous social and political uprisings are buying gold…. They are deliberately suppressing rates, injecting liquidity and debasing your currency to ‘make’ you buy risk that provides a yield they no longer provide. Have another look at their reserves and see how many shares and houses they own…

“Don’t do as I do, do as I say” may well apply to them….