Canary in the Coal Mine is Dead

News

|

Posted 07/12/2018

|

6861

What another fascinating night on Wall St! At one stage the Dow was down nearly 800 points on some awful manufacturing and housing data, added trade fears with the Huawei saga spooking markets, Russia not agreeing to cut oil production and the Brexit outcome looking decidedly scary. But right on cue, and probably spurred on by a Euro closing short squeeze, the Wall St Journal published a piece that the widely expected December rate hike may not happen nor maybe ANY in 2019 and up she rallied to end just 78 points in the red. Such is the turnaround in sentiment, that the market is now pricing in less than 1 hike in 2019 and a cut in 2020! That means the market is expecting economic weakness ahead and yet it rallied…. Gold and silver saw right through this contradiction and held strong.

Stepping away from these immediate gyrations, today we present an unedited article by Chris Hamilton of Econimica from yesterday titled “Canary in the Coal Mine is Dead...Any Reason to be Concerned?” that details some historical charts of remarkable correlation that should only be ignored if you truly think that somehow ‘this time is different’. There are some interesting links at the end for a bit of extra weekend reading if you have the time.

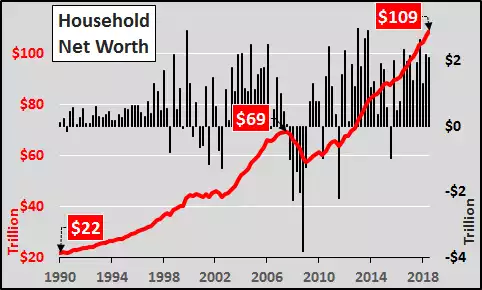

“America is rich as Midas, at least on paper, according to the latest Z1 Federal Reserve Statistical Release. Chart below shows total net worth of all US households (red line) and the year over year change on a quarterly basis (black columns).

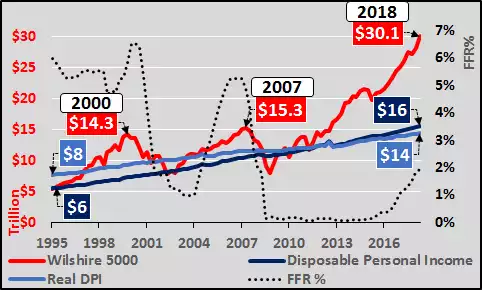

But what happens when asset valuations rise well in excess of income? Generally bubbles form...and then burst. With that in mind, I present the Wilshire 5000 (red line representing all publicly traded US equities), disposable personal income (dark blue line), real disposable personal income (light blue line), and federal funds rate (black dashed line). During each bubble, assets have appreciated far faster than incomes to support those higher asset prices. Lower interest rates and higher leverage have been used to incent greater quantities of debt...to be paid in the future. All data is through Q3 but not inclusive of the volatility seen thus far in Q4.

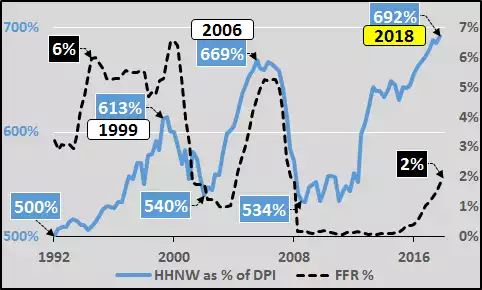

And what role did lower interest rates play in rising asset valuations (and the encouragement of higher leverage)? Quite a bit. Chart below shows the household net worth as a percentage of disposable personal income versus the federal funds rate...and that is not a pretty picture. Asset valuations have never been higher in comparison to disposable income (what is left to all American's after taxes are paid).

But the HHNW data only goes through Q2 2018...and I still expect to see one more bump in Q3...but after that, the die is cast, and asset valuations will likely be far lower, starting with Q4 and on.

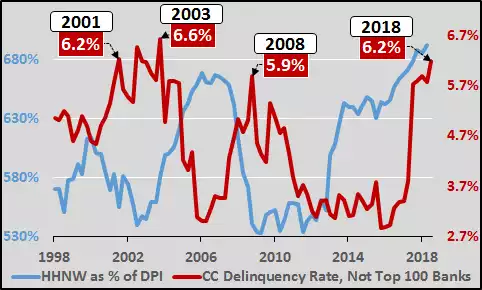

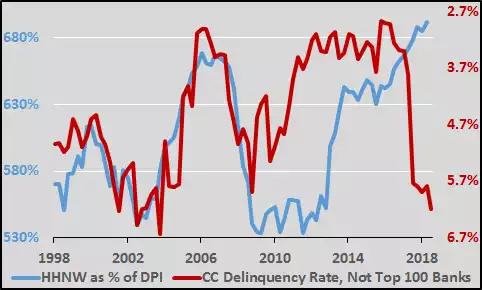

How could we have guessed it??? Credit card delinquencies among the not top 100 US banks versus household net worth as a % of disposable income (chart below). Essentially, on the way up, it's a party and many folks (including those most marginal) feel rich. But at some point the higher asset prices push rents too damn high, etc. etc. and the marginal consumer OD's on credit. Then the delinquencies begin. Consumers and banks both find themselves over their skis and in need of cutting back. A vicious cycle typically ensues.

Finally, I've inverted the credit card delinquencies among the not top 100 banks versus HHNW as % of DPI (chart below). That seems telling. The other 4600+ US banks not getting interest on excess reserves, not too big to fail, have overextend to make a buck and keep up with the big banks. Now we find that the marginal US consumer is misusing subprime credit cards and the proverbial "canary in the coalmine" is dead. A typical pullback would see total household net worth decline about 25% until incomes are again more in-line and we have already seen a 10% pullback in US equities. But, my guess is this next retrace will not be typical and instead has great potential to be quite "atypically" severe.

Perhaps the current market turmoil, the massive surge in federal spending coupled with slashed corporate taxation...maybe there's something behind all this more than the "trade war" narrative allows? It could be the massive surge in the "not in labor force" yet to come HERE or the minimal further growth in employment HERE or the next round of housing trouble now underway HERE. Or maybe it's a little bigger than that, something like the growth in global energy consumption collapsing, the details and causes discussed HERE.”