Calm Before the Unknown Storm – Why shares surged and gold fell last night

News

|

Posted 16/03/2022

|

7518

Unless you live under a rock, you may have heard the US Fed meet tonight and will almost certainly raise US rates for the first time since December 2015. Since we left the gold standard, there is a 100% track record of every reversal of rate policy triggering a recession soon after. 100%. And yet last night growth shares surged, the NASDAQ up over 3%, and gold, silver and bonds all came off. Why?

Last night the certainty of a rate hike was even more locked in when we saw US PPI (Producer Price Index) print an eye watering 10%, the highest since Bloomberg data began and the 21st straight month of rising prices at the factory door. Critically too, it’s still 2% above CPI… #nottransitory…

However, we also saw a much weaker than expected New York State Manufacturing index print. From Bloomberg:

“The Federal Reserve Bank of New York’s general business conditions index decreased to minus 11.8 -- the lowest since May 2020 -- from 3.1 a month earlier, a report showed Tuesday. Figures less than zero indicate contraction, and the gauge was well below the most pessimistic forecast in a Bloomberg survey of economists.

The Fed’s measures of orders and shipments also plummeted. Employment growth also softened. In a sign that supply chains remain fragile, an index of delivery times jumped more than 11 points.”

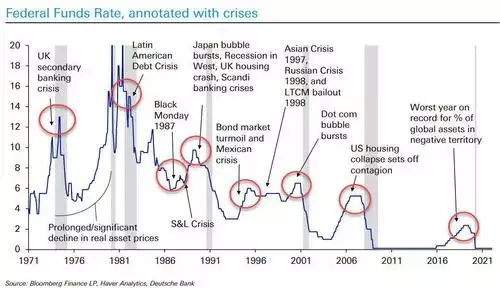

And so we have the set up, again reinforcing the Big Fed Policy Mistake trade, that the Fed will be forced into hiking into fundamental weakness. The chart below illustrates clearly the 100% coincidence of a financial crisis of some sort on each and every Fed hiking cycle…

And so the psychology of last night’s trade may well be the belief that yes the Fed will hike, but maybe not as aggressively as is already priced in, and then almost certainly will then quickly have to reverse course and unleash a fresh round of monetary stimulus to fight the inevitable recession the hiking triggered.

Some call the long term US treasuries market the ‘market of truth’. That market is telling us exactly that – looser money is around the corner. We are about to, or already have, peaked and 30 years of structural declines amid the sheer weight of debt accumulated since we left the gold standard and the associated monetary debasement indicates we will soon reverse course toward zero.

What the myopic equities crowd, or more dangerously the passive fund behemoth, forget is the structural issues with the entire economy looking at the Fed’s choice of - hike and crash the entire equities markets (growth AND value) amid a moribund economy, OR don’t hike and rampant inflation destroys consumers and corporate earnings alike, precipitating into, you guessed it, a sharemarket crash. To narrow either scenario to shares is also way too simplistic. The elephant in the room as always is the extraordinary scale of intertwined derivatives and CDS’s that sit on certain assumptions that would get fundamentally tested in either scenario. Likewise whole property markets, arguably none more than Australia, are predicated on ultra low interest rates. As we reminded Monday, the Exters Pyramid and funnel analogy we used should be at the forefront of investor’s minds right now.

It is rare that an asset presents such an each way bet as gold potentially does right now. The penny just hasn’t dropped yet…