Bye Bye Buybacks

News

|

Posted 21/10/2019

|

13859

We have presented plenty of evidence and commentary on the unprecedented level of corporate share buybacks (most recently here and the motivations here) that have undoubtedly raised or at the very least supported the US sharemarket when needed.

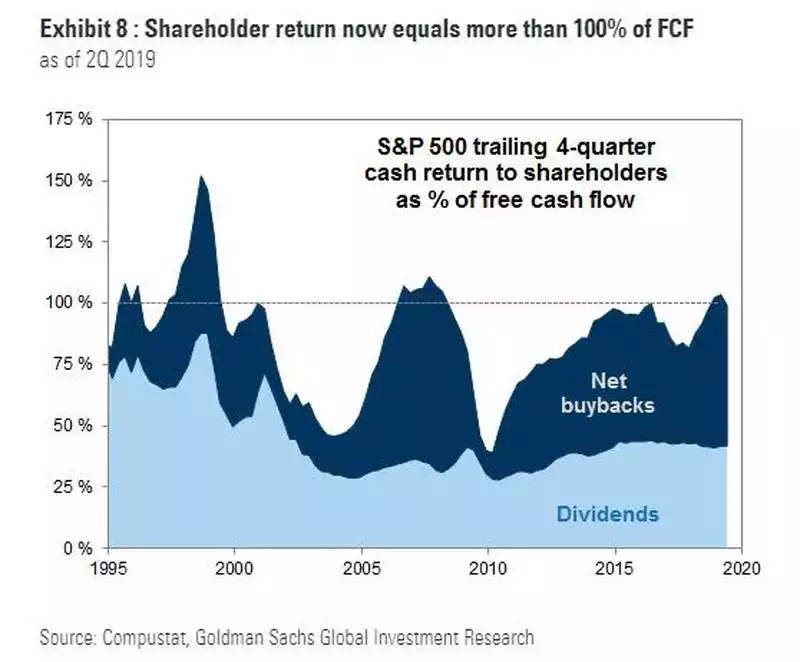

Readers will know that 2018 set an all time record in that regard, up 25% year on year, and 2019 has been very strong too. Goldman Sachs have just dissected all of this and one of the most alarming charts was this one showing that for the first time since the GFC, companies spent more on dividends and buybacks than their free cash flow (like just before the GFC)!

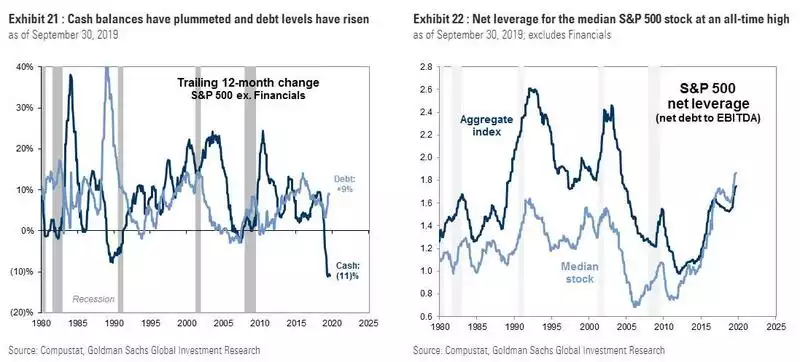

The following charts should therefore not come as a surprise. S&P500 companies (excluding financial institutions) have seen a massive 15% fall in cash balances over the year (highest since 1980) and net leverage (debt/earnings) has jumped to the highest since 2005 at the same time as the median share price is at an all time high….

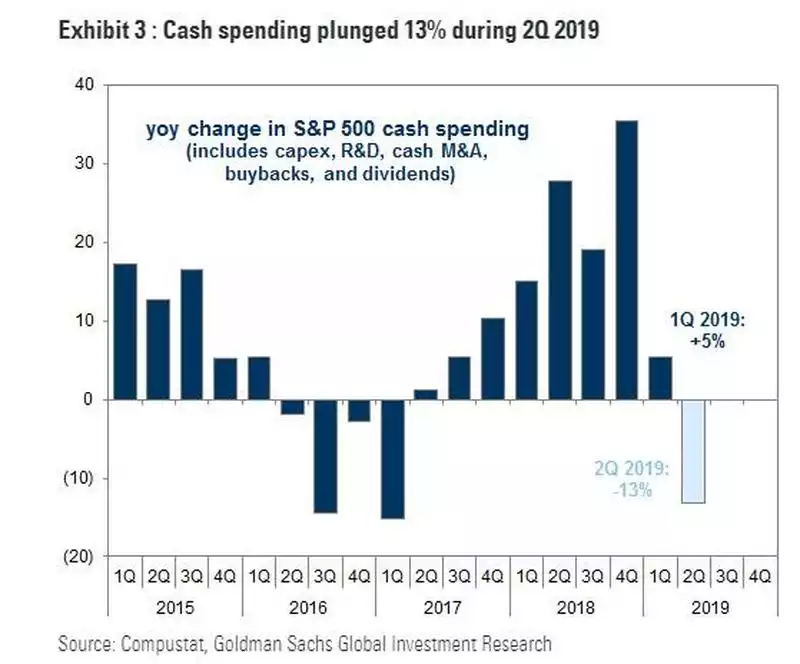

Goldmans are now warning that might all be coming to a halt with Q2 2019 figures showing a 13% fall in cash spending by S&P500 companies.

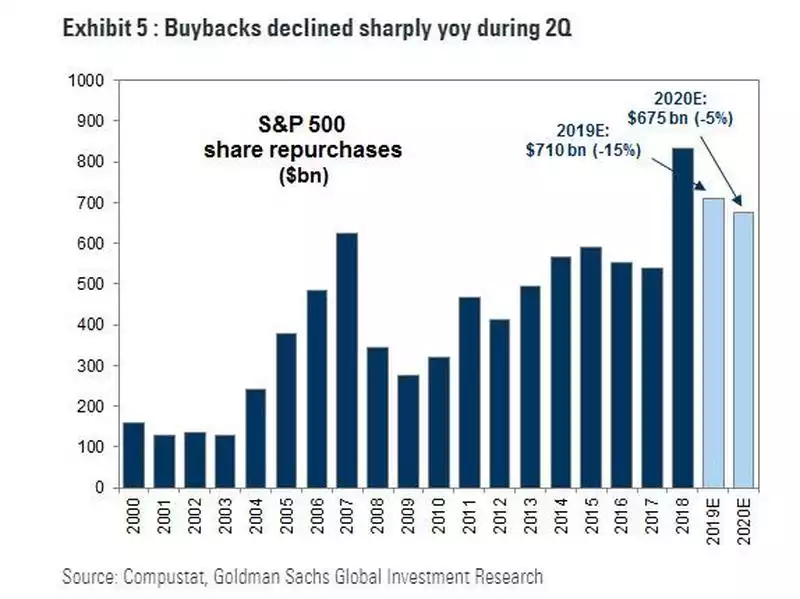

And more specifically when it comes to buybacks they think this is a trend to continue this year and next:

The charts above are a double whammy for the sharemarket. The policy of central banks to lower what you can get from banks or bonds is explicitly aimed at getting you to buy shares and property in search of yield. Reducing dividends of course reduces yields. With buybacks being such a massive part of driving up the capital growth of those shares, reducing that also presents the prospect of falling prices on top of falling yields.

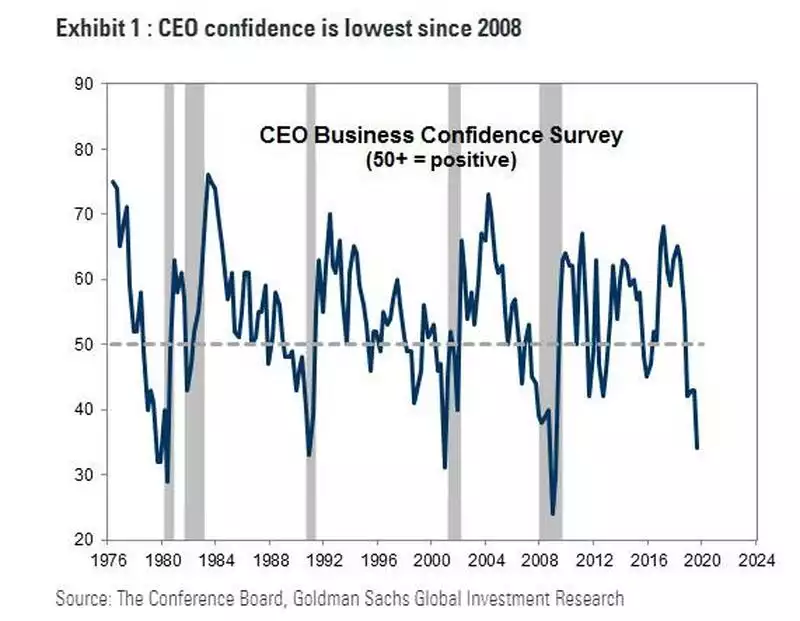

So what’s driving this reversal in corporate strategy? CEO confidence is plummeting:

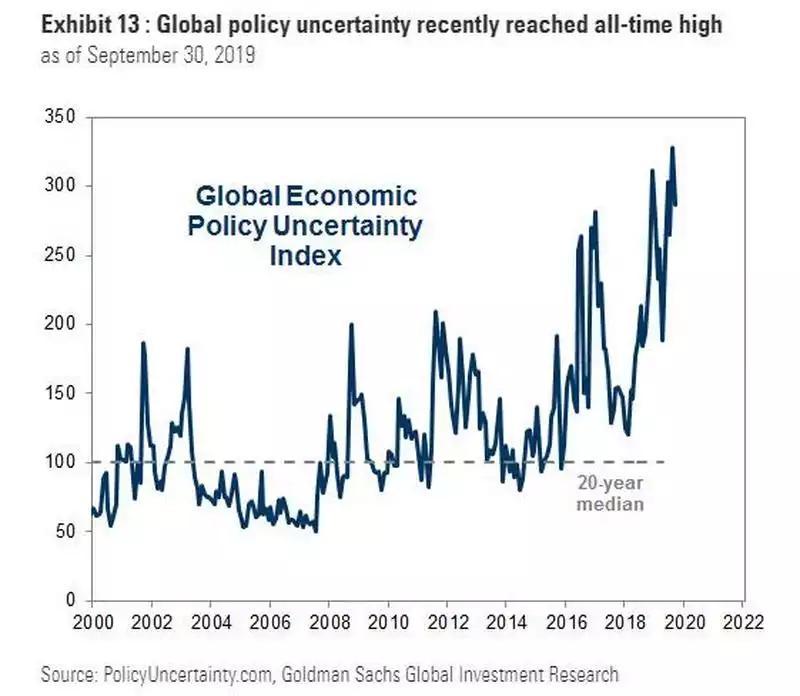

We saw how short lived the celebrations of a US – China deal were last week. Nothing to date should give anyone with half an independent brain reason to expect any tweet or highly conditioned ‘break through’ has any depth of meaning or longevity. Yet again this article, like so many includes the word ‘unprecedented’. That is a fact of so much of this current global economic setup where central banks have extended their own bubble beyond anything before it and have the hubris and ignorance to believe it can all work out just fine. The following chart puts this clearly into context: