Buying The Dip?

News

|

Posted 19/01/2021

|

5109

Buying The Dip

Recently Bitcoin experienced a much-expected pull back. Bitcoin, over its short history, has established a trademark “dip” of 20-30% during bull markets. This price usually precedes further extraordinary gains… will it happen again?

Last week, over a 2-day period bitcoin, dipped 28% from its highs of almost $54,000 down to $39,500. This characteristic move echoes the many times it has occurred during bitcoin bull markets in the past.

For example all through 2016 and 2017:

during the current bull market:

Seasoned crypto investors are all too familiar with crypto’s signature dip. Often extremely violent and short-lived, these dips are the perfect time for investors to gain exposure during a bull market. Interestingly, based on history, on-chain data points to the recent pullback not being the top, but rather just a normal dip of a longer-term bull market. While volatile, this often means that further gains are available. Additionally, Bitcoin tends not to take very long to set new higher highs and continue its trend and after 30% drops is often marked by 100%+ gains.

*USD

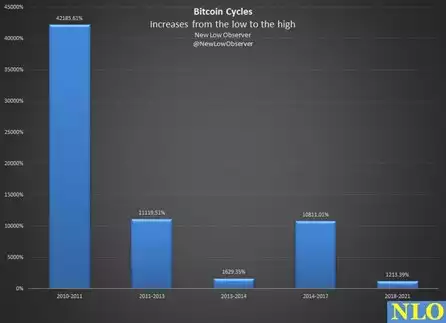

It isn't unreasonable to have price targets above $100,000. Bitcoin cycles are epic, often finding thousands of percent during each bull market. The current bull market has *only* found 1213% which on its own sounds incredible, but it pales in comparison compared to the 3-year bull market of 2014-2017. Sure, those sorts of gains will be a lot harder to find going forward but it goes to show that there are still a lot more gains on the table. And this time institutions with deep pockets are flowing into the market and on-ramps are more accessible to the public.

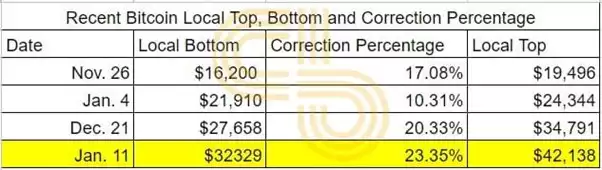

On a more short-term basis, BTC has had four double-digit percentage losses since first encountering resistance from the 2017 all-time high level in November. The progression has created higher highs and higher lows after each correction.

*USD

If the trend continues, last week’s bottom could the local bottom before further upside.

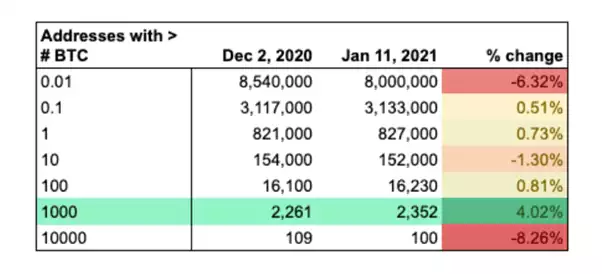

Since December last year, the number of Bitcoin addresses with more than 1,000 BTC has increased by 150.

We have been here before. Dizzying highs and lows are not a new phenomenon for bitcoin. However, the cryptocurrency is now finally gaining institutional support, which eluded it for a long time. The pandemic certainly helped. During the widespread lockdowns, online commerce and payments ballooned, increasing interest in digital currencies exponentially.

Bitcoin was always volatile. But the past year has shown that every asset class can become wobbly in an uncertain environment. It was always regarded as an interesting store of value due to the ultimate ceiling of 21 million and the difficulties in mining it. But its wider acceptance is bringing a sense of credibility and stability that was hitherto missing.

The above comparison adds fuel to the narrative that institutions are buying BTC at the expense of retail investors and traders. Furthermore, long-term Bitcoin tops (for example, 2013 and 2017) were marked by retail euphoria. Currently, what the markets are witnessing is precisely the opposite.

So, while this big drop in Bitcoin’s price may be unpleasant for newcomers, it should serve as a reminder of just how unpredictable it can be. That’s why if you’re considering an investment, it should surely be for the long run.

Despite one short-term blip on what looks to be Bitcoin’s meteoric long-term rise, many investors and analysts still consider the cryptocurrency a buy. This makes the current dip a great chance to load up on more Bitcoin investments or get your foot in the door if you haven’t already.

The trouble is knowing how much to buy. While dollar-cost averaging can help, it’s impossible to know if Bitcoin will continue its rebound quickly or selloff further, offering an even bigger discount.

This is all the more reason to make a long-term investment. Of course, you want to buy it for the lowest price possible today, but even if you overpay slightly, if you hold it for years and Bitcoin appreciates as many expect it to, the price you bought it at will be the last thing on your mind.