BTC through $10K – Here we go again?

News

|

Posted 13/05/2019

|

45001

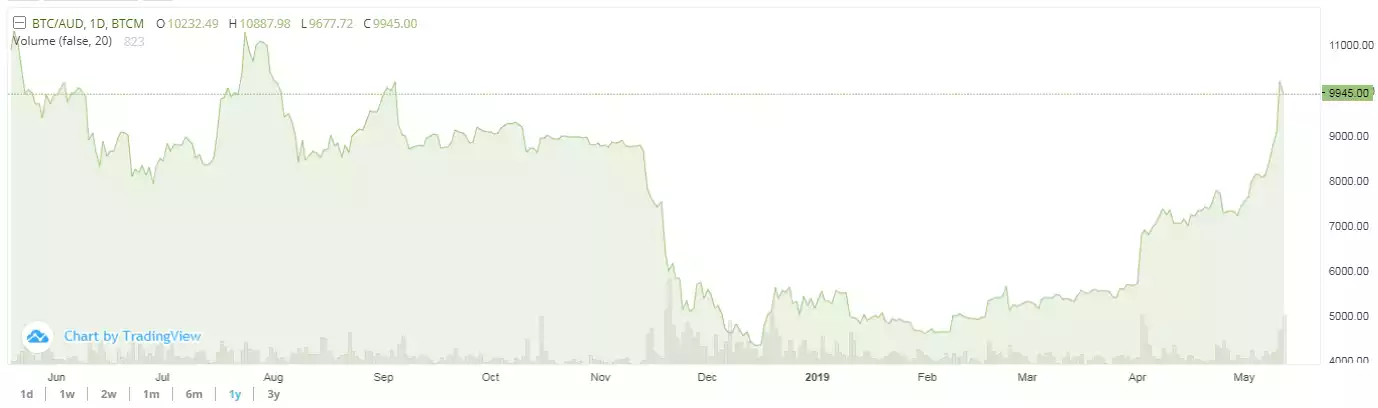

Late last week and over the weekend we saw Bitcoin surge to levels not seen in nearly a year. Hitting US$7500 yesterday it is now up almost exactly 100% on its mid December 2018 low of US$3250. In Aussie dollars it hit $10,600 yesterday off its mid December 2018 low of $4400.

You can see the resistance line above and in the USD chart below it’s the $6500 that everyone has been watching. It smashed through it on Friday after multiple failed attempts and that big capitulation in December last year. Was that the final clean out that many were waiting for?

The thing is, as financial advisory firm Canaccord Genuity pointed out in a Cointelegraph interview over the weekend, we’ve been here before. They believe there is a 4 year cycle in line with the so called ‘halving’ where the mining reward halves every 210,000 blocks. The chart below compares this to the top in end of 2017, with the current cycle. Their conclusion is BTC could hit US$20,000 by 2021 with a repetition of this trend. Founder and CEO of Galaxy Digital crypto fund, Mike Novogratz was pretty close to this stating we will see the previous US$20,000 high exceeded in the next 18 months.

Interestingly, Novogratz weighed in on the eternal ‘use case’ argument for Bitcoin at the ConsenSys summit on Saturday. Novogratz sees Bitcoin more as a store of value than everyday transactional currency comparing it to gold “arguing that both have value as a social construct.”.

In that context (as “digital gold”) he argues bitcoin itself “won’t change the world” rather it will be cyptos that have use within the so called Web3.0 (like Ethereum) which he describes (via Cointelegraph) ‘envisions a revolution in how networks function and data is treated as it is “a decentralized platform to process information. It’s separating data from the processing of it.”’

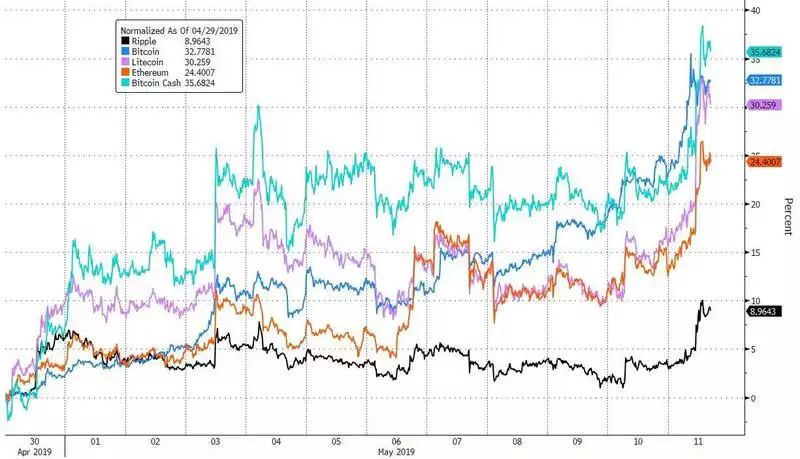

Bitcoin’s dominance in this rally has seen its market cap share rise to 59% of the total $211b but it hasn’t rallied alone with BCH actually outperforming it since this rally started in April:

Where to from here is anyone’s guess really. There has been an enormous amount of money sitting on the sidelines waiting for a demonstrable break out and the weekend certainly looked like that but investors may still be wary and be waiting for more ‘proof’ this is the start of the inevitable next bull run.

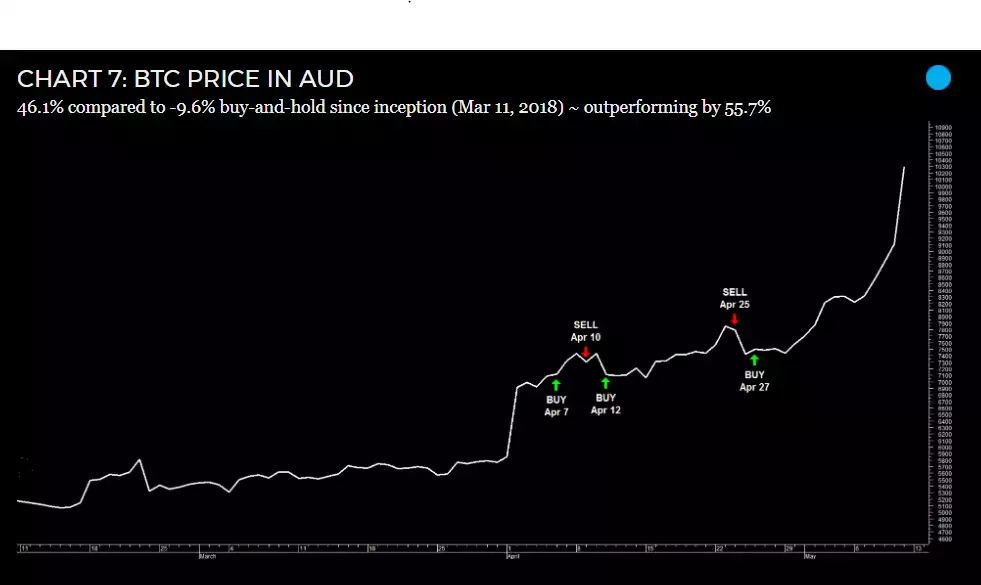

So what’s Ainslie Intelligence’s AI signals saying? It picked the latest rally and it still has BTC as a buy but we will be very keen to see what it tells us at 2pm today! To learn more about Ainslie Intelligence click here.

Ainslie Wealth provides a safe, high value, person to person means of buying crypto OTC (over the counter) via our store, phone (1800 987 648) or webshop.

If you are looking to take profit believing we might have a bit of a correction, Gold Standard (AUS) and Silver Standard (AGS) gold and silver backed crypto tokens are your perfect secure home. For more info visit https://www.goldsilverstandard.com/ or trade now through Ainslie Wealth per above.