BTC & ETH – Strength to Strength

News

|

Posted 10/08/2021

|

6642

The crypto market rallies higher as indications of a Bitcoin on-chain supply squeeze take shape, and Ethereum successfully rolls out EIP1559. After breaking recent highs, the two largest crypto’s look ready to make a run up back to the highs. Let’s jump into some on-chain metrics and have a look at the driving force behind these moves.

The Bitcoin market has seen another strong week, with prices rallying 20% from lows of $37,524 (US) up to a high of $45,215. The market briefly traded above the 200-day moving average ($45k) over the weekend, before retracing and commencing consolidation - the response of the market is usually to reject or breach the 200-day MA. Printing above the 200MA is typically a bullish signal and is worthwhile keeping an eye on over the coming days. This morning it broke through it…

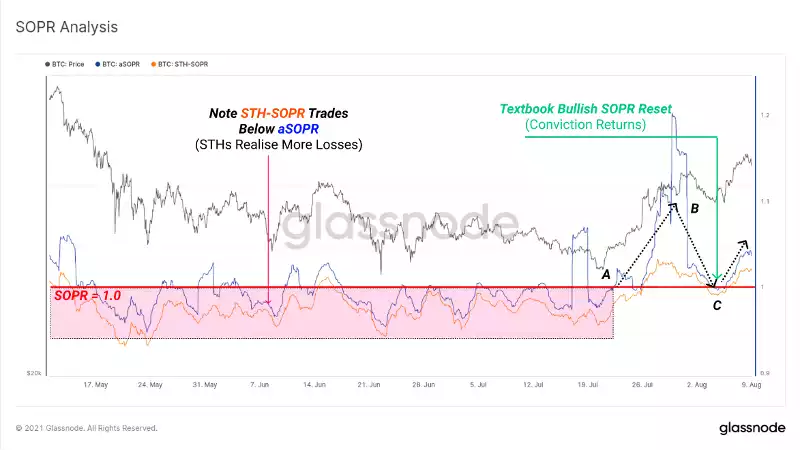

As price action confirms underlying market strength, the on-chain response to the rally shows that Bitcoin holders are not taking exit liquidity, rather they are accumulating, or HODLing on. Glassnode's SOPR analysis measures profit and loss realised by coins spent on-chain. In their latest on-chain report, Glassnode believes that "SOPR metrics have executed what looks like a textbook bullish reversal.”

A textbook SOPR bullish reversal is as follows:

- A: SOPR breaks above 1.0 after a sustained period of losses being realised on-chain. This signals profits are realised, and the market was able to absorb that supply.

- B: SOPR reaches a local high, profitable coins take advantage of market strength to spend and realise profits. This creates a local top via over-supply, and price corrects.

- C: SOPR resets back to 1.0 signalling profitable coins have stopped being spent and conviction returns to the market and the dip is bought. SOPR then trades higher repeating the rally higher.

“The Spent Output Age Bands demonstrate that on the whole, middle-age (3m-12m) and old coins (> 1y) remain relatively dormant, and are not existing the market seen in 2018. The majority of spending in this cohort are younger and aged between 3m-6m, representing bull market buyers. These transactors may be exiting or de-risking closer to their cost basis. Overall, this metric remains fairly bullish in that urgent exit selling by old hands does not seem to be occurring.”

But the real exciting news of the last week is that the Ethereum network has recently rolled out the London upgrade which includes the new fee stability mechanism EIP1559. As part of the implementation details is a burn mechanism for the BASE FEE portion of the transaction fee, denominated in ETH.

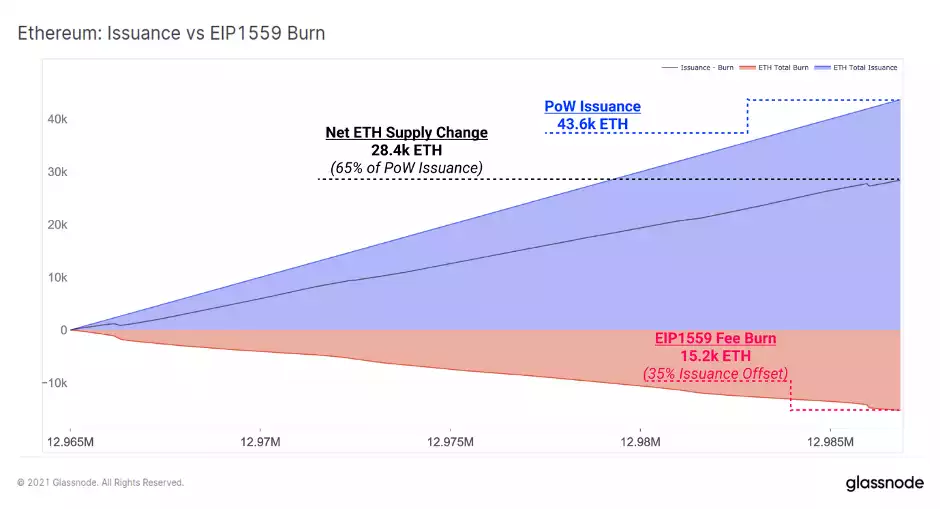

Since the launch of the London upgrade, a total of 43.6k ETH has been issued via PoW mining. In that same time, a total of 15.25k ETH has been burned representing a 35% reduction in total net issuance. The tokenomics are therefore 35% better essentially overnight, with many experts believing this is the beginning of Ethereum's run-up to take out Bitcoin as the largest cryptocurrency by market cap. Ethereum bulls point to the network recently overtaking bitcoin in a number of metrics and its price performance relative to bitcoin over the last year. Ethereum has soared 600% over the last 12 months, compared to *only* 250% for BTC.

Taking a look at the volume of ETH burned per block, we can see that so far fee pressure has pushed the burning mechanism above the design 2 ETH issuance in a handful of instances creating net deflationary blocks. So far, EIP1559 has a mean burn rate of 0.697 ETH per block.

Ethereum's London upgrade also aims to help the blockchain scale and make surging transaction fees more manageable. The entire upgrade isn't expected to be fully realized until well into 2022 but already the upgrades are taking their effect on the price.

Ethereum also recently surpassed bitcoin in the total number of active daily addresses, and that momentum shows no signs of slowing as the network continues to power key DeFi and NFT trends.

There’s still a lot of room to move until we starting printing new all-time highs again but the market is certainly set up to get back there. It’s not too late to jump into a market that’s clearly moving from strength to strength.

Remember if you are a bit ‘scared’ about entering this still relatively new space, Ainslie Wealth allows you to deal with a human who can answer your queries and explain how things work and also provide completely offline cold storage for you so you don’t need to worry about where to safely store it.