Bond Market Portends “Nightmare” in Shares

News

|

Posted 08/10/2018

|

6990

Bond Market Portends “Nightmare” in Shares

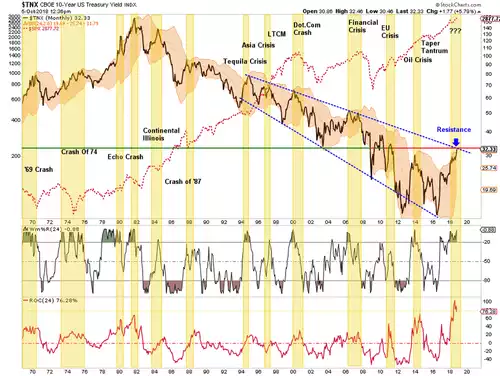

Late last week Bloomberg stated "All the Nightmares for Stock Investors Start in the Bond Market." Few would argue. Last week saw nearly $880 billion wiped off global bond markets and so pushing yields up well over 3% with the 10year US Treasury yield sitting at over 3.2%. Not surprisingly US shares fell as history shows they do after 3% is breached. But it was the extent and momentum last week that had many concerned. Lance Roberts of RealInvestmentAdvice thinks something may have just broken:

““The disproportionate role of quant strategies also represents a profound market risk when rates are advancing, particularly relative to consensus disinterest and even lack of understanding of the role of this dominant market player. This is important, because if the correlations that underpin risk parity begin to fail — basically when both bonds and stocks fall simultaneously — as they have in the last week, they likely will cause an impactful unwind of risk-parity portfolios that are sizable and very leveraged.”

The recent blow out in risk parity, as noted by a surge in volatility, is evidence that something likely just broke.

History bears this out as well.

Whenever the 10-year yield has traded at, or above, 2-standard deviations above the 2-year moving average, bad things have tended to occur from recessions, to corrections, to outright crisis. Given the 2-year rate of change on the 10-year has surged to the highest level in over 50-years – if something hasn’t already broken, it likely will soon.”

This chart spells that out very clearly….

Roberts explains beautifully:

“More importantly, rising rates are NOT JUST a consideration of stocks versus bonds.

If the stock market falls, the top-20% of the economy gets a little depressed because their wealth declines a bit.

However, given the bottom 80% have very little invested in the financial markets, when RATES surge higher, it is 100% of the economy that feels the pinch. As Doug notes, interest rates run through the entirety of the financial and economic backdrop.

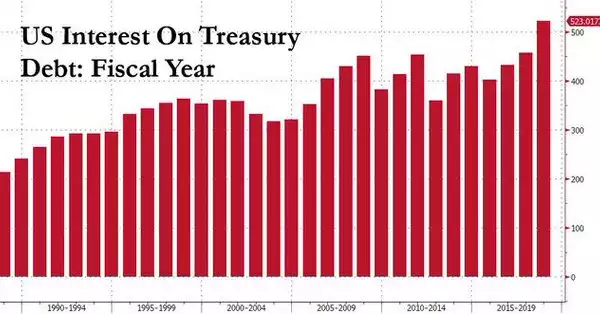

- The private and public sector have inflated debt loads today. Rising interest rates raise the cost of servicing that debt and reduce spending and productive investment. [* see below]

- Private-sector activity is importantly influenced by interest rates:

- Rising mortgage rates and higher mortgage payments reduce home affordability and hurt home turnover and refinancings.

- Slowing home sales and reduced refinancings hurt spending on renovations and remodeling.

- Consumer, mortgage and corporate loans that are variable rate are hurt by climbing interest rates.

- The credit markets fall when interest rates rise, serving to have a negative wealth effect on consumers and corporations that own bonds.

- Debt is often issued by corporations in order to buy back stock and pay dividends. Advancing rates reduce a company’s return on investment on those buybacks.

- Corporate capital spending is partially dependent on borrowings. Higher borrowing costs could lead to lower capital spending.

- Public-sector activity and profitability are also importantly influenced by interest rates:

- The deficit/GDP ratio will increase as interest rates rise and the consensus expectation for lower future deficits will crumble.

- Dividend discount models are based on future estimates of cash flow discounted back at an appropriate interest rate:

- Rising interest rates reduce the value of those future cash flows and, in turn, the value or worth of a company’s stock.

- There is now an alternative to stocks as the yield on the one-month bill (2.16%) and the two-year Treasury note (2.89%) compare favorably to the S&P 500’s dividend yield of only 1.77%. Further rises in interest rates will serve as an even more competitive and attractive alternative to stocks.

- Rising interest rates in the U.S. will buoy the dollar, exacerbating the ability of weaker countries and corporations to service their dollar-denominated debt.

The issue of rising interest rates may have finally woken overly complacent investors from their bullish slumber.

We won’t know until we get a rally that fails to set a new high.

But one thing is for sure... if something hasn’t already broken, it will break soon if rates keep rising.

That day may be much sooner than most expect.

As noted above, we have tightened up stops considerably and next week will begin to start rebalancing and hedging risks accordingly.”

Whilst Roberts is currently calling further gains in shares for his investors, he is clearly getting nervous and has spoken previously of his favourite ‘hedge’ being gold.

To quantify that first point for the US alone, the following chart shows their interest cost on the $21.5 trillion in debt they now have:

Over half a trillion USD every year in interest alone! From Zerohedge:

“But besides the economic and political catalysts, a bigger threat is the soaring US budget deficit: with tax cuts by Trump’s administration putting the U.S. budget deficit on track to hit $1 trillion next year, Steven Mnuchin’s Treasury plans to borrow $770 billion in the second half of 2018, a more than 60% increase from the same period last year; and with the Fed actively reducing its own portfolio now at a $50 billion/month pace amid a sharp drop in pension fund and foreign investor buying, interest rates have nowhere else to go but up to attract buyers.

The net impact is dramatic. BlackRock estimates that the net supply of Treasury securities will more than double this year, to over $900 billion, and rise to nearly $1.2 trillion in 2019. The market hasn’t had to digest that much government debt since 2010 when the Fed was monetizing a substantial portion of this deficit with QE1 and QE2.”

All eyes will be on bonds this week and the speed with which further yield rises may happen. Earlier this year at Davos, the head of the world’s biggest hedge fund, Bridgewater’s Ray Dalio said:

“A 1 percent rise in bond yields will produce the largest bear market in bonds that we have seen since 1980 to 1981,"

On that note let’s finish with how we started:

"All the Nightmares for Stock Investors Start in the Bond Market."