Bitcoin Misery Index

News

|

Posted 12/03/2018

|

7272

Thomas Lee is a Wall St strategist and the co-founder of Fundstrat Global Advisors. As one of the relatively few big name Wall St strategists who provides forward price guidance and analysis of Bitcoin, when he speaks, he has the ears of many.

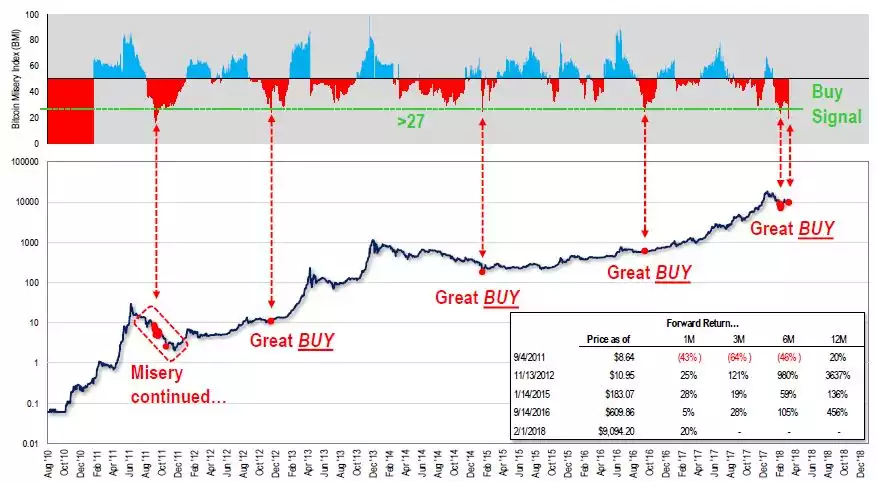

Earlier this year after Bitcoin experienced its big correction, he maintained it would hit $25,000 by the end of this year. He has just come out again, maintaining that $25,000 2018 target and issuing what he calls the Bitcoin Misery Index (BMI). Essentially a contrarian index, it measures factors such as volatility and the number of winning trades out of the total and comes out with a number between 0 and 100. As he explained in an interview with CNBC:

“When the bitcoin misery index is at ‘misery’ (below 27), bitcoin sees the best 12-month performance. A signal is generated about every year…. When the BMI is at a 'misery' level, future returns are very good."

Take note of the returns in the break out box and note the price scale is logarithmic.

Since the crypto markets seemed to find a bottom on 6 February, they took another dip (though still a higher low) last week on yet more news around regulation and exchange security. At the time of writing, the top 5 cryptos that Ainslie sells were all rallying, with BTC up over 9% (24hrs).

Thomas Lee’s graph beautifully depicts that map of human emotion that dictates markets. It’s why Buffet has done so well being ‘greedy when others are fearful’.

News of regulation of exchanges should not send the tremors that it does. Below is a graph of the S&P500 group of shares traded on a highly regulated exchange called the New York Stock Exchange. Things can go ok on a regulated and secure exchange….

The difference is that not many people are screaming blood in the streets on that market like we are seeing in crypto right now. In fact, to complete Buffet’s famous quote, it looks more relevant to be feeling ‘fearful when others are greedy’ in financial markets.