Bitcoin Halving Arrives. Where To Next?

News

|

Posted 12/05/2020

|

16657

Earlier today, the number of bitcoins rewarded to those that maintain the bitcoin network, called miners, cut by half—dropping from 12.5 bitcoin to 6.25.

The effects of 2020 bitcoin halving, the first since bitcoin exploded onto the global stage as a result of its massive 2017 bull run, has been debated for years.

No one knows how the bitcoin price will react to the supply squeeze, though many in the bitcoin and cryptocurrency community are confident the bitcoin price will climb eventually.

History has proven that each time the bitcoin mining reward halves, the price rallies. In the image below, the vertical green lines indicate the previous two halvings (2012-11-28 and 2016-7-9). Note how the price has jumped significantly after each halving.

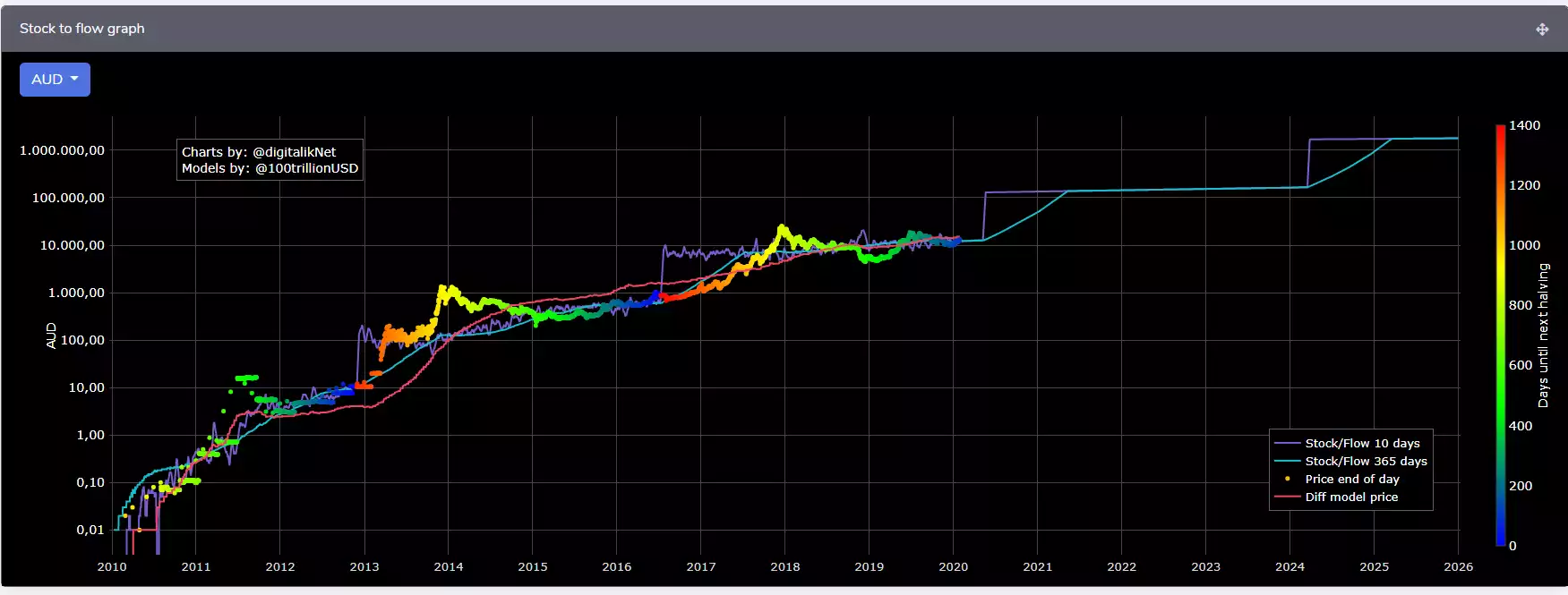

Additional speculation supporting an increase in the price of bitcoin as a result of the halving uses PlanB’s stock-to-flow model as proof.

Stock-to-flow ratios are used to evaluate the current stock of a commodity (total amount currently available) against the flow of new production (amount mined that specific year).

Halving events will continue taking place until the reward for miners reaches 0 BTC. Since Bitcoin's value representation has 8 decimal places, after the 33rd halving, the value of the reward will hit precisely 0 BTC. 33 halving events every 4 years adds up to 132 years total. The last Bitcoin to be mined into existence will be mined in the year 2140. It will be the 21 millionth Bitcoin to come into existence, and last, after which point it will be impossible to create anymore. From then on, Bitcoin will become truly 'deflationary', since mining new coins will no longer be possible, and if owners keep on losing their private keys, as they currently are, then the supply would further deflate by that lost-keys ratio. It is not possible to copy or forge Bitcoins, and the total supply is strictly limited. All transactions are written in blocks, and nobody can spend coins that belong to someone else's bitcoin address. That is where "scarcity" comes into play. The dictionary definition of scarcity is when something is difficult to come across in nature or the lab; very similar to precious metals. Once something becomes scarce enough, it can be used as money. Stock to flow is defined as a relationship between production and current stock that is out there.

On the above chart, price is overlaid on top of the stock-to-flow ratio line. We can see that price has continued to follow the stock-to-flow of Bitcoin over time. The theory, therefore, suggests that we can project where price may go by observing the projected stock-to-flow line, which can be calculated as we know the approximate mining schedule of future Bitcoin mining. As we reported last week, the model currently is predicting bitcoin to reach 288,000 USD during the next phase/bull run.

Bitcoin has already seen an uptick in volatility in the run-up to the halving over the last week.

After starting last week at under 9,000 USD per bitcoin, the bitcoin price rallied hard to over 10,000 USD before crashing back over the weekend.

"The move back down to $8,000 wasn’t a big surprise," said Rich Rosenblum, co-head of trading at Hong Kong-based crypto market maker GSR, adding, "it’s likely that we’re going to see increased volatility through May, with the pandemic, ongoing stimulus measures and the halving."

Bitcoin has been one of the best-performing assets since the broad coronavirus market crash in March, with the bitcoin price more than doubling from lows of around 4,000 USD.

Many bitcoin and cryptocurrency exchanges have reported surging user numbers and trading volume.

"Bitcoin has risen over 100% over the last few months and we believe most of that rise was driven by continued retail demand," said Scott Freeman, co-founder of New Jersey-based bitcoin and crypto-focused institutional trading firm JST Capital.

"We expect continued volatility but expect to see good long-term risk-reward in bitcoin and also expect it to behave in an uncorrelated manner to traditional financial assets."

Meanwhile, the bitcoin and crypto community was rocked last week by news legendary macro investor Paul Tudor Jones is buying bitcoin as a hedge against the inflation he sees coming as a result of unprecedented coronavirus and lockdown-induced central bank money-printing.

In a letter to clients, Jones said it reminded him of the role gold played in the 1970s.

"Given the COVID-19 crisis and the easy money policies of major central banks, real money and macro investors are increasingly concerned about the value of traditional financial assets," Freeman said, adding, "We received several calls over the past week from institutional investors who now see bitcoin as a great hedge against the easy money policies and the looming global recession."

To celebrate the halving we are offering Bitcoin purchased today until 4pm AEST at just 2.5% above spot. Click here or call on 1800 987 648 to purchase at this historic juncture.