Bitcoin’s 10% Jump in Context

News

|

Posted 18/07/2018

|

7153

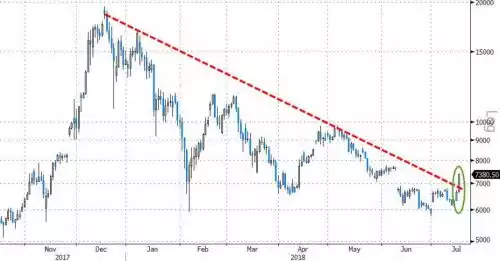

It would be remiss to not note the price action on crypto markets since our article yesterday. The last dot point of institutional crypto uptake spoke to the announcement by the world’s largest asset manager, BlackRock that it intended entering the space. For context, BlackRock has US$6.3 TRILLION of assets under management and is also the world’s biggest provider of ETF’s. The timing of the announcement and the price action thereafter can’t be ignored, up over 10% in 24 hours and threatening a 100DMA breakthrough after already smashing through the 50DMA.

Importantly too, it appears to have broken the downturn trend since the December highs…

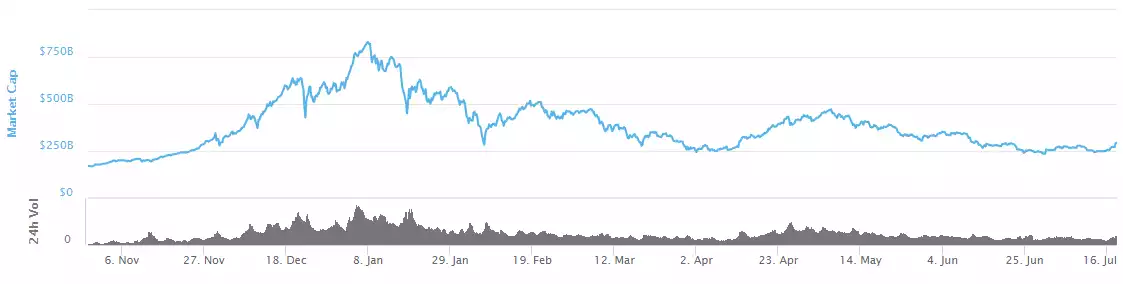

Whilst Bitcoin has enjoyed better gains than most, the rise is across the board with the total market cap for cryptos jumping to US$294b. It’s worth pausing and really looking at that number. First, let’s put it in context against just BlackRock’s book alone. US$294b represents just 4.7% of the US$6.3t BlackRock invests. Remember too, that US$294b is the value of ALL 1641 cryptocurrencies. There is a lot of rubbish in there that BlackRock would never look at. Bitcoin alone has a market cap of US$126b, just 2% of BlackRock’s FUM. That’s is one institution and the entire Bitcoin value. More broadly there is around $300 trillion in financial products in the world, reducing the entire crypto space to just 0.1%. Talk about potential for institutional influence….

Looking at the chart below, the total market cap for crypto was US$294 back on 27 November last year. At its peak of US$836b on 7 January it was up 284% in a little over a month. Twice since it has tested this level. In January we saw the dead cat bounce to $513b off $279b (184%) and in April it bottomed at US$258b before rallying to US$467 (181%). At the end of June we saw a bottom of $235b and yesterday’s rally may be the sign of the next leg up.

So the two takeaways today are we still have a new asset class in its infancy or ‘early adoption phase’ compared to established markets and even individual finance institutions. Yes crypto can be volatile and that graph above simplistically looks flat and bearish. Such is the combination however, that the ‘troughs’ to ‘peaks’ as we currently ‘bounce along the bottom’ represent an almost doubling of your money if you time it right. If you’re not a trader, buying dips and holding still sees you outperforming any other asset class. This time last year Bitcoin was $2174, a third of its value today.