Bitcoin – The Best Macro Asset of 2020

News

|

Posted 02/10/2020

|

7245

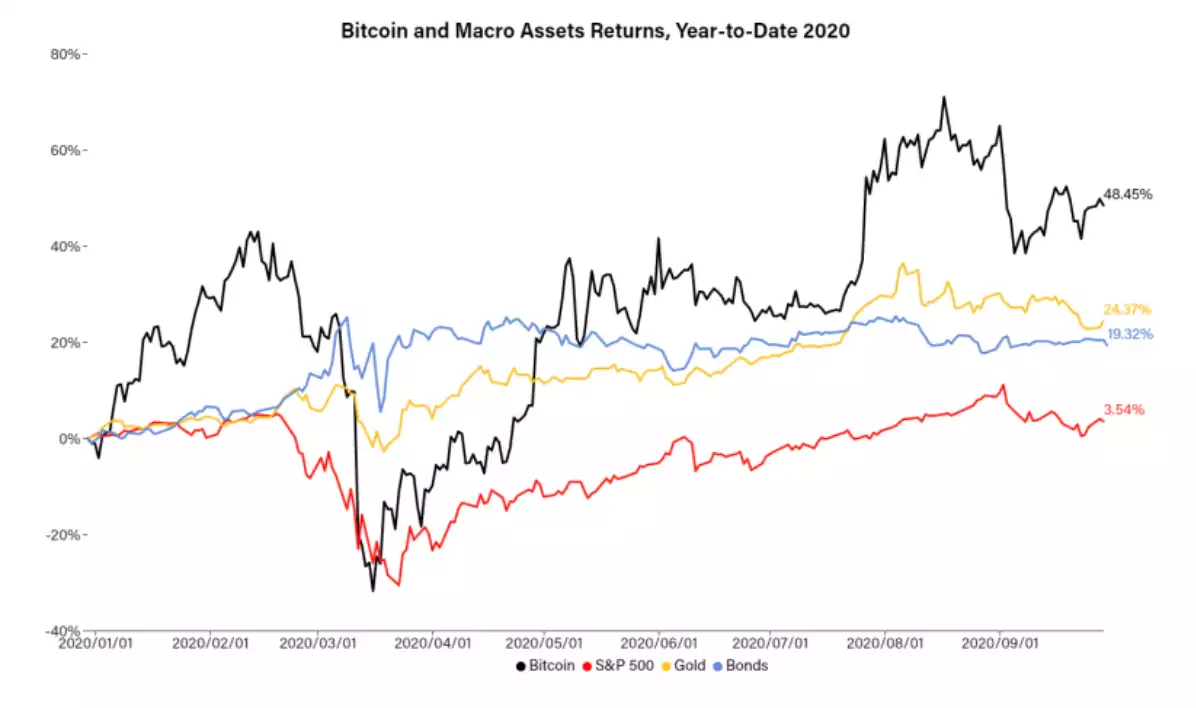

It's no secret that this has been a crazy year for precious metals but as bitcoin heads into the closing months of 2020, the largest cryptocurrency's 2020 investment gains are twice those of the yellow metal.

Bitcoin gained 50% in the nine months through September versus gold’s 25%, during a year when a global pandemic devastated the economy and provoked central banks to print trillions of dollars. Many investors believe that the extra wave of money could ultimately send consumer prices spiralling higher, and to protect themselves have been flocking to bitcoin and other cryptocurrencies.

And bitcoin's performance looks particularly stark when compared with the Standard & Poor's 500 Index, which has returned 3.5% this year and the bond market which has returned 19.3% this year. It's clear what the right play has been this year.

While billionaire investor Warren Buffett still isn’t on the crypto wagon, many other Wall Street analysts see the value and express their views:

Denis Vinokourov, Bequant: The market is testing the upper bounds of its recent range and, with the absence of fresh macro news flow that could dampen the risk on sentiment, bitcoin may just find enough momentum to break through the $11,000 price level and, more importantly, stay there. Open options interest continues to show signs of recovery.

Charlie Morris, ByteTree: The vast majority of bitcoin’s past gains coincided with periods of a flat or weak dollar. The implication is that bitcoin is likely to be a powerful hedge against U.S. dollar weakness. How likely is that? Quite likely given it is Fed policy.

IntoTheBlock: There are two areas of strong resistance for bitcoin based on on-chain data. The first one is the current resistance it is facing around the $11,000 mark, where 626K BTC has been bought by 1.17 million addresses. This creates resistance from many of these addresses looking to close their positions to break-even. After that, there is another similar resistance level between $11,400 and $11,700 as shown in the graph above. The good news is that past these resistance levels, there is likely to be less selling pressure past $12,000.

Matt Blom, Diginex: Despite the propensity to buy, hold and not move bitcoin, the network remains buoyed by growth. The only thing going sideways in bitcoin is the price.

Jason Lau, OKCoin: Bitcoin’s price momentum is still positive, with its pullbacks leaving higher highs. This is signalling a possible further continuation of this upwards move. Bitcoin perpetual swaps funding rates have started turning positive. This indicates that investors are more willing to go long at current price levels.

George McDonaugh, Keld van Schreven, Kr1 Plc: We are currently seeing some correlation [involving] bitcoin, other digital assets and movements in the equity and gold markets. We expect the trend of strengthening balance sheets and diversification into bitcoin to continue as the world’s monetary policies shift evermore towards unbridled money printing and higher inflation.

QCP Capital: The key support from the early month lows of $10,000 on BTC and $310 on ETH both saw substantial buying demand. This prevented any cascading short gamma selling into quarter-end, which had been our fear if those levels broke.

Constantin Kogan, BitBull Capital: We’re seeing a spike in activity by new participants coming into BTC not yet reflected in price. It doesn’t happen often. This is what traders call a divergence. In this case the trend looks more bullish.

Patrick Tan, Novum Alpha: While it may be tempting to subscribe to the notion that bitcoin will represent a safe haven in times of instability, there’s little evidence to support that view – especially since gold, tech stocks and bitcoin have all tracked each other closely this year. A further round of stimulus, or a smoother than expected political transition, could pave the way for bitcoin to move higher as politicians get past electing and get back to spending.

Bitcoin is trading in the narrow range of $10,600 US to $11,000 US for the seventh continuous day.

The long-term sentiment remains bullish, as evidenced by a sustained decline in the number of coins retained on cryptocurrency exchanges – a sign of investors shifting to holding strategies and not primed ready to sell on the next green candle.

In the short run, the cryptocurrency could continue to take cues from the U.S. dollar and stock markets.

The cryptocurrency fell by over 7% in September, settling its greatest monthly decline since March as the oversold dollar index rose approximately 1.8%. Bitcoin, gold and S&P 500 have moved largely in the opposite direction to the dollar index since March.

There’s no doubt that on a macro level we are still heading in the one direction. Now, more than ever, it's imperative to diversify your portfolio. Take advantage of the recent dip… give us a call and we can discuss including crypto or bullion in your investment portfolio.