Bitcoin Adoption Ramping Up

News

|

Posted 08/06/2021

|

6739

El Salvador's President Nayib Bukele has announced through his Twitter account that he plans to make Bitcoin, the original and premier cryptocurrency, as a legal tender in their country. If the El Salvador President's proposal goes through, El Salvador will become the first country in the world to legally use Bitcoin as a digital legal tender.

President Bukele is set to push the Bitcoin legal tender legislation to congress in the coming week. 70 per cent of El Salvador's population does not have access to a bank account or banking system. There are a couple of reasons President Bukele is pushing to make Bitcoin a legal tender in the country. Firstly, more than 2 million El Salvador residents live outside their country for work and send more than $4 billion back home to their families in the form of remittance.

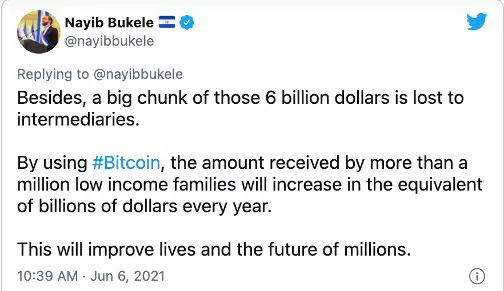

The fees for sending money abroad are often quite expensive and people sending money to their families back home from abroad lose a lot of their money just because the fees of sending money is unsustainable. It can take days or weeks for the money to arrive in their families bank accounts. On the other hand, the transfer fees using Bitcoin are quite low and near-instant when the Bitcoin network isn't congested. Even when the fees become high due to congestion, it's still quite low compared to using money wiring services internationally.

President Bukele's decision to enforce Bitcoin as a legal tender could have huge long-term implications. As he mentioned in a set of Tweets, over 70 per cent of El Salvador's population do not have access to banking. Using Bitcoin could replace the same service that banks provide, a fast, cheap, and reliable way to make and receive payments, without the hassle and the fees of using banking services. This could potentially encourage other smaller countries with weaker economies to open up to crypto as an alternative to fiat currencies, paving the way for mainstream future adoption worldwide. Already, Venezuela and many African countries have started using crypto currencies as a long term store of value, as their currencies are deflating quickly.

The transformation by El Salvador of bitcoin into legal tender, i.e, a foreign currency, makes the accounting treatment much more straightforward, enabling every corporation in America to hold bitcoin in the same way that it holds other forms of cash. Such a change could dramatically increase the utility of bitcoin for corporate treasury management.

El Salvador’s decision has ramifications for one of the greatest sources of scepticism for Bitcoin’s staying power: the theory that the U.S. will ban the digital currency if it ever becomes a true competitor to the U.S. dollar. “Bitcoin’s greatest risk is its success,” said Ray Dalio, founder of the world's largest hedge fund, Bridgewater Associates, at the Consensus cryptocurrency conference in May. But banning the official national currency of another country would be an unprecedented step for the U.S., one that could undermine the USD's utility as the world's premier fiat currency.

Finally, there is plenty of talk too around the fact that you can’t have capital gains tax on gains in legal tender value. This puts Bitcoin in a whole new light in this country and potentially opening up various investment vehicles domiciled there.

El Salvador may be the smallest country in Central America. But if President Bukele’s bitcoin proposal becomes law, El Salvador could become one of the most significant monetary centres in the world. Adoption certainly is pushing in the right direction and this is a major step up for Bitcoin's legitimacy.