Big Week For Gold, Big Miss for US

News

|

Posted 10/05/2021

|

6090

Somewhat quietly, last week was potentially very instructive for the price of gold going forward from here. This move was punctuated by the abysmal US non farm payrolls Friday night and what that really maybe means. But first let’s acknowledge and celebrate gold’s strongest week in over half a year, convincingly smashing back above US$1800 to $1840, itself a 3 month high. Technically too, decisively moving past the support of the so called ‘double bottom’ through the $1700 resistance line has given analysts a lot of confidence that the 7 month fall from August last year is over.

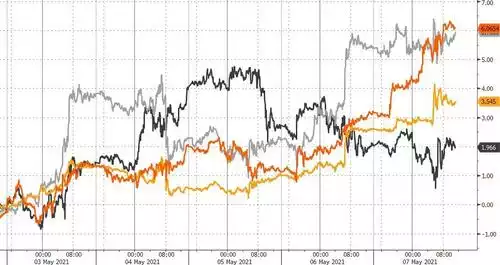

For silver the news is potentially even more bullish as it rides the commodities run as well. On another strong week for commodities among growing demand and inflation concerns, only copper (just) outperformed silver, both up 6%, For context, copper is now at a new all time record high and up 90% for the year…. not bad company…

However technical analysis and prices are one thing. But where is the value? Price is transient, value lasts.

The value proposition of gold, silver, platinum and the likes of bitcoin and Ethereum is, like nearly everything, relative to other assets. For something to have a price, there must be a denominator. Its value is relative to that denominator. For the world more broadly that tends to be the USD, at home more likely the AUD but more personally again it’s against whatever is your benchmark, say how many ounces of gold to buy a home versus the median house price.

For now though, as the world’s reserve currency carrying over 80% of all trade and by far the biggest denomination of global debt, it is the USD. We and many others write continually of the unprecedented debasement of the USD through the actions of the US Fed and government creating and spending it at a simply unbelievable pace. As a reminder over 25% of all the USD ever created was created just last year. And that was before the nearly $4trillion in stimulus from Biden being unleashed. Such stimulus is supposedly temporary to ‘get America going again’. However we again have written continually of the trap that financial markets are completely dependent on it and the debt burden now so big it cannot handle higher rates if ‘natural forces’ were allowed to prevail. It is the much discussed Fed Trap.

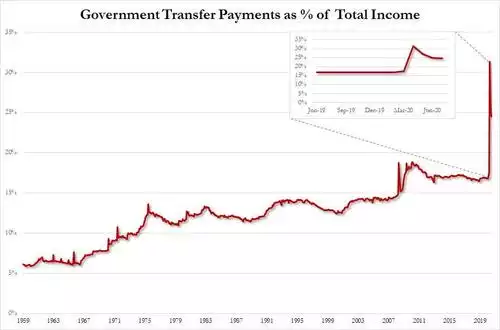

On Friday night we saw the monthly US Nonfarm Payrolls official employment figures released. Expectations were for around 900,000 to over 1m new jobs created in line with the ‘everything’s awesome’ narrative. In the 2nd biggest miss ever, the print was just 266K new jobs and the unemployment rate actually went up to 6.1%, not down to 5.8% as expected. But wait there is more… The previous month was also revised lower by 146K fewer to 770K on actuals. HOWEVER…. there are still over 8m fewer Americans employed now than before the pandemic.

Part of this is there are simply sectors still knocked out and these people can’t take the jobs on offer. But a large part remains the fact that many are quite happy to take the generous dole than take a low paying job. The more cynical and aware of the Fed Trap could see this as convenience. Pay people to stay at home, get weak employment data, continue to keep easy monetary policy, not blow up the ship…

The following chart puts into clear perspective the amount of money being dished out to US citizens now:

What is becoming more abundantly clear is that we will be in gold’s ‘sweet spot’ of very negative real interest rates and looming economic reckoning for some time but many will be late to see this amid a narrative of recovery. That is good news for accumulators now as the price slowly recovers… for now. The Fed MUST keep their rates low and printers going brrrr, and inflation will be here, be it on the measure of more dollars buying fewer or same goods, or plain old wages growth (to beat welfare and entice some of those 8m at home), or supply constraint prices rises. And if not? Out of control natural rate rises on the bond market overcoming the Fed Funds Rates sees this whole debt laden ship sink. There is very precious little freeboard as it is. Should that happen, history shows us time and time again that precious metals prevail. That is the point where value versus price makes a whole lot more sense….